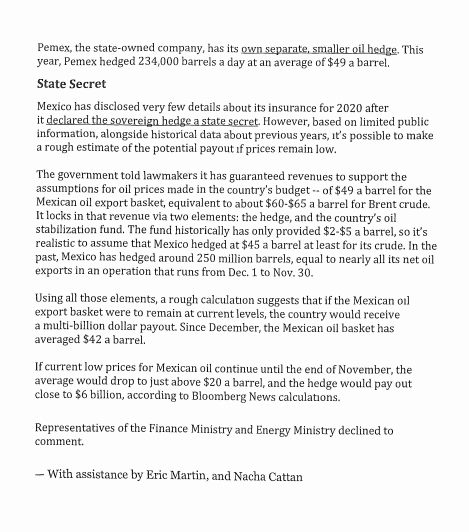

article mentioned in the post

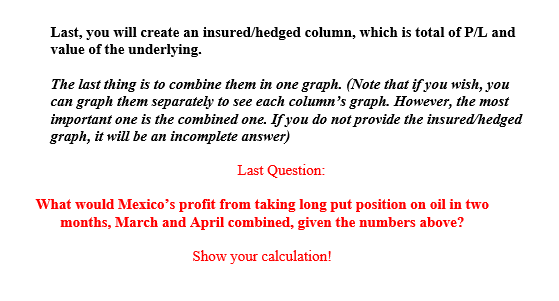

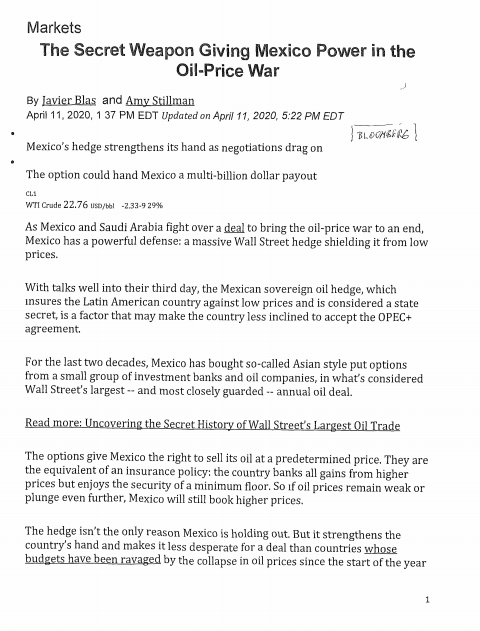

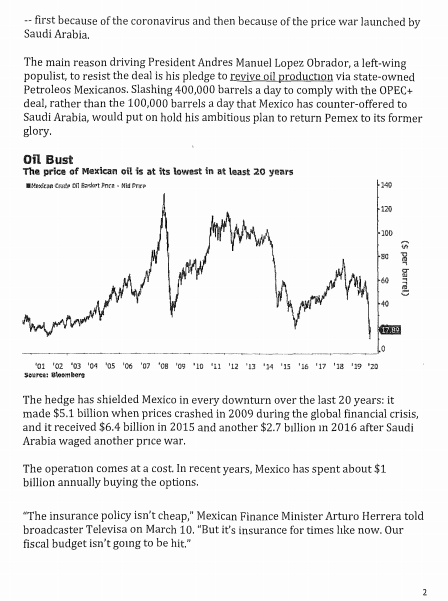

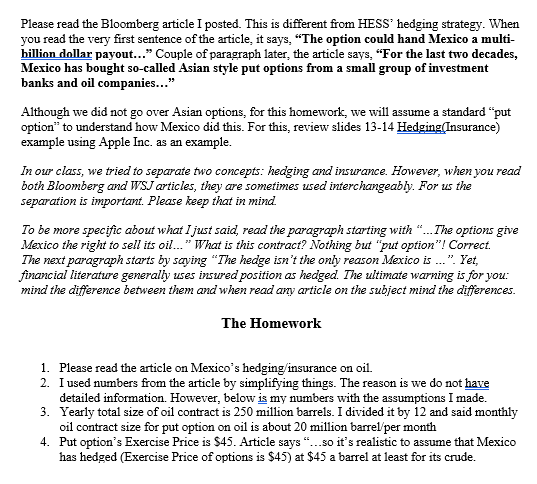

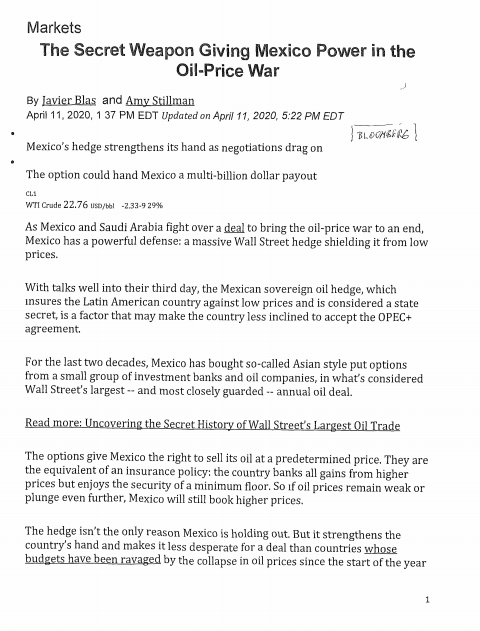

Please read the Bloomberg article I posted. This is different from HESS' hedging strategy. When you read the very first sentence of the article, it says. "The option could hand Mexico a multi- billion dollar payout..." Couple of paragraph later, the article says, "For the last two decades, Mexico has bought so-called Asian style put options from a small group of investment banks and oil companies..." Although we did not go over Asian options, for this homework, we will assume a standard put option" to understand how Mexico did this. For this review slides 13-14 Hedging (Insurance) example using Apple Inc. as an example. In our class, we tried to separate two concepts: hedging and insurance. However, when you read both Bloomberg and WSJ articles, they are sometimes used interchangeably. For us the separation is important. Please keep that in mind. To be more specific about what I just said, read the paragraph starting with "... The options give Mexico the right to sell its oil...." What is this contract? Nothing but "put option"! Correct. The next paragraph starts by saying "The hedge isn't the only reason Mexico is ...". Yet, financial literature generally uses insured position as hedged. The ultimate warning is for you: mind the difference between them and when read any article on the subject mind the differences. The Homework 1. Please read the article on Mexico's hedging insurance on oil. 2. I used numbers from the article by simplifying things. The reason is we do not have detailed information. However, below is my numbers with the assumptions I made. 3. Yearly total size of oil contract is 250 million barrels. I divided it by 12 and said monthly oil contract size for put option on oil is about 20 million barrel per month 4. Put option's Exercise Price is $45. Article says"...so it's realistic to assume that Mexico has hedged (Exercise Price of options is $45) at $45 a barrel at least for its crude. 5. I assume/estimate the cost of put options on average monthly as about $80million. I got this number from the following statement. The article says "...The operations comes at a cost. In recent years, Mexico has spent about $1billion annually buying the options..." So I divided yearly cost by 12 to make it monthly cost. 6. Prepare a table with the given instructions below. Note that you will create four columns: i Payoff to Put Option (Cash Flow from Put Option) ii. P/L of Put Option (Cash Flow of Profit and Loss) iii. Payoff to Underlying Asset, (Cash Flow from the underlying asset of oil) iv. Insured Hedged position (This is the total of P/L of put option and the value of underlying asset combined (Total Cash Flow insured/hedged position) 7. Once you prepare these 4 rows, graph them in one table with colored lines representing each position. Make sure you label the axes properly. Numbers to use for the problem: Although we do not have detailed monthly data about Mexico's insurance/hedging strategy, I provide some numbers to do the analysis under reasonable assumptions. Below are the numbers you are going to use in your calculations and graphs. Assume: 1. 