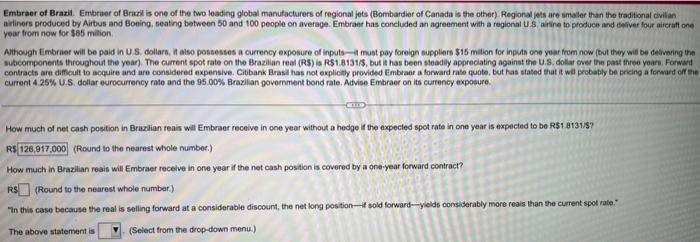

ariners produced by Airbus and Boeing. seating between 50 and 100 people on average. Embeaer has conctuded an agreement with a regional U. 5 . airine io produce and iseliver four aircuht one year from now for $95 milioh. Athough Emtraer will be paid in US. doltars, it also possesses a curtency exposure of inputs-it nust pay foreign supplens $15 milion for inputs one year from now cbut they will be deilivering ithe contracts are diffoult to acquire and are considered expensive. Chbark Brasil has not explicity provided timbraer a forwird rate quote, but has stated that it will pecbebly be pricing a foreard of the curent 425% U.S. doliar eurocurrency rate and the 95.00% Brazilian government bond rate. Advise Embraer on its currency exposure. How much of net cash posbon in Brarian reah will Embraer receive in one year without a hedpe if the expected spot rate in ore year is expected to be fist is13tis? Rs. (Round to the nearest whiole number) How much in Brazilan raas wil Embreer recelve in one year if the net cash position is covered by a one-year forward contract? Rs (Round to the nearest whole number) "In Eis case because the real is selling forward at a considerable discount, the net long position-if sold forwact-yields consideratly more reals than the current spok rate" The abave statement is (Select from the drop-down menu.) Embraer of Braxil. Embraer of Brazl is one of the two leading global manufacturers of regional jets (Bombardier of Canada is the other). Regional jets are smaler than the traditional cilian airiners produced by Airbus and Boning, seating between 50 and 100 people on average. Embraer has concluded an agreement with a regional U. 3 alitine to produce and idefiver four aircraff one year from now for 385 mition. Athough Embraer will be paid in US. dollars, it alse possesses a currency exposure of inputs - a must pay foreign suppliers $15 milion for inputs one yoar from now fout itey wit be detivering th subcomponents throughout the yean. The curtent spot rate on the Brazilian real (R5) is RS1.8131/5, but it has been steadily apgreciating against the U.S. dollar over the past threo yeare. Forwar contracts are diffcult to acquire and are considered expensive. Citibank Brasil has not explichy provided Fimbraer a forward rate quote, but has stased ehat it wal probably be preing a formard of current 425% U.S. doliar eurocurrency rate and the 95.00% Brazilan government bond rate. Advise Embraer on its currency exposure. How much of net cash position in Brazlian reais will Embrser receive in one year without a hedge if the axpected spot rate in one year is expected to be R\$1 8131/3 ? Rs (Round to the nearest whole number.) How much in Brazilian reais will Embraer receive in one year if the net cash position is covered by a one-year forward contract? R: (Round to the nearest whole number.) "In this case because the real is selling forward at a considerable discount, the net long position-if sold forward-ylelds consiberably more reais than the current spot rate." The above statement is (Select from the drop-down menu)