Question

Alpha acquired 100% of Betas common shares on December 31, 2012, paying $4,000,000 in cash, issuing to Betas shareholders 3,500,000 in debt and 100,000 new

Alpha acquired 100% of Beta’s common shares on December 31, 2012, paying $4,000,000 in cash, issuing to Beta’s shareholders 3,500,000 in debt and 100,000 new common shares of Alpha. The market value of each Alpha share is $24. The par value of each Alpha share is $6.

Beta is a provider of data networking products and services in Canada and Mexico. As a result of the acquisition, the company will be the leading provider of data networking products and services in the U.S., Canada, and Mexico. The merged company expects to achieve significant synergies and cost reductions by eliminating redundant processes and facilities.

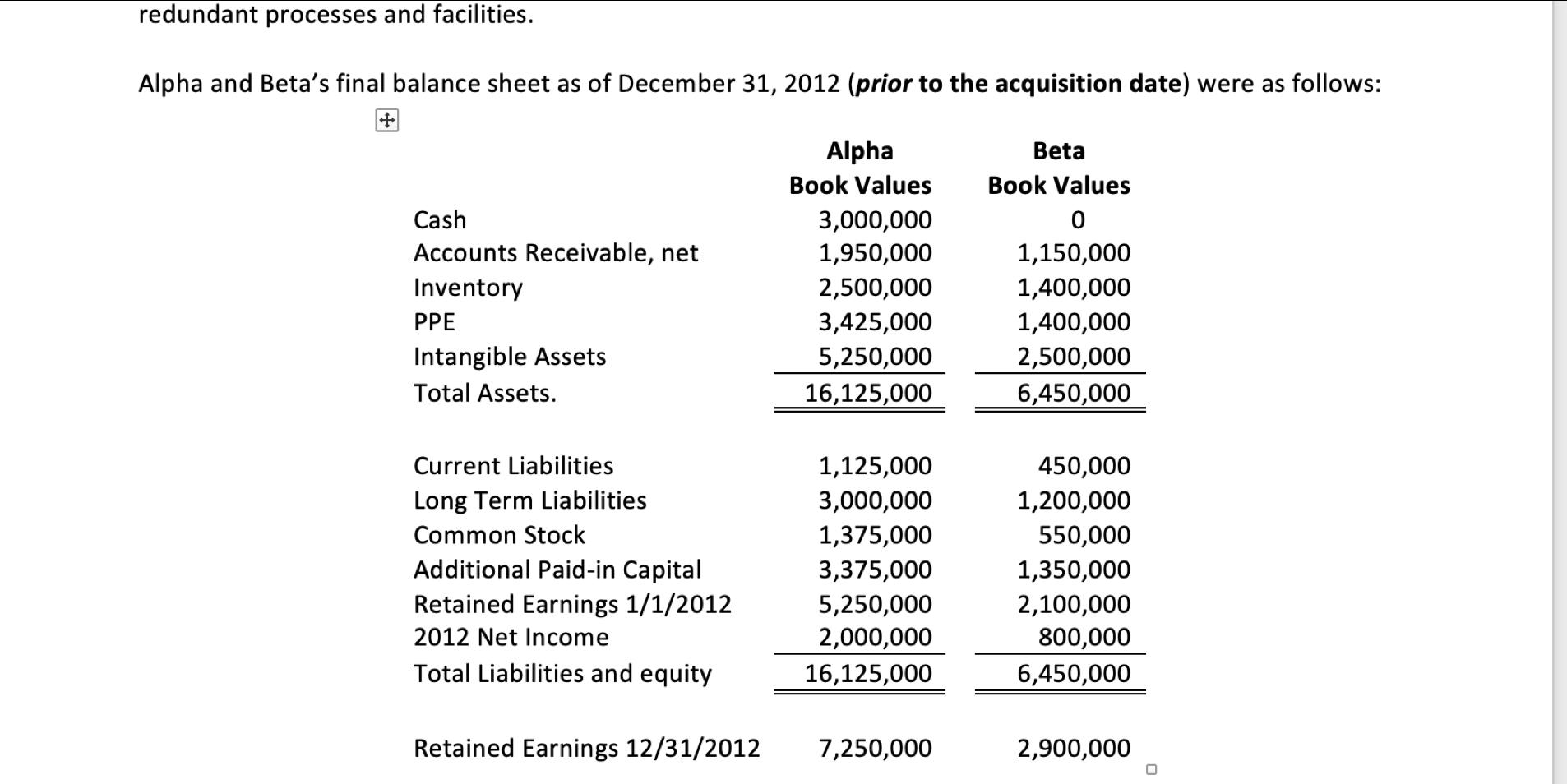

Alpha and Beta’s final balance sheet as of December 31, 2012 (prior to the acquisition date) were as follows:

A contingent consideration arrangement require Alpha to pay $2,000,000 of additional consideration to Beta‘s former shareholders if Beta‘s revenues increase by a compound annual growth rate 30% over a three-year period. The present value of the contingent consideration arrangement at the acquisition date was $1,000,000. Alpha estimated the present value of the contingent consideration using a probability-weighted discounted cash flow model.

In determining its offer, Alpha noted the following with respect to Beta’s assets and liabilities:

- The fair value of the net accounts receivable acquired is $1,550,000.

- Inventory is overvalued by $300,000, i.e., the fair value for Beta’s inventory is lower than its book value.

- Beta holds Property, Plant and Equipment with a fair value of $100,000 more than its book value.

- The $2,500,000 of Beta’s book value for Intangible Assets approximates the fair value. However, Alpha considered that Beta has developed a registered trademark, which is not recorded in Beta’s books. Alpha estimates that the trademark’s fair value is $1,400,000. Also, Alpha noted that Beta has research and development in process with an appraised fair value of $1,000,000. The research and development has resulted in a product with technological feasibility.

- Alpha realized that there was a contingency related to pending patent infringement lawsuits in which Beta is the defendant. Alpha has determined that the range of the potential loss on such contingency between $0 and $500,000. The acquisition date present value of the contingent liability is $100,000 based on a probability-weighted discounted cash flow valuation technique.

- Beta’s book value for current liabilities differs from its fair value. The fair value of current liabilities is $500,000.

- The fair value for Beta’s long-term liabilities is lower than the book value by $200,000.

Alpha incurred $105,000 of acquisition-related costs, including legal fees and due diligence expenses. Alpha also incurred $100,000 in costs associated with issuing and registering the shares issued to former Beta’s shareholders.

Required:

- Prepare the supporting working papers at the acquisition date

- Provide the entries passed by Alpha on the acquisition date

- Provide a balance sheet for Alpha immediately after the entries passed on the acquisition date

- Option A: Beta will continue to operate and report as an independent company, provide a consolidated balance sheet on the acquisition date

- Option A: Beta will be dissolved on Jan 1, 2013, immediately after the acquisition, provided the dissolution entry is passed by Alpha.

Step by Step Solution

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To account for the acquisition of Beta by Alpha we will go through the steps required to prepare the working papers at the acquisition date provide th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started