2. Exercise price of Put Option: $45 per barrel. Premium of Put Option: $85million/per month. (I got this number by dividing yearly S7billion dollar cost of buying options, article) Size of contract: 20million barrel/month. (Assume that Mexico signs custom made one contract with an investment bank) Assume that in March and April they use average oil price as the price of oil at maturity. (I just averaged using the data I provided oil prices since Jan. 01, 2020) For March assume ST = 31.35 For April assume ST = 18.50 5. For both months use possible oil prices at maturity from $0 to 60 in increments of $2.5 6. Graph only for month of April. (No graph for March!). Therefore, you will present only one-month's position in graph, month of April. To summarize up to this point: You will have one column of put option payoff values for prices at maturity from S0-560 in increments of $2.5. Then you will have a column showing P/L of the option position. Then you will have another column showing the payoff of underlying asset. Last, you will create an insured/hedged column, which is total of P/L and value of the underlying. The last thing is to combine them in one graph. (Note that if you wish, you can graph them separately to see each column's graph. However, the most important one is the combined one. If you do not provide the insured hedged graph, it will be an incomplete answer) Last Question: What would Mexico's profit from taking long put position on oil in two months, March and April combined, given the numbers above? Show your calculation! Markets The Secret Weapon Giving Mexico Power in the Oil-Price War By Javier Blas and Amy Stillman April 11, 2020, 137 PM EDT Updated on April 11, 2020, 5:22 PM EDT 1 BLOCHER Mexico's hedge strengthens its hand as negotiations dragon The option could hand Mexico a multi-billion dollar payout WTI Crude 22.76 / -333-929% As Mexico and Saudi Arabia fight over a deal to bring the oil-price war to an end, Mexico has a powerful defense: a massive Wall Street hedge shielding it from low prices. With talks well into their third day, the Mexican sovereign oil hedge, which insures the Latin American country against low prices and is considered a state secret, is a factor that may make the country less inclined to accept the OPEC+ agreement For the last two decades, Mexico has bought so-called Asian style put options from a small group of investment banks and oil companies, in what's considered Wall Street's largest and most closely guarded -- annual oil deal. Read more: Uncovering the Secret History of Wall Street's Largest Oil Trade The options give Mexico the right to sell its oil at a predetermined price. They are the equivalent of an insurance policy: the country banks all gains from higher prices but enjoys the security of a minimum floor. So if oil prices remain weak or piunge even further, Mexico will still book higher prices. The hedge isn't the only reason Mexico is holding out. But it strengthens the country's hand and makes it less desperate for a deal than countries whose budgets have been ravaged by the collapse in oil prices since the start of the year -- first because of the coronavirus and then because of the price war launched by Saudi Arabia The main reason driving President Andres Manuel Lopez Obrador, a left-wing populist, to resist the deal is his pledge to revive oil production via state-owned Petroleos Mexicanos. Slashing 400,000 barrels a day to comply with the OPEC+ deal, rather than the 100,000 barrels a day that Mexico has counter-offered to Saudi Arabia, would put on hold his ambitious plan to return Pemex to its former glory. Oil Bust The price of Mexican oil is at its lowest in at least 20 years Bad Bad Pre-Nid Pro (s per barrel) hy mannen 01 02 03 04 Sorellenberg 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 The hedge has shielded Mexico in every downturn over the last 20 years: it made $5.1 billion when prices crashed in 2009 during the global financial crisis, and it received $6.4 billion in 2015 and another $2.7 billion in 2016 after Saudi Arabia