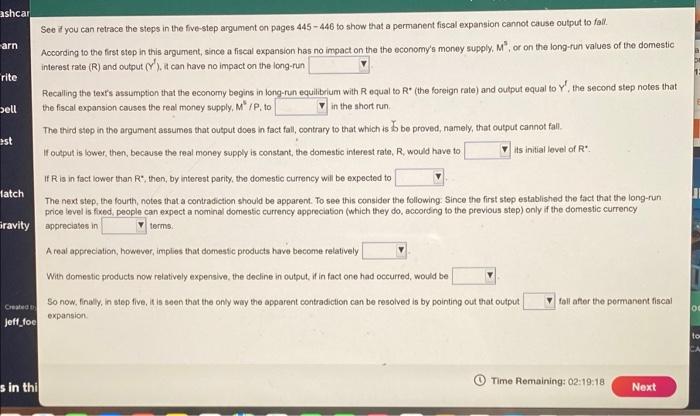

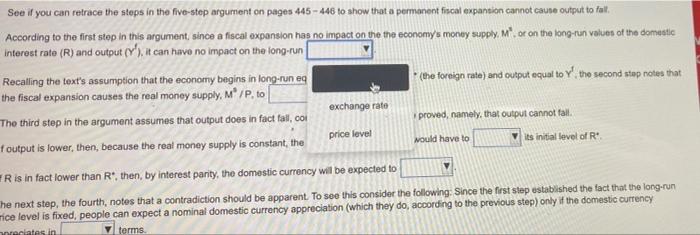

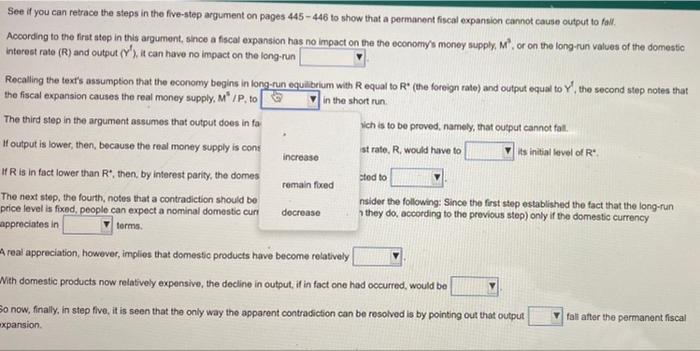

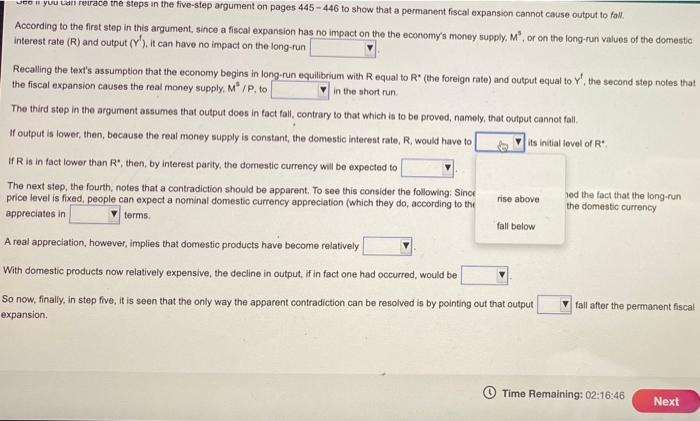

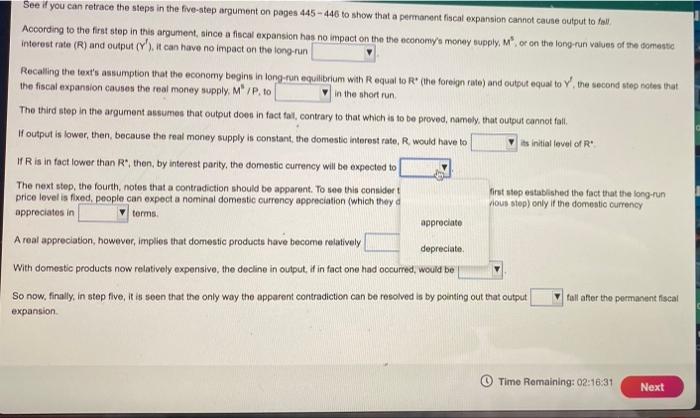

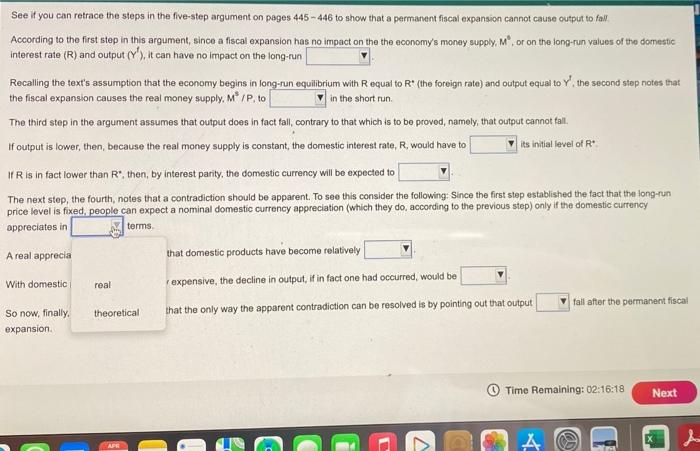

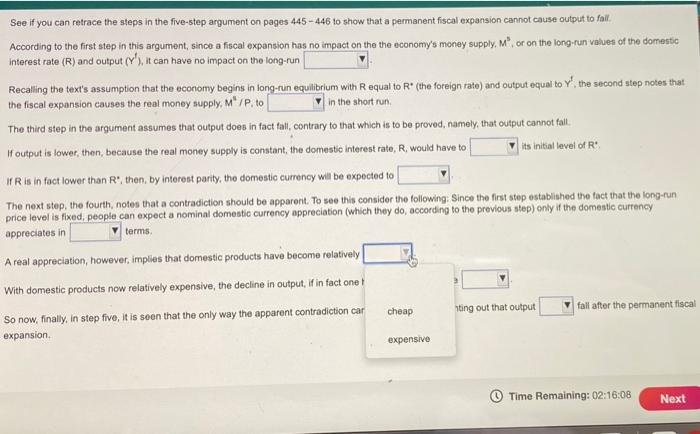

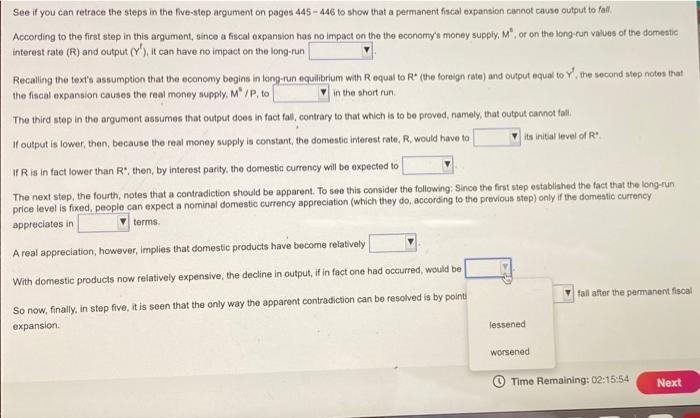

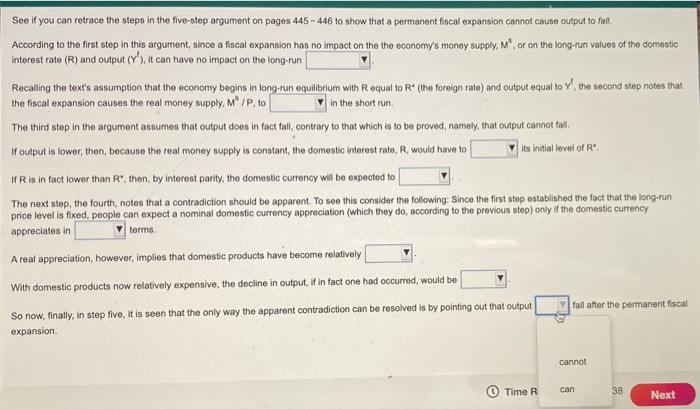

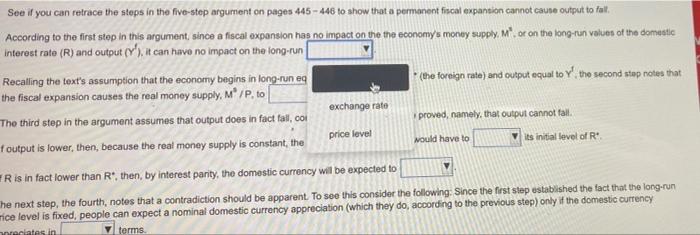

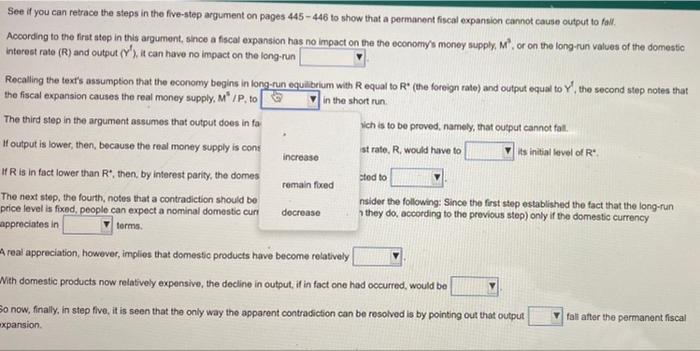

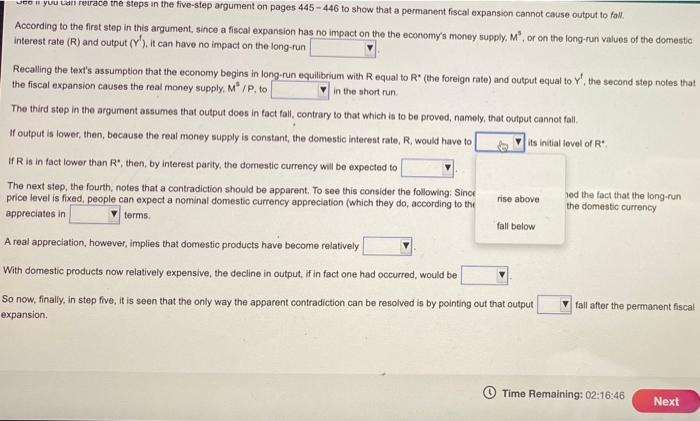

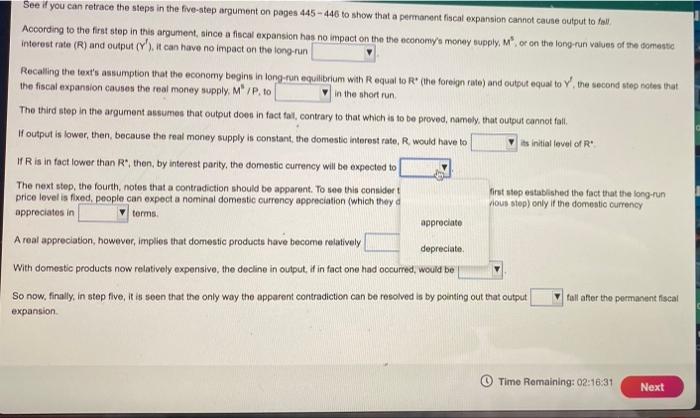

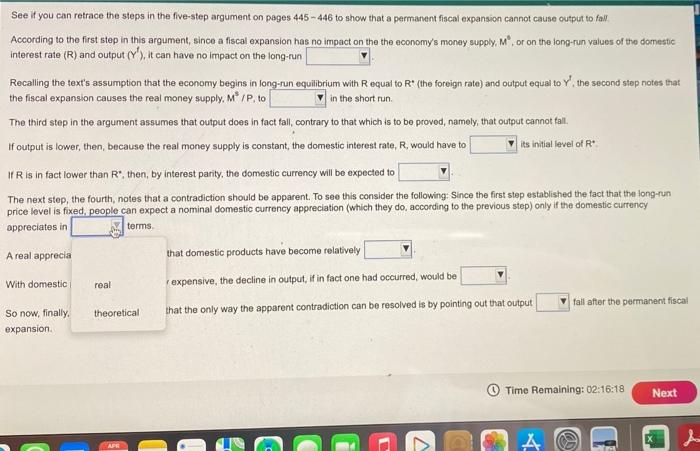

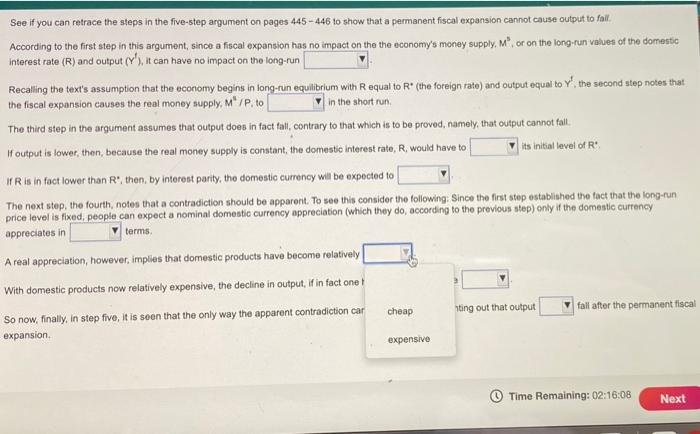

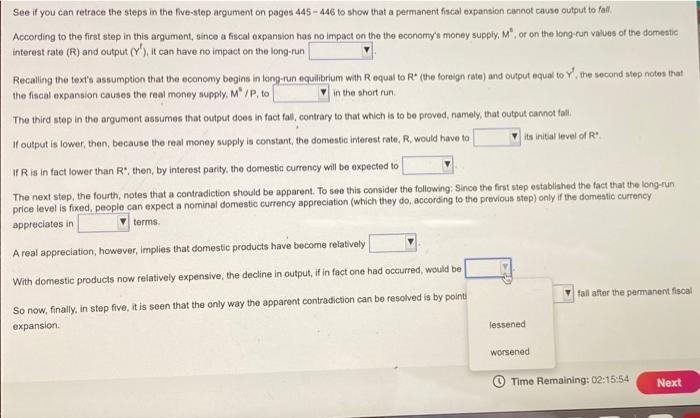

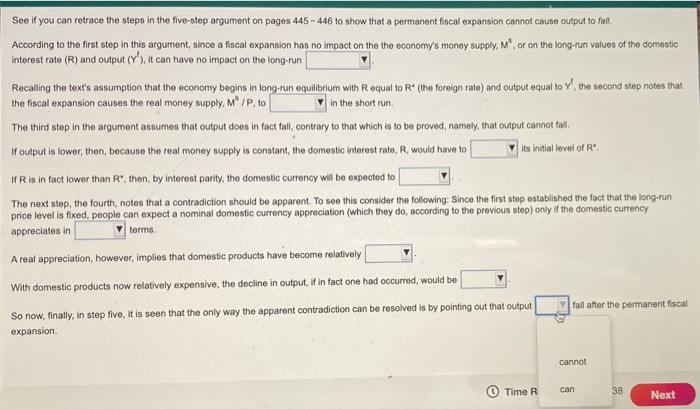

arn rite est ashcar See if you can retrace the steps in the five-step argument on pages 445 446 to show that a permanent fiscal expansion cannot cause output to fall, According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic interest rate (R) and output (Y). It can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to the second step notes that pell the fiscal expansion causes the real money supply, M/P.to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is l be proved, namely, that output cannot fat. If output is lower then, because the real money supply is constant, the domestic interest rate, R. would have to its initial level of R IfR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency Gravity appreciates in terms A moal appreciation, however, implies that domestic produtts have become relatively With domestic products now relatively expensive, the decline in output, in fact one had occurred, would be So now, finally, in stop five, is seen that the only way the apparent contradiction can be resolved is by pointing out that output foll after the pormanent facial Jeft_foe latch Created O expansion lo s in thi Time Remaining: 02:19:18 Next See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to tut. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M. or on the long-run value of the don domestic Interest rate (R) and output (Y'), it can have no impact on the long run Recalling the text's assumption that the economy begins in long-run eq (the foreign rate) and output equal to the second stap notes that the fiscal expansion causes the real money supply, M/P.to exchange rate The third step in the argument assumes that output does in fact fall, col proved, namely, that output cannot fall price level 4 output is lower, then, because the real money supply is constant, the its initial level of R. would have to V ER is in fact lower than R*, then, by interest party, the domestic currency will be expected to he next step, the fourth, notes that a contradiction should be apparent to see this consider the following: Since the first step established the fact that the long run mice level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency preciates in terms increase See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, Mor on the long-run values of the domestic Interest rate (R) and