Arthur Lloyd associates provided the following information.

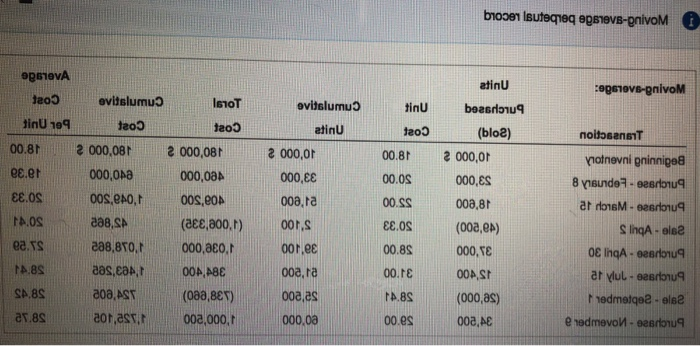

Moving average perpetual inventory

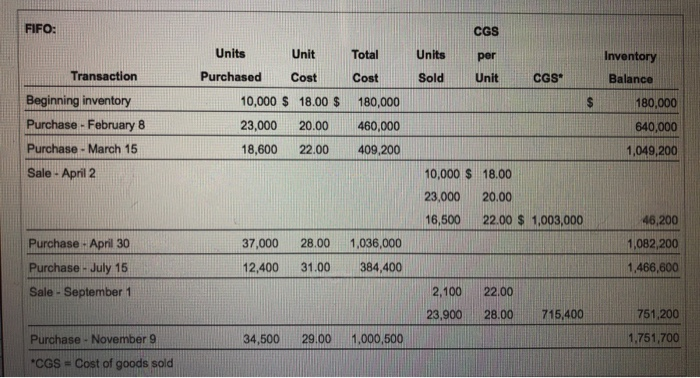

FIFO perpetual inventory

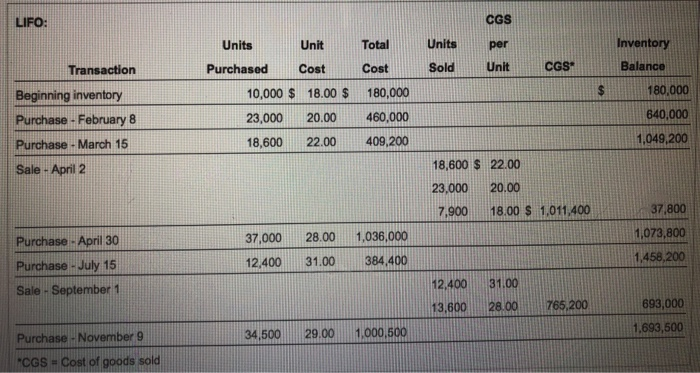

LIFO perpetual inventory

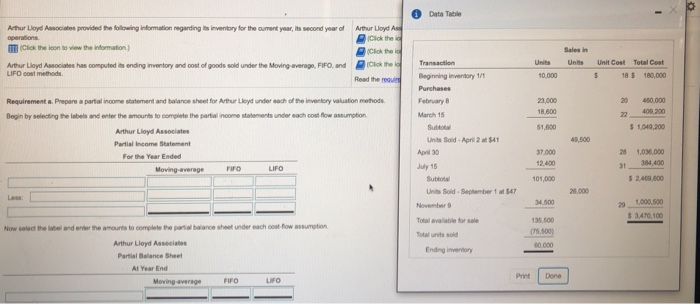

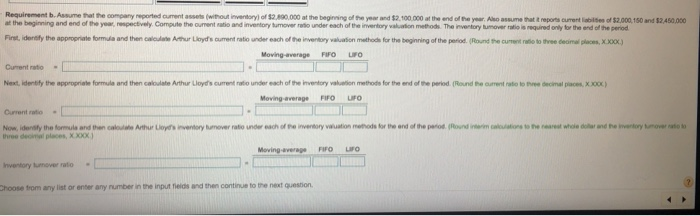

Data Table Arhur Lioyd Associates provided the following information negarding ts inventory for the oument year, its second year o Arthur Lloyd Ass (Cick the icon to view the itemation) Arthur Lioyd Associates has computed its ending inventory and cost of goods sold under the Moving average, FIFO, and (CleTransaction Sales in Units Units Unit Cost Total Cest $ 18$ 180,000 LIFO cost methods Read the requ inning inventory 1/ Purchasers February March 15 Requirement a. Pepare partal none statement and balance sheet for Arthur ueyd-nder each ofthe motory valuation matods. 20 40,000 22409,200 1,049,200 18,600 Begin by seledting the labels and enter the amounts to complete the partial income statements under each cost fow assumption $1,600 Arthur Lloyd Associates Unts Soid- April 2 at 541 9,500 April 30 July 15 37,000 12.400 101,000 1,036.000 31 384,400 5 2,409 600 For the Year Ended Moving awrngO 6,000 Units Sold Seplember 1 at $47 November Toal avalable for sale Total units sold 20 1.000,500 s 3,470 10o 34 500 Now select the label and enter the amounts to complete the partial bailance sheet under each oost fow assumption (76.800 Arthur Lioyd Asseciates Partial Balance Sheet Ending inveriory Print Done Moving-average LiFO Requirement b.Assume that the company reported cument assets (without inventory) of $2.890.000 at the beginning of the year and $2,100.000 at the end of the year. Also assume that it reports cument labilsens of at the beginning and end of the your, renspectively. Compute the oument ratio and inventory tumover ratio under each of the invertory valbuation methods. The inventory lumover ratio is required only for the end of the period First, identify the appropriate formula and then caloulate Athur Lioyd's cument ratio under each of the inventory valuason mathods for the beginning of the period. (Reound the cument ratilo to tvee deamal places, x.x00x) Moving-average FIFUPO $2,000 180 and $2,460,000 Current ratio Next, idrery te "ppr prate frmula and then cak late Arthur Lloyd's cum, neo under each ofhenvetry waka en metom for erd ofre pen dpa ndheanunt sto -0nal place. xxxx) Moving -average FIFO UFO Current ratio Now, idensfy the formula and then calouale Arthur Lioyt's inventory tumover ratio under each of re inventory valuation methods for the and of the perod Roundnciations to the rearest whole dolar and he venlory tunover ato so three decial places, X.xox) Moving-average FIFO Lro Inventory lumover rato hoose trom any list or enter any number in the input fleids