waged another price war. The operation comes at a cost. In recent years, Mexico has spent about $1 billion annually buying the options. "The insurance policy isn't cheap," Mexican Finance Minister Arturo Herrera told broadcaster Televisa on March 10. "But it's insurance for times like now. Our fiscal budget isn't going to be hit." Pemex, the state-owned company, has its own separate, smaller oil hedge. This year, Pemex hedged 234,000 barrels a day at an average of $49 a barrel. State Secret Mexico has disclosed very few details about its insurance for 2020 after it declared the sovereign hedge a state secret. However, based on limited public information, alongside historical data about previous years, it's possible to make a rough estimate of the potential payout if prices remain low. The government told lawmakers it has guaranteed revenues to support the assumptions for oil prices made in the country's budget -- of $49 a barrel for the Mexican oil export basket, equivalent to about $60-$65 a barrel for Brent crude. It locks in that revenue via two elements: the hedge, and the country's oil stabilization fund. The fund historically has only provided $2-$5 a barrel, so it's realistic to assume that Mexico hedged at $45 a barrel at least for its crude. In the past, Mexico has hedged around 250 million barrels, equal to nearly all its net oil exports in an operation that runs from Dec. 1 to Nov. 30. Using all those elements, a rough calculation suggests that if the Mexican oil export basket were to remain at current levels, the country would receive a multi-billion dollar payout. Since December, the Mexican oil basket has averaged $42 a barrel. If current low prices for Mexican oil continue until the end of November, the average would drop to just above $20 a barrel, and the hedge would pay out close to $6 billion, according to Bloomberg News calculations. Representatives of the Finance Ministry and Energy Ministry declined to comment - With assistance by Eric Martin, and Nacha Cattan Please read the Bloomberg article I posted. This is different from HESS' hedging strategy. When you read the very first sentence of the article, it says. "The option could hand Mexico a multi- billion dollar payout..." Couple of paragraph later, the article says, "For the last two decades, Mexico has bought so-called Asian style put options from a small group of investment banks and oil companies..." Although we did not go over Asian options, for this homework, we will assume a standard put option" to understand how Mexico did this. For this review slides 13-14 Hedging (Insurance) example using Apple Inc. as an example. In our class, we tried to separate two concepts: hedging and insurance. However, when you read both Bloomberg and WSJ articles, they are sometimes used interchangeably. For us the separation is important. Please keep that in mind. To be more specific about what I just said, read the paragraph starting with "... The options give Mexico the right to sell its oil...." What is this contract? Nothing but "put option"! Correct. The next paragraph starts by saying "The hedge isn't the only reason Mexico is ...". Yet, financial literature generally uses insured position as hedged. The ultimate warning is for you: mind the difference between them and when read any article on the subject mind the differences. The Homework 1. Please read the article on Mexico's hedging insurance on oil. 2. I used numbers from the article by simplifying things. The reason is we do not have detailed information. However, below is my numbers with the assumptions I made. 3. Yearly total size of oil contract is 250 million barrels. I divided it by 12 and said monthly oil contract size for put option on oil is about 20 million barrel per month 4. Put option's Exercise Price is $45. Article says"...so it's realistic to assume that Mexico has hedged (Exercise Price of options is $45) at $45 a barrel at least for its crude. 