output (Yl), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R" (the foreign rate) and output equal to the second stop notes that the fiscal expansion causes the real money supply, M/P.to in the short run. The third step in the argument assumes that output does in fa hich is to be proved, namely, that output cannot fat. I output is lower, then, because the real money supply is cons strato, R. would have to its initial level of R IR is in fact lower than R", then, by interest parity, the domes The next step, the fourth, notes that a contradiction should be nsider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic curi a they do, according to the previous step) only if the domestic currency appreciates in forms. Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output fall after the permanent fiscal xpansion stod to remain foxed decrease veen you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to row. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply. M, or on the long-run values of the domestic Interest rate (R) and output (Yl). It can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R" (the foreign rate) and output equal to y', the second step notes that the fiscal expansion causes the real money supply. m/P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fall. If output is lower then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of IR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since rise above sed the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the the domestic currency appreciates in terms A real appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is soon that the only way the apparent contradiction can be resolved is by polinting out that output fall after the permanent fiscal expansion fall below Time Remaining: 02:16:46 Next See if you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, m" or on the long-run Values of the domestic interest rate (R) and output('), it can have no impact on the long run Rocalling the text's assumption that the economy begins in long-run equilibrium with equal to R" (the foreign rate) and output equal to y', the second step notes that the fiscal expansion causes the real money supply, M/P.to in the short run The third step in the argument assumes that output does in fact tat, contrary to that which is to be proved, namely, that output cannot fall I output is lower, then, because the real money supply is constant, the domestic interest rate, R would have to its initial level of R Ris in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider t first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation which they d vious step) only if the domestic currency oppreciates in Areal appreciation, however, imples that domestic products have become relatively depreciate With domestic products now relatively expensive, the decline in output, if in fact ono had oocurred, would be So now, finally, in stop five, it is seen that the only way tho apparent contradiction can be resolved is by pointing out that output fait after the permanent fiscal expansion terms appreciate Time Remaining: 02:16:31 Next 3 See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fol. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic interest rate (R) and output (Y), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R* (the foreign rate) and output equal to the second step notes that the fiscal expansion causes the real money supply. M* IP, to in the short run The third step in the argument assumes that output does in tact fall, contrary to that which is to be proved, namely, that output cannot fall, If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R IR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first stop established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms A real apprecia that domestic products have become relatively With domestic real expensive, the decline in output, if in fact one had occurred, would be fall after the permanent fiscal theoretical that the only way the apparent contradiction can be resolved is by pointing out that output So now, finally expansion Time Remaining: 02:16:18 Next AEE > 4 See if you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, sinco a fiscal expansion has no impact on the the economy's money supply, M", or on the long-run values of the domestic Interest rate (R) and output (Y'), it can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R (the foreign tate) and output equal to the second step notes that the fiscal expansion causes the real money supply, M" /P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fait. If output is lower, then, because the real money supply is constant, the domestic Interest rate, R. would have to its initial level of R IR is in fact lower than R, then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation which they do, according to the previous step) only if the domestic currency appreciates in V terms Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one ! cheap So now, finally, in step five, it is soon that the only way the apparent contradiction car ating out that output fall after the permanent fiscal expansion expensive Time Remaining: 02:16:08 Next See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fail According to the first step in this argument, since a focal expansion has no impact on the the economy's money supply. Mor on the long-run values of the domestic interest rate (R) and output (Y'), it can have no impact on the long-run Recalling the texts assumption that the economy begins in long-run equilibrium with Requal to R (the foreign rate) and output equal to the second stop notos that the fiscal expansion causes the real money supply, M'/P, to in the short run The third stop in the argument assumes that output does in fact fat, contrary to that which is to be proved, namely, that output cannot talt, If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R IR is in fact lower than then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms A real appreciation, however, Implies that domestic products