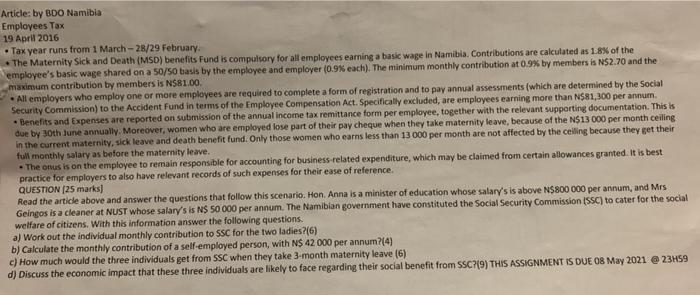

Article: by BDO Namibia Employees Tax 19 April 2016 Tax year runs from 1 March - 28/29 February The Maternity Sick and Death (MSD) benefits Fund is compulsory for all employees earning a basic wage in Namibia. Contributions are calculated as 1.8% of the employee's basic wage shared on a 50/50 basis by the employee and employer (0.9% each). The minimum monthly contribution at 0.9% by members is N$2.70 and the maximum contribution by members is N$81.00 - All employers who employ one or more employees are required to complete a form of registration and to pay annual assessments (which are determined by the Social Security Commission) to the Accident Fund in terms of the Employee Compensation Act. Specifically excluded, are employees earning more than N$81,300 per annum - Benefits and Expenses are reported on submission of the annual income tax remittance form per employee, together with the relevant supporting documentation. This is due by 30th June annually. Moreover, women who are employed lose part of their pay cheque when they take maternity leave, because of the N$13 000 per month ceiling in the current maternity, sick leave and death benefit fund. Only those women who earns less than 13 000 per month are not affected by the ceiling because they get their full monthly salary as before the maternity leave. The onus is on the employee to remain responsible for accounting for business related expenditure, which may be claimed from certain allowances granted. It is best practice for employers to also have relevant records of such expenses for their ease of reference. QUESTION (25 marks) Read the article above and answer the questions that follow this scenario. Hon. Anna is a minister of education whose salary's is above N$800 000 per annum, and Mrs Geingos is a cleaner at NUST whose salary's is N$ 50 000 per annum. The Namibian government have constituted the Social Security Commission (SSC) to cater for the social welfare of citizens. With this information answer the following questions. a) Work out the individual monthly contribution to SSC for the two ladies?(6) b) Calculate the monthly contribution of a self-employed person, with N$ 42 000 per annum?(4) c) How much would the three individuals get from SSC when they take 3-month maternity leave (6) d) Discuss the economic impact that these three individuals are likely to face regarding their social benefit from SSC?(9) THIS ASSIGNMENT IS DUE 08 May 2021 23H59 Article: by BDO Namibia Employees Tax 19 April 2016 Tax year runs from 1 March - 28/29 February The Maternity Sick and Death (MSD) benefits Fund is compulsory for all employees earning a basic wage in Namibia. Contributions are calculated as 1.8% of the employee's basic wage shared on a 50/50 basis by the employee and employer (0.9% each). The minimum monthly contribution at 0.9% by members is N$2.70 and the maximum contribution by members is N$81.00 - All employers who employ one or more employees are required to complete a form of registration and to pay annual assessments (which are determined by the Social Security Commission) to the Accident Fund in terms of the Employee Compensation Act. Specifically excluded, are employees earning more than N$81,300 per annum - Benefits and Expenses are reported on submission of the annual income tax remittance form per employee, together with the relevant supporting documentation. This is due by 30th June annually. Moreover, women who are employed lose part of their pay cheque when they take maternity leave, because of the N$13 000 per month ceiling in the current maternity, sick leave and death benefit fund. Only those women who earns less than 13 000 per month are not affected by the ceiling because they get their full monthly salary as before the maternity leave. The onus is on the employee to remain responsible for accounting for business related expenditure, which may be claimed from certain allowances granted. It is best practice for employers to also have relevant records of such expenses for their ease of reference. QUESTION (25 marks) Read the article above and answer the questions that follow this scenario. Hon. Anna is a minister of education whose salary's is above N$800 000 per annum, and Mrs Geingos is a cleaner at NUST whose salary's is N$ 50 000 per annum. The Namibian government have constituted the Social Security Commission (SSC) to cater for the social welfare of citizens. With this information answer the following questions. a) Work out the individual monthly contribution to SSC for the two ladies?(6) b) Calculate the monthly contribution of a self-employed person, with N$ 42 000 per annum?(4) c) How much would the three individuals get from SSC when they take 3-month maternity leave (6) d) Discuss the economic impact that these three individuals are likely to face regarding their social benefit from SSC?(9) THIS ASSIGNMENT IS DUE 08 May 2021 23H59