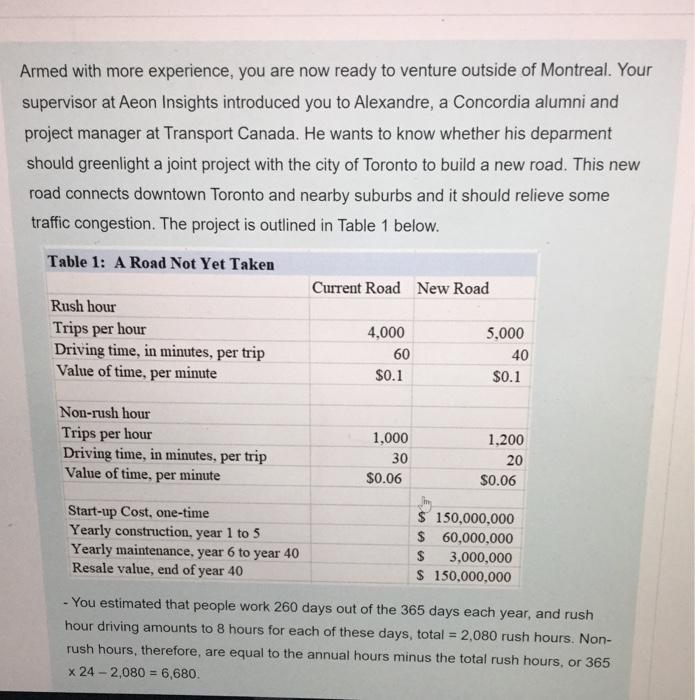

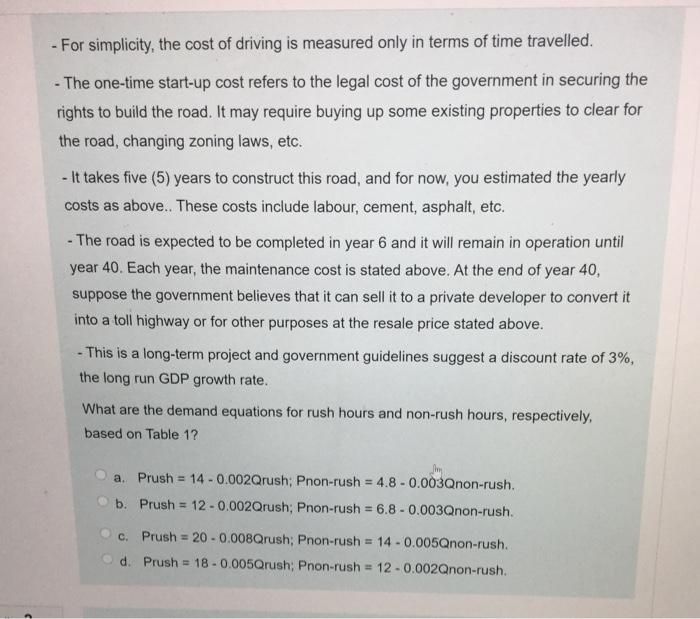

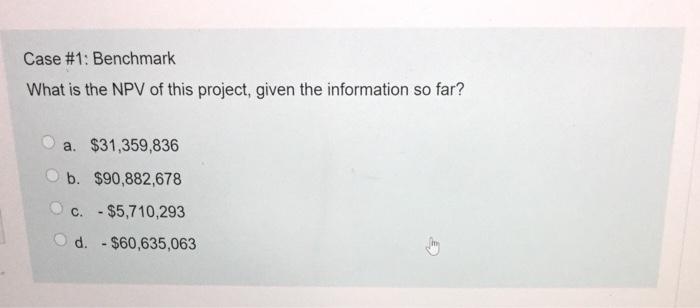

Armed with more experience, you are now ready to venture outside of Montreal. Your supervisor at Aeon Insights introduced you to Alexandre, a Concordia alumni and project manager at Transport Canada. He wants to know whether his deparment should greenlight a joint project with the city of Toronto to build a new road. This new road connects downtown Toronto and nearby suburbs and it should relieve some traffic congestion. The project is outlined in Table 1 below. Table 1: A Road Not Yet Taken Current Road New Road Rush hour Trips per hour Driving time, in minutes, per trip Value of time, per minute 4,000 60 $0.1 5,000 40 $0.1 Non-rush hour Trips per hour Driving time, in minutes, per trip Value of time, per minute 1,200 1.000 30 $0.06 20 $0.06 Start-up Cost, one-time Yearly construction, year 1 to 5 Yearly maintenance, year 6 to year 40 Resale value, end of year 40 $ 150,000,000 $ 60,000,000 $ 3,000,000 $ 150,000,000 - You estimated that people work 260 days out of the 365 days each year, and rush hour driving amounts to 8 hours for each of these days, total = 2,080 rush hours. Non- rush hours, therefore, are equal to the annual hours minus the total rush hours, or 365 x 24-2,080 = 6,680. - For simplicity, the cost of driving is measured only in terms of time travelled. - The one-time start-up cost refers to the legal cost of the government in securing the rights to build the road. It may require buying up some existing properties to clear for the road, changing zoning laws, etc. - It takes five (5) years to construct this road, and for now, you estimated the yearly costs as above. These costs include labour, cement, asphalt, etc. - The road is expected to be completed in year 6 and it will remain in operation until year 40. Each year, the maintenance cost is stated above. At the end of year 40, suppose the government believes that it can sell it to a private developer to convert it into a toll highway or for other purposes at the resale price stated above. - This is a long-term project and government guidelines suggest a discount rate of 3%, the long run GDP growth rate. What are the demand equations for rush hours and non-rush hours, respectively, based on Table 1? a. Prush = 14 -0.002Qrush; Pnon-rush = 4.8 -0.003Qnon-rush. b. Prush = 12 -0.002Qrush; Pnon-rush = 6.8 -0.003Qnon-rush. c. Prush = 20 -0.008Qrush: Pnon-rush = 14 -0.005Qnon-rush. d. Prush = 18 -0.005Qrush; Pnon-rush = 12 -0.002Qnon-rush. Case #1: Benchmark What is the NPV of this project, given the information so