and then continue to the next question oe61evA teo0 tinU 199 atinU egenovs-enivoM evitslumuo Is1OT tao5 eviislumu te atinU (bloe) taoo 00.8 2 000,0 00.0S 00.SS .os 00.8s 0o.re ooasr A8S (0oo.as) 00.eS noitosan1T 2 000,08 notnevni gninnigeB ec.er .os tA.os 388.s ea.ys 000,08A oos.eoA (ace,800,t) 000,E8 008,ra 0or.s 000,ES 008,8 oo8,e) 000,TE 8 nsundeT eesdonu9 000,0-8 00s.eh0,t 288,SA S inqA-als2 A8S a0s.ca 00A ABE ooa,ra 00a,as aor asv.f 002.000.000.03 008, AST h nedmetqea -else 008,A FIFO: CGS Units Unit Total Units per Inventory Balance Purchased ost Cost Sold Unit CGS Transaction Beginning inventory Purchase - February 8 Purchase- March 15 Sale-April 2 10,000 $ 18.00 $ 180,000 23,000 20.00460,000 18,600 22.00 409,200 180,000 640,000 1,049,200 10,000 $ 18.00 23,000 20.00 16,500 22.00 $ 1,003,000 46,200 1,082,200 1.466,600 Purchase April 30 37,000 28.00 1,036,000 12,400 31.00 384,400 Purchase July 15 Sale- September 1 2,100 22.00 23.900 28.00 716 00 75,20 751,200 1.751,700 Purchase November 9 CGS -Cost of goods sold 34,500 29.00 1,000,500 LIFO: CGS Units UnitTotal Units per Inventory Transaction Purchased Cost Cost Sold Unit CGS Balance Beginning inventory Purchase February8 Purchase -March 15 Sale - April 2 10,000 $ 18.00180,000 23,000 20.00460,000 18,600 22.00 409,200 180,000 640,000 1,049200 18,600 $ 22.00 23,000 20.00 37,800 1,073,800 1,458,200 7,900 18.00 $ 1.011,400 37,000 28.00 1,036,000 Purchase -April 30 Purchase- July 15 Sale - September 1 12.400 31.00 384.400 12,400 31.00 13,600 28.00 765,200693,000 1,693,500 Purchase November 9 34,500 29.00 1,000,500 "CGS = Cost of goods sold Data Table Arhur Lioyd Associates provided the following information negarding ts inventory for the oument year, its second year o Arthur Lloyd Ass (Cick the icon to view the itemation) Arthur Lioyd Associates has computed its ending inventory and cost of goods sold under the Moving average, FIFO, and (CleTransaction Sales in Units Units Unit Cost Total Cest $ 18$ 180,000 LIFO cost methods Read the requ inning inventory 1/ Purchasers February March 15 Requirement a. Pepare partal none statement and balance sheet for Arthur ueyd-nder each ofthe motory valuation matods. 20 40,000 22409,200 1,049,200 18,600 Begin by seledting the labels and enter the amounts to complete the partial income statements under each cost fow assumption $1,600 Arthur Lloyd Associates Unts Soid- April 2 at 541 9,500 April 30 July 15 37,000 12.400 101,000 1,036.000 31 384,400 5 2,409 600 For the Year Ended Moving awrngO 6,000 Units Sold Seplember 1 at $47 November Toal avalable for sale Total units sold 20 1.000,500 s 3,470 10o 34 500 Now select the label and enter the amounts to complete the partial bailance sheet under each oost fow assumption (76.800 Arthur Lioyd Asseciates Partial Balance Sheet Ending inveriory Print Done Moving-average LiFO Requirement b.Assume