5. I assume/estimate the cost of put options on average monthly as about $80million. I got this number from the following statement. The article says "...The operations comes at a cost. In recent years, Mexico has spent about $1billion annually buying the options..." So I divided yearly cost by 12 to make it monthly cost. 6. Prepare a table with the given instructions below. Note that you will create four columns: i Payoff to Put Option (Cash Flow from Put Option) ii. P/L of Put Option (Cash Flow of Profit and Loss) iii. Payoff to Underlying Asset, (Cash Flow from the underlying asset of oil) iv. Insured Hedged position (This is the total of P/L of put option and the value of underlying asset combined (Total Cash Flow insured/hedged position) 7. Once you prepare these 4 rows, graph them in one table with colored lines representing each position. Make sure you label the axes properly. Numbers to use for the problem: Although we do not have detailed monthly data about Mexico's insurance/hedging strategy, I provide some numbers to do the analysis under reasonable assumptions. Below are the numbers you are going to use in your calculations and graphs. Assume: 1. 2. Exercise price of Put Option: $45 per barrel. Premium of Put Option: $85million/per month. (I got this number by dividing yearly S7billion dollar cost of buying options, article) Size of contract: 20million barrel/month. (Assume that Mexico signs custom made one contract with an investment bank) Assume that in March and April they use average oil price as the price of oil at maturity. (I just averaged using the data I provided oil prices since Jan. 01, 2020) For March assume ST = 31.35 For April assume ST = 18.50 5. For both months use possible oil prices at maturity from $0 to 60 in increments of $2.5 6. Graph only for month of April. (No graph for March!). Therefore, you will present only one-month's position in graph, month of April. To summarize up to this point: You will have one column of put option payoff values for prices at maturity from S0-560 in increments of $2.5. Then you will have a column showing P/L of the option position. Then you will have another column showing the payoff of underlying asset. Last, you will create an insured/hedged column, which is total of P/L and value of the underlying. The last thing is to combine them in one graph. (Note that if you wish, you can graph them separately to see each column's graph. However, the most important one is the combined one. If you do not provide the insured hedged graph, it will be an incomplete answer) Last Question: What would Mexico's profit from taking long put position on oil in two months, March and April combined, given the numbers above? Show your calculation! Markets The Secret Weapon Giving Mexico Power in the Oil-Price War By Javier Blas and Amy Stillman April 11, 2020, 137 PM EDT Updated on April 11, 2020, 5:22 PM EDT 1 BLOCHER Mexico's hedge strengthens its hand as negotiations dragon The option could hand Mexico a multi-billion dollar payout WTI Crude 22.76 / -333-929% As Mexico and Saudi Arabia fight over a deal to bring the oil-price war to an end, Mexico has a powerful defense: a massive Wall Street hedge shielding it from low prices. With talks well into their third day, the Mexican sovereign oil hedge, which insures the Latin American country against low prices and is considered a state secret, is a factor that may make the country less inclined to accept the OPEC+ agreement For the last two decades, Mexico has bought so-called