have become relatively fall after the permanent fiscal With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in stop five, it is seen that the only way the apparent contradiction can be resolved is by pointi expansion lessened worsened Time Remaining: 02:15:54 Next See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic Interest rate (R) and output (y'), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to Y', the second step notes that the fiscal expansion causes the real money supply, m /P. to in the short run The third stop in the argument assumes that output does in fact fall contrary to that which is to be proved, namely, that output cannot fall Houtput is lower, then, because the real money supply is constant, the domestic interest rate, R. would have to its initial level of R If R is in fact lower than R', then, by interest panty, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in v terms Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, it in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output expansion fall after the permanent fiscal cannot Time R can 38 Next arn rite est ashcar See if you can retrace the steps in the five-step argument on pages 445 446 to show that a permanent fiscal expansion cannot cause output to fall, According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic interest rate (R) and output (Y). It can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to the second step notes that pell the fiscal expansion causes the real money supply, M/P.to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is l be proved, namely, that output cannot fat. If output is lower then, because the real money supply is constant, the domestic interest rate, R. would have to its initial level of R IfR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency Gravity appreciates in terms A moal appreciation, however, implies that domestic produtts have become relatively With domestic products now relatively expensive, the decline in output, in fact one had occurred, would be So now, finally, in stop five, is seen that the only way the apparent contradiction can be resolved is by pointing out that output foll after the pormanent facial Jeft_foe latch Created O expansion lo s in thi Time Remaining: 02:19:18 Next See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to tut. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M. or on the long-run value of the don domestic Interest rate (R) and output (Y'), it can have no impact on the long run Recalling the text's assumption that the economy begins in long-run eq (the foreign rate) and output equal to the second stap notes that the fiscal expansion causes the real money supply, M/P.to exchange rate The third step in the argument assumes that output does in fact fall, col proved, namely, that output cannot fall price level 4 output is lower, then, because the real money supply is constant, the its initial level of R. would have to V ER is in fact lower than R*, then, by interest party, the domestic currency will