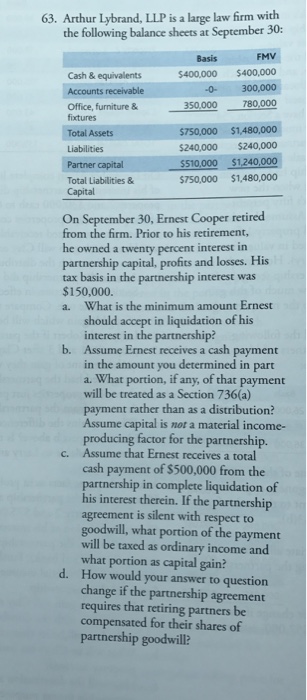

Arthur Lybrand, LLP is a large law firm with the following balance sheets at September 30: On September 30, Ernest Cooper retired from the firm. Prior to his retirement, he owned a twenty percent interest in partnership capital, profits and losses. His tax basis in the partnership interest was $150,000. a. What is the minimum amount Ernest should accept in liquidation of his interest in the partnership? b. Assume Ernest receives a cash payment in the amount you determined in part a. What portion, if any, of that payment will be treated as a Section 736 (a) payment rather than as a distribution? Assume capital is not a material income-producing factor for the partnership. c. Assume that Ernest receives a total cash payment of $500.000 from the partnership in complete liquidation of his interest therein. If the partnership agreement is silent with respect to goodwill, what portion of the payment will be taxed as ordinary income and what portion as capital gain? d. How would your answer to question change if the partnership agreement requires that retiring partners be compensated for their shares of partnership goodwill? Arthur Lybrand, LLP is a large law firm with the following balance sheets at September 30: On September 30, Ernest Cooper retired from the firm. Prior to his retirement, he owned a twenty percent interest in partnership capital, profits and losses. His tax basis in the partnership interest was $150,000. a. What is the minimum amount Ernest should accept in liquidation of his interest in the partnership? b. Assume Ernest receives a cash payment in the amount you determined in part a. What portion, if any, of that payment will be treated as a Section 736 (a) payment rather than as a distribution? Assume capital is not a material income-producing factor for the partnership. c. Assume that Ernest receives a total cash payment of $500.000 from the partnership in complete liquidation of his interest therein. If the partnership agreement is silent with respect to goodwill, what portion of the payment will be taxed as ordinary income and what portion as capital gain? d. How would your answer to question change if the partnership agreement requires that retiring partners be compensated for their shares of partnership goodwill