that the company reported cument assets (without inventory) of $2.890.000 at the beginning of the year and $2,100.000 at the end of the year. Also assume that it reports cument labilsens of at the beginning and end of the your, renspectively. Compute the oument ratio and inventory tumover ratio under each of the invertory valbuation methods. The inventory lumover ratio is required only for the end of the period First, identify the appropriate formula and then caloulate Athur Lioyd's cument ratio under each of the inventory valuason mathods for the beginning of the period. (Reound the cument ratilo to tvee deamal places, x.x00x) Moving-average FIFUPO $2,000 180 and $2,460,000 Current ratio Next, idrery te "ppr prate frmula and then cak late Arthur Lloyd's cum, neo under each ofhenvetry waka en metom for erd ofre pen dpa ndheanunt sto -0nal place. xxxx) Moving -average FIFO UFO Current ratio Now, idensfy the formula and then calouale Arthur Lioyt's inventory tumover ratio under each of re inventory valuation methods for the and of the perod Roundnciations to the rearest whole dolar and he venlory tunover ato so three decial places, X.xox) Moving-average FIFO Lro Inventory lumover rato hoose trom any list or enter any number in the input fleids and then continue to the next question oe61evA teo0 tinU 199 atinU egenovs-enivoM evitslumuo Is1OT tao5 eviislumu te atinU (bloe) taoo 00.8 2 000,0 00.0S 00.SS .os 00.8s 0o.re ooasr A8S (0oo.as) 00.eS noitosan1T 2 000,08 notnevni gninnigeB ec.er .os tA.os 388.s ea.ys 000,08A oos.eoA (ace,800,t) 000,E8 008,ra 0or.s 000,ES 008,8 oo8,e) 000,TE 8 nsundeT eesdonu9 000,0-8 00s.eh0,t 288,SA S inqA-als2 A8S a0s.ca 00A ABE ooa,ra 00a,as aor asv.f 002.000.000.03 008, AST h nedmetqea -else 008,A FIFO: CGS Units Unit Total Units per Inventory Balance Purchased ost Cost Sold Unit CGS Transaction Beginning inventory Purchase - February 8 Purchase- March 15 Sale-April 2 10,000 $ 18.00 $ 180,000 23,000 20.00460,000 18,600 22.00 409,200 180,000 640,000 1,049,200 10,000 $ 18.00 23,000 20.00 16,500 22.00 $ 1,003,000 46,200 1,082,200 1.466,600 Purchase April 30 37,000 28.00 1,036,000 12,400 31.00 384,400 Purchase July 15 Sale- September 1 2,100 22.00 23.900 28.00 716 00 75,20 751,200 1.751,700 Purchase November 9 CGS -Cost of goods sold 34,500 29.00 1,000,500 LIFO: CGS Units UnitTotal Units per Inventory Transaction Purchased Cost Cost Sold Unit CGS Balance Beginning inventory Purchase February8 Purchase -March 15 Sale - April 2 10,000 $ 18.00180,000 23,000 20.00460,000 18,600 22.00 409,200 180,000 640,000 1,049200 18,600 $ 22.00 23,000 20.00 37,800 1,073,800 1,458,200 7,900 18.00 $ 1.011,400 37,000 28.00 1,036,000 Purchase -April 30 Purchase- July 15 Sale - September 1 12.400 31.00 384.400 12,400 31.00 13,600 28.00 765,200693,000 1,693,500 Purchase November 9 34,500 29.00 1,000,500 "CGS = Cost of goods sold