Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Armrest Inc. is a Canadian company that specialized in designing and manufacturing smart armrests for the wheelchair industry. The company invested $1,000,000 in a production

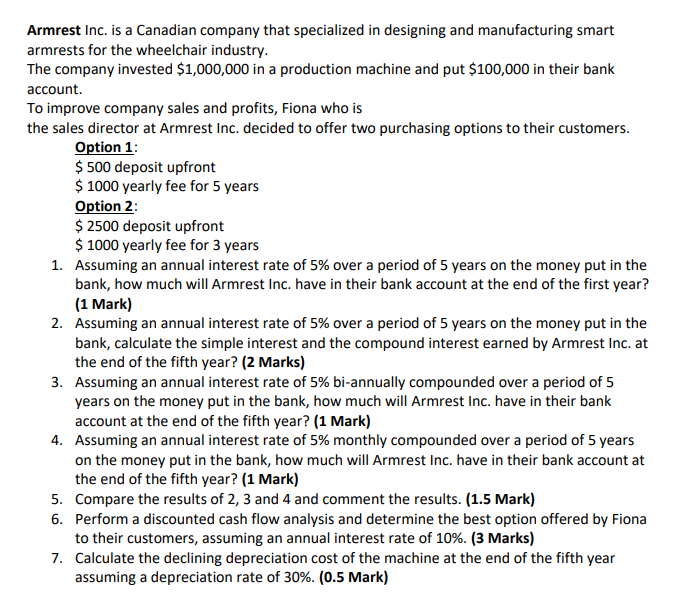

Armrest Inc. is a Canadian company that specialized in designing and manufacturing smart armrests for the wheelchair industry. The company invested $1,000,000 in a production machine and put $100,000 in their bank account. To improve company sales and profits, Fiona who is the sales director at Armrest Inc. decided to offer two purchasing options to their customers. Option 1: $500 deposit upfront $1000 yearly fee for 5 years Option 2: $2500 deposit upfront $1000 yearly fee for 3 years 1. Assuming an annual interest rate of 5% over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the first year? (1 Mark) 2. Assuming an annual interest rate of 5% over a period of 5 years on the money put in the bank, calculate the simple interest and the compound interest earned by Armrest Inc. at the end of the fifth year? (2 Marks) 3. Assuming an annual interest rate of 5% bi-annually compounded over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the fifth year? (1 Mark) 4. Assuming an annual interest rate of 5% monthly compounded over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the fifth year? (1 Mark) 5. Compare the results of 2, 3 and 4 and comment the results. (1.5 Mark) 6. Perform a discounted cash flow analysis and determine the best option offered by Fiona to their customers, assuming an annual interest rate of 10\%. (3 Marks) 7. Calculate the declining depreciation cost of the machine at the end of the fifth year assuming a depreciation rate of 30%. (0.5 Mark)

Armrest Inc. is a Canadian company that specialized in designing and manufacturing smart armrests for the wheelchair industry. The company invested $1,000,000 in a production machine and put $100,000 in their bank account. To improve company sales and profits, Fiona who is the sales director at Armrest Inc. decided to offer two purchasing options to their customers. Option 1: $500 deposit upfront $1000 yearly fee for 5 years Option 2: $2500 deposit upfront $1000 yearly fee for 3 years 1. Assuming an annual interest rate of 5% over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the first year? (1 Mark) 2. Assuming an annual interest rate of 5% over a period of 5 years on the money put in the bank, calculate the simple interest and the compound interest earned by Armrest Inc. at the end of the fifth year? (2 Marks) 3. Assuming an annual interest rate of 5% bi-annually compounded over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the fifth year? (1 Mark) 4. Assuming an annual interest rate of 5% monthly compounded over a period of 5 years on the money put in the bank, how much will Armrest Inc. have in their bank account at the end of the fifth year? (1 Mark) 5. Compare the results of 2, 3 and 4 and comment the results. (1.5 Mark) 6. Perform a discounted cash flow analysis and determine the best option offered by Fiona to their customers, assuming an annual interest rate of 10\%. (3 Marks) 7. Calculate the declining depreciation cost of the machine at the end of the fifth year assuming a depreciation rate of 30%. (0.5 Mark) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started