Question

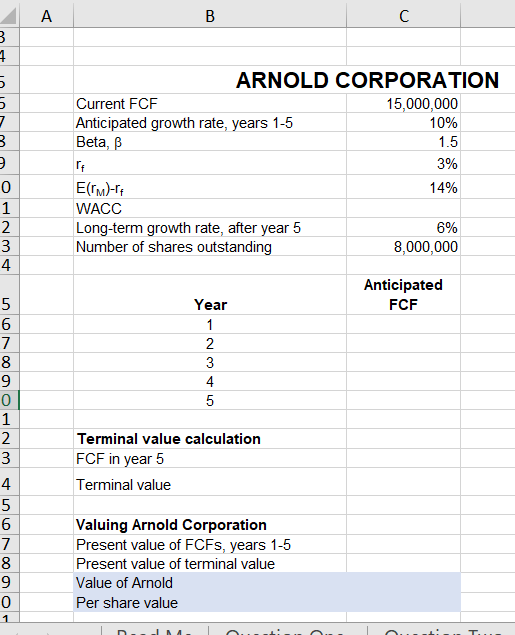

Arnold Corporation currently has a free cash flow (FCF) of $15 million. A reputable analyst estimates that this FCF is anticipated to increase by 10%

Arnold Corporation currently has a free cash flow (FCF) of $15 million. A reputable analyst estimates that this FCF is anticipated to increase by 10% per year for the next 5 years. The analyst estimates that at the end of 5 years the company's terminal value will be based on the year 5 FCF and a long-tem rate FCF growth rate of 6%.

Suppose the Arnold's b=1.5, the rf = 3%, the market risk premium [E(rM) - rf ]= 14%, and Arnold has 8 million shares outstanding, How shoud the analyst value the shares of the company? Assume all cash flows occur at year-end.

https://docs.google.com/spreadsheets/d/1aL9EELa4alxMvIaZceLJ6Z-N0T6b2XQSsfI9LsWhyMI/edit?usp=sharing

B 4 5 5 7 B 9 01234 5 WNTO60vas 7 8 9 1 2 3 4567ao- 8 9 0 1 A B E(rm)-rf WACC Current FCF Anticipated growth rate, years 1-5 Beta, B rf Long-term growth rate, after year 5 Number of shares outstanding Year 1 2 3 ARNOLD CORPORATION 15,000,000 4 5 Terminal value calculation FCF in year 5 Terminal value Valuing Arnold Corporation Present value of FCFS, years 1-5 Present value of terminal value Value of Arnold Per share value 10% 1.5 3% 14% 6% 8,000,000 Anticipated FCF

Step by Step Solution

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To value the shares of Arnold Corporation the analyst needs to calculate the present value of the anticipated free cash flows FCFs for years 15 and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started