Question

Arizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital:

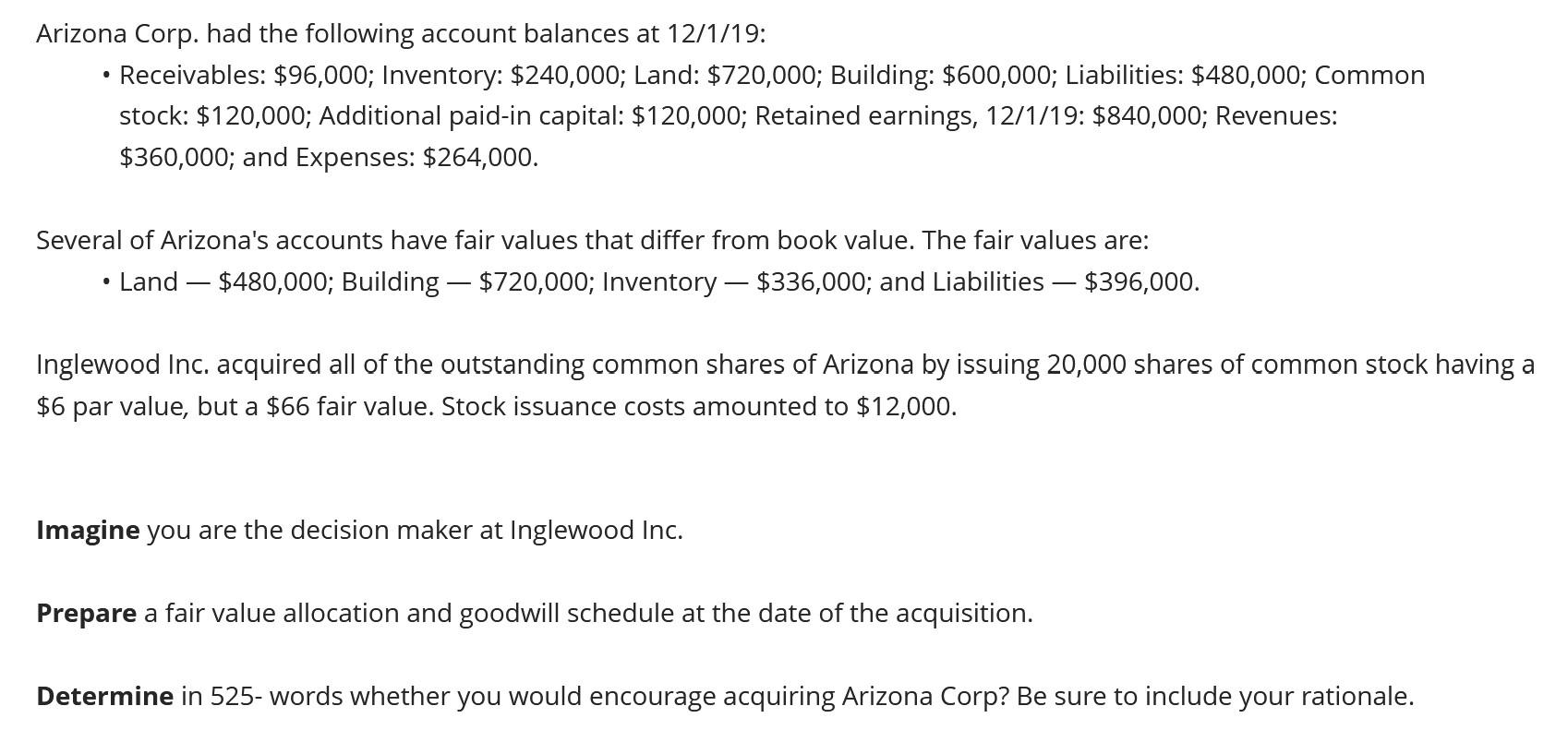

Arizona Corp. had the following account balances at 12/1/19: Receivables: $96,000; Inventory: $240,000; Land: $720,000; Building: $600,000; Liabilities: $480,000; Common stock: $120,000; Additional paid-in capital: $120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000.

Several of Arizona's accounts have fair values that differ from book value. The fair values are: Land $480,000; Building $720,000; Inventory $336,000; and Liabilities $396,000.

Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000.

Imagine you are the decision maker at Inglewood Inc.

Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Determine in 525- words whether you would encourage acquiring Arizona Corp? Be sure to include your rationale.

Please help

Arizona Corp. had the following account balances at 12/1/19 : - Receivables: \$96,000; Inventory: \$240,000; Land: \$720,000; Building: \$600,000; Liabilities: \$480,000; Common stock: $120,000; Additional paid-in capital: \$120,000; Retained earnings, 12/1/19: $840,000; Revenues: $360,000; and Expenses: $264,000. Several of Arizona's accounts have fair values that differ from book value. The fair values are: - Land - \$480,000; Building - \$720,000; Inventory - \$336,000; and Liabilities - \$396,000. Inglewood Inc. acquired all of the outstanding common shares of Arizona by issuing 20,000 shares of common stock having a $6 par value, but a $66 fair value. Stock issuance costs amounted to $12,000. Imagine you are the decision maker at Inglewood Inc. Prepare a fair value allocation and goodwill schedule at the date of the acquisition. Determine in 525- words whether you would encourage acquiring Arizona Corp? Be sure to include your rationaleStep by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare a fair value allocation and goodwill schedule well follow these steps Step 1 Determine the Purchase Consideration Inglewood Inc issued 2000...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started