Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arizona Corporation acquired the business Data Systems for $315,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of

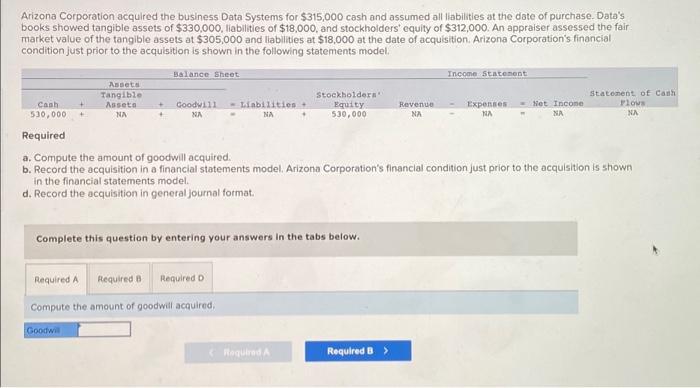

Arizona Corporation acquired the business Data Systems for $315,000 cash and assumed all liabilities at the date of purchase. Data's books showed tangible assets of $330,000, liabilities of $18,000, and stockholders' equity of $312,000. An appraiser assessed the fair market value of the tangible assets at $305,000 and liabilities at $18,000 at the date of acquisition. Arizona Corporation's financial condition just prior to the acquisition is shown in the following statements model. + Required A Assets Tangible Assets Goodwill Balance Sheet + Goodwill = Liabilities + + Complete this question by entering your answers in the tabs below. Cash 530,000 Required a. Compute the amount of goodwill acquired. b. Record the acquisition in a financial statements model. Arizona Corporation's financial condition just prior to the acquisition is shown in the financial statements model. d. Record the acquisition in general journal format. Required B Required D Compute the amount of goodwill acquired. Stockholders' Equity 530,000 Required A Revenue Required B > Income Statement Expenses Net Income Statement of Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started