be expected to he next step, the fourth, notes that a contradiction should be apparent to see this consider the following: Since the first step established the fact that the long run mice level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency preciates in terms increase See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, Mor on the long-run values of the domestic Interest rate (R) and output (Yl), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R" (the foreign rate) and output equal to the second stop notes that the fiscal expansion causes the real money supply, M/P.to in the short run. The third step in the argument assumes that output does in fa hich is to be proved, namely, that output cannot fat. I output is lower, then, because the real money supply is cons strato, R. would have to its initial level of R IR is in fact lower than R", then, by interest parity, the domes The next step, the fourth, notes that a contradiction should be nsider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic curi a they do, according to the previous step) only if the domestic currency appreciates in forms. Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output fall after the permanent fiscal xpansion stod to remain foxed decrease veen you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to row. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply. M, or on the long-run values of the domestic Interest rate (R) and output (Yl). It can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R" (the foreign rate) and output equal to y', the second step notes that the fiscal expansion causes the real money supply. m/P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fall. If output is lower then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of IR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since rise above sed the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the the domestic currency appreciates in terms A real appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in step five, it is soon that the only way the apparent contradiction can be resolved is by polinting out that output fall after the permanent fiscal expansion fall below Time Remaining: 02:16:46 Next See if you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, m" or on the long-run Values of the domestic interest rate (R) and output('), it can have no impact on the long run Rocalling the text's assumption that the economy begins in long-run equilibrium with equal to R" (the foreign rate) and output equal to y', the second step notes that the fiscal expansion causes the real money supply, M/P.to in the short run The third step in the argument assumes that output does in fact tat, contrary to that which is to be proved, namely, that output cannot fall I output is lower, then, because the real money supply is constant, the domestic interest rate, R would have to its initial level of R Ris in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider t first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation which they d vious step) only if the domestic currency oppreciates in Areal appreciation, however, imples that domestic products have become relatively depreciate With domestic products now relatively expensive, the decline in output, if in fact ono had oocurred, would be So now, finally, in stop five, it is seen that the only way tho apparent contradiction can be resolved is by pointing out that output fait after the permanent fiscal expansion terms appreciate Time Remaining: 02:16:31 Next 3 See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fol. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic interest rate (R) and output (Y), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with Requal to R* (the foreign rate) and output equal to the second step notes that the fiscal expansion causes the real money supply. M* IP, to in the short run The third step in the argument assumes that output does in tact fall, contrary to that which is to be proved, namely, that output cannot fall, If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R IR is in fact lower than R", then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first stop established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms A real apprecia that domestic products have become relatively With domestic real expensive, the decline in output, if in fact one had occurred, would be fall after the permanent fiscal theoretical that the only way the apparent contradiction can be resolved is by pointing out that output So now, finally expansion Time Remaining: 02:16:18 Next AEE > 4 See if you can retrace the steps in the five-step argument on pages 445-446 to show that a permanent fiscal expansion cannot cause output to fall According to the first step in this argument, sinco a fiscal expansion has no impact on the the economy's money supply, M", or on the long-run values of the domestic Interest rate (R) and output (Y'), it can have no impact on the long run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R (the foreign tate) and output equal to the second step notes that the fiscal expansion causes the real money supply, M" /P, to in the short run The third step in the argument assumes that output does in fact fall, contrary to that which is to be proved, namely, that output cannot fait. If output is lower, then, because the real money supply is constant, the domestic Interest rate, R. would have to its initial level of R IR is in fact lower than R, then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation which they do, according to the previous step) only if the domestic currency appreciates in V terms Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, if in fact one ! cheap So now, finally, in step five, it is soon that the only way the apparent contradiction car ating out that output fall after the permanent fiscal expansion expensive Time Remaining: 02:16:08 Next See if you can retrace the steps in the five-stop argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fail According to the first step