far? a. $31,359,836 b. $90,882,678 C. - $5,710,293 d. - $60,635,063 Armed with more experience, you are now ready to venture outside of Montreal. Your supervisor at Aeon Insights introduced you to Alexandre, a Concordia alumni and project manager at Transport Canada. He wants to know whether his deparment should greenlight a joint project with the city of Toronto to build a new road. This new road connects downtown Toronto and nearby suburbs and it should relieve some traffic congestion. The project is outlined in Table 1 below. Table 1: A Road Not Yet Taken Current Road New Road Rush hour Trips per hour Driving time, in minutes, per trip Value of time, per minute 4,000 60 $0.1 5,000 40 $0.1 Non-rush hour Trips per hour Driving time, in minutes, per trip Value of time, per minute 1,200 1.000 30 $0.06 20 $0.06 Start-up Cost, one-time Yearly construction, year 1 to 5 Yearly maintenance, year 6 to year 40 Resale value, end of year 40 $ 150,000,000 $ 60,000,000 $ 3,000,000 $ 150,000,000 - You estimated that people work 260 days out of the 365 days each year, and rush hour driving amounts to 8 hours for each of these days, total = 2,080 rush hours. Non- rush hours, therefore, are equal to the annual hours minus the total rush hours, or 365 x 24-2,080 = 6,680. - For simplicity, the cost of driving is measured only in terms of time travelled. - The one-time start-up cost refers to the legal cost of the government in securing the rights to build the road. It may require buying up some existing properties to clear for the road, changing zoning laws, etc. - It takes five (5) years to construct this road, and for now, you estimated the yearly costs as above. These costs include labour, cement, asphalt, etc. - The road is expected to be completed in year 6 and it will remain in operation until year 40. Each year, the maintenance cost is stated above. At the end of year 40, suppose the government believes that it can sell it to a private developer to convert it into a toll highway or for other purposes at the resale price stated above. - This is a long-term project and government guidelines suggest a discount rate of 3%, the long run GDP growth rate. What are the demand equations for rush hours and non-rush hours, respectively, based on Table 1? a. Prush = 14 -0.002Qrush; Pnon-rush = 4.8 -0.003Qnon-rush. b. Prush = 12 -0.002Qrush; Pnon-rush = 6.8 -0.003Qnon-rush. c. Prush = 20 -0.008Qrush: Pnon-rush = 14 -0.005Qnon-rush. d. Prush = 18 -0.005Qrush; Pnon-rush = 12 -0.002Qnon-rush. Case #1: Benchmark What is the NPV of this project, given the information so far? a. $31,359,836 b. $90,882,678 C. - $5,710,293 d. - $60,635,063