Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Arlington Company has the following securities in its portfolio of trading equity securities on 12/31/23: 4,000 shares of Able Corp. 7,000 shares of Baxter

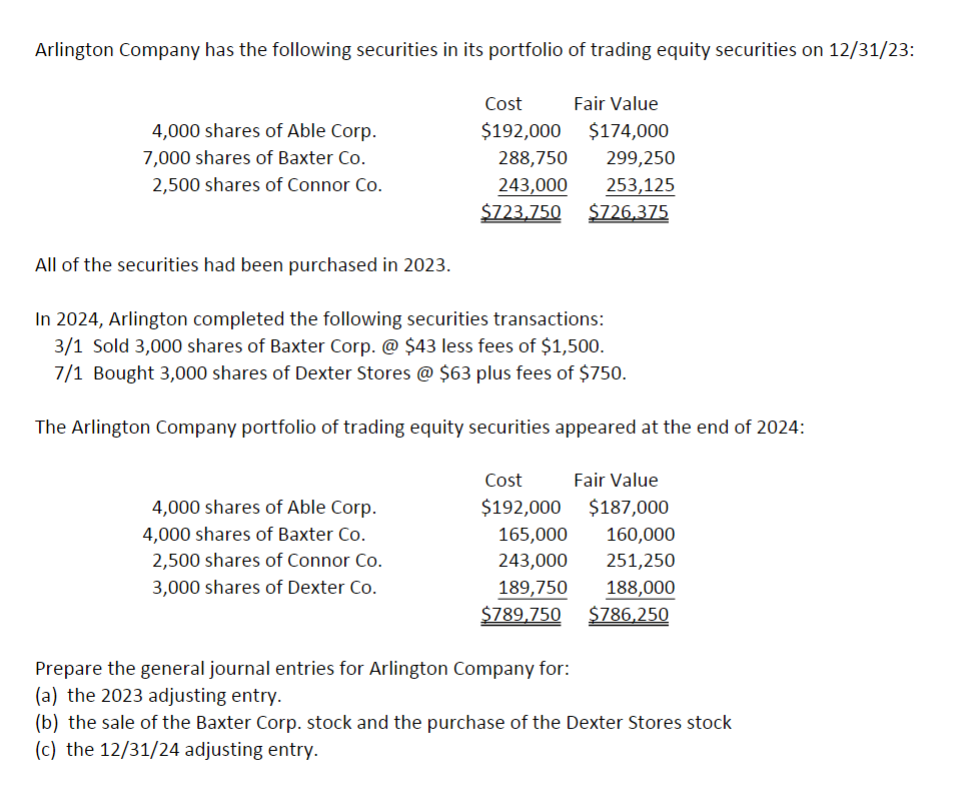

Arlington Company has the following securities in its portfolio of trading equity securities on 12/31/23: 4,000 shares of Able Corp. 7,000 shares of Baxter Co. 2,500 shares of Connor Co. Cost $192,000 Fair Value $174,000 288,750 299,250 243,000 $723,750 253,125 $726,375 All of the securities had been purchased in 2023. In 2024, Arlington completed the following securities transactions: 3/1 Sold 3,000 shares of Baxter Corp. @ $43 less fees of $1,500. 7/1 Bought 3,000 shares of Dexter Stores @ $63 plus fees of $750. The Arlington Company portfolio of trading equity securities appeared at the end of 2024: Cost Fair Value 4,000 shares of Able Corp. $192,000 $187,000 4,000 shares of Baxter Co. 165,000 160,000 2,500 shares of Connor Co. 243,000 251,250 3,000 shares of Dexter Co. 189,750 188,000 $789,750 $786,250 Prepare the general journal entries for Arlington Company for: (a) the 2023 adjusting entry. (b) the sale of the Baxter Corp. stock and the purchase of the Dexter Stores stock (c) the 12/31/24 adjusting entry.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started