Asian style put options from a small group of investment banks and oil companies, in what's considered Wall Street's largest and most closely guarded -- annual oil deal. Read more: Uncovering the Secret History of Wall Street's Largest Oil Trade The options give Mexico the right to sell its oil at a predetermined price. They are the equivalent of an insurance policy: the country banks all gains from higher prices but enjoys the security of a minimum floor. So if oil prices remain weak or piunge even further, Mexico will still book higher prices. The hedge isn't the only reason Mexico is holding out. But it strengthens the country's hand and makes it less desperate for a deal than countries whose budgets have been ravaged by the collapse in oil prices since the start of the year -- first because of the coronavirus and then because of the price war launched by Saudi Arabia The main reason driving President Andres Manuel Lopez Obrador, a left-wing populist, to resist the deal is his pledge to revive oil production via state-owned Petroleos Mexicanos. Slashing 400,000 barrels a day to comply with the OPEC+ deal, rather than the 100,000 barrels a day that Mexico has counter-offered to Saudi Arabia, would put on hold his ambitious plan to return Pemex to its former glory. Oil Bust The price of Mexican oil is at its lowest in at least 20 years Bad Bad Pre-Nid Pro (s per barrel) hy mannen 01 02 03 04 Sorellenberg 05 06 07 08 09 10 11 12 13 14 15 16 17 18 19 20 The hedge has shielded Mexico in every downturn over the last 20 years: it made $5.1 billion when prices crashed in 2009 during the global financial crisis, and it received $6.4 billion in 2015 and another $2.7 billion in 2016 after Saudi Arabia waged another price war. The operation comes at a cost. In recent years, Mexico has spent about $1 billion annually buying the options. "The insurance policy isn't cheap," Mexican Finance Minister Arturo Herrera told broadcaster Televisa on March 10. "But it's insurance for times like now. Our fiscal budget isn't going to be hit." Pemex, the state-owned company, has its own separate, smaller oil hedge. This year, Pemex hedged 234,000 barrels a day at an average of $49 a barrel. State Secret Mexico has disclosed very few details about its insurance for 2020 after it declared the sovereign hedge a state secret. However, based on limited public information, alongside historical data about previous years, it's possible to make a rough estimate of the potential payout if prices remain low. The government told lawmakers it has guaranteed revenues to support the assumptions for oil prices made in the country's budget -- of $49 a barrel for the Mexican oil export basket, equivalent to about $60-$65 a barrel for Brent crude. It locks in that revenue via two elements: the hedge, and the country's oil stabilization fund. The fund historically has only provided $2-$5 a barrel, so it's realistic to assume that Mexico hedged at $45 a barrel at least for its crude. In the past, Mexico has hedged around 250 million barrels, equal to nearly all its net oil exports in an operation that runs from Dec. 1 to Nov. 30. Using all those elements, a rough calculation suggests that if the Mexican oil export basket were to remain at current levels, the country would receive a multi-billion dollar payout. Since December, the Mexican oil basket has averaged $42 a barrel. If current low prices for Mexican oil continue until the end of November, the average would drop to just above $20 a barrel, and the hedge would pay out close to $6 billion, according to Bloomberg News calculations. Representatives of the Finance Ministry and Energy Ministry declined to comment - With assistance by Eric Martin, and Nacha Cattan