in this argument, since a focal expansion has no impact on the the economy's money supply. Mor on the long-run values of the domestic interest rate (R) and output (Y'), it can have no impact on the long-run Recalling the texts assumption that the economy begins in long-run equilibrium with Requal to R (the foreign rate) and output equal to the second stop notos that the fiscal expansion causes the real money supply, M'/P, to in the short run The third stop in the argument assumes that output does in fact fat, contrary to that which is to be proved, namely, that output cannot talt, If output is lower, then, because the real money supply is constant, the domestic interest rate, R, would have to its initial level of R IR is in fact lower than then, by interest parity, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long-run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in terms A real appreciation, however, Implies that domestic products have become relatively fall after the permanent fiscal With domestic products now relatively expensive, the decline in output, if in fact one had occurred, would be So now, finally, in stop five, it is seen that the only way the apparent contradiction can be resolved is by pointi expansion lessened worsened Time Remaining: 02:15:54 Next See if you can retrace the steps in the five-step argument on pages 445 - 446 to show that a permanent fiscal expansion cannot cause output to fall. According to the first step in this argument, since a fiscal expansion has no impact on the the economy's money supply, M, or on the long-run values of the domestic Interest rate (R) and output (y'), it can have no impact on the long-run Recalling the text's assumption that the economy begins in long-run equilibrium with R equal to R* (the foreign rate) and output equal to Y', the second step notes that the fiscal expansion causes the real money supply, m /P. to in the short run The third stop in the argument assumes that output does in fact fall contrary to that which is to be proved, namely, that output cannot fall Houtput is lower, then, because the real money supply is constant, the domestic interest rate, R. would have to its initial level of R If R is in fact lower than R', then, by interest panty, the domestic currency will be expected to The next step, the fourth, notes that a contradiction should be apparent. To see this consider the following: Since the first step established the fact that the long run price level is fixed, people can expect a nominal domestic currency appreciation (which they do, according to the previous step) only if the domestic currency appreciates in v terms Areal appreciation, however, implies that domestic products have become relatively With domestic products now relatively expensive, the decline in output, it in fact one had occurred, would be So now, finally, in step five, it is seen that the only way the apparent contradiction can be resolved is by pointing out that output expansion fall after the permanent fiscal cannot Time R can 38 Next