Answered step by step

Verified Expert Solution

Question

1 Approved Answer

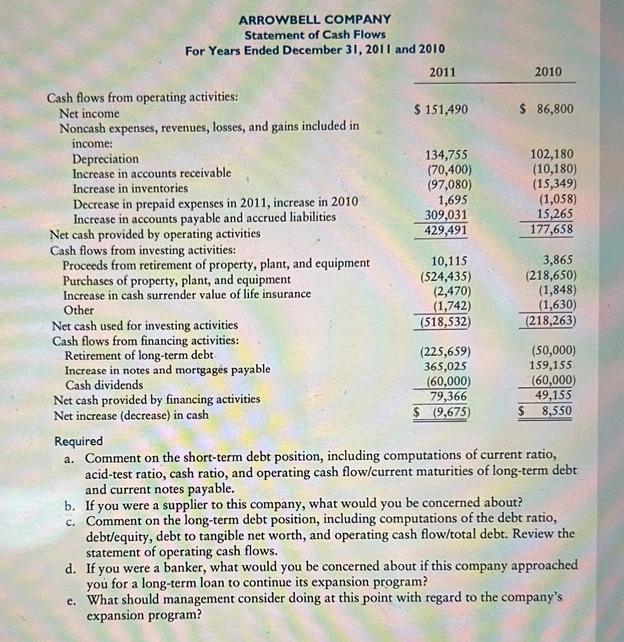

ARROWBELL COMPANY Statement of Cash Flows For Years Ended December 31, 2011 and 2010 Cash flows from operating activities: Net income Noncash expenses, revenues,

ARROWBELL COMPANY Statement of Cash Flows For Years Ended December 31, 2011 and 2010 Cash flows from operating activities: Net income Noncash expenses, revenues, losses, and gains included in income: Depreciation. Increase in accounts receivable Increase in inventories Decrease in prepaid expenses in 2011, increase in 2010 Increase in accounts payable and accrued liabilities Net cash provided by operating activities Cash flows from investing activities: Proceeds from retirement of property, plant, and equipment Purchases of property, plant, and equipment Increase in cash surrender value of life insurance Other Net cash used for investing activities Cash flows from financing activities: Retirement of long-term debt Increase in notes and mortgages payable Cash dividends Net cash provided by financing activities Net increase (decrease) in cash 2011 $ 151,490 134,755 (70,400) (97,080) 1,695 309,031 429,491 10,115 (524,435) (2,470) (1,742) (518,532) (225,659) 365,025 (60,000) 79,366 $ (9,675) 2010 $ 86,800 $ 102,180 (10,180) (15,349) (1,058) 15,265 177,658 3,865 (218,650) (1,848) (1,630) (218,263) (50,000) 159,155 (60,000) 49,155 8,550 Required a. Comment on the short-term debt position, including computations of current ratio, acid-test ratio, cash ratio, and operating cash flow/current maturities of long-term debt and current notes payable. b. If you were a supplier to this company, what would you be concerned about? c. Comment on the long-term debt position, including computations of the debt ratio, debt/equity, debt to tangible net worth, and operating cash flow/total debt. Review the statement of operating cash flows. d. If you were a banker, what would you be concerned about if this company approached you for a long-term loan to continue its expansion program? e. What should management consider doing at this point with regard to the company's expansion program?

Step by Step Solution

★★★★★

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a The current ratio is 113 acidtest ratio is 089 and cash ratio is 008 The operating cash flow to cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started