Answered step by step

Verified Expert Solution

Question

1 Approved Answer

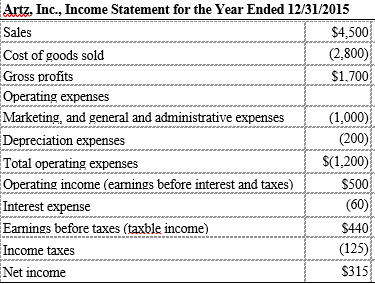

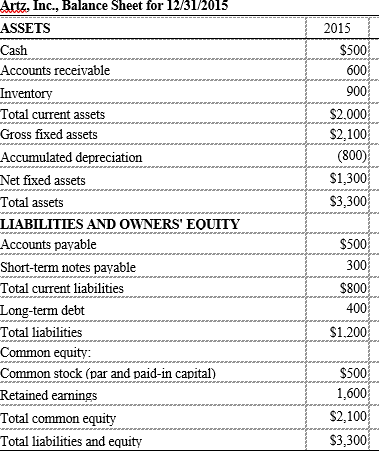

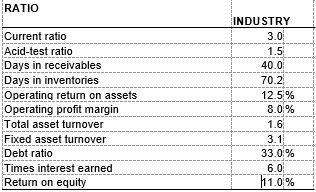

Artz, Inc.'s financial statements for 2015 are shown below The chief financial officer for Artz has acquired industry averages for the following ratios: a. Compute

Artz, Inc.'s financial statements for 2015 are shown below

The chief financial officer for Artz has acquired industry averages for the following ratios:

a. Compute the ratios listed above for Artz.

b. Compared to the industry:

(1) How liquid is the firm?

(2) Are its managers generating attractive operating profit on the firm's assets?

(3) How is the firm financing its assets?

(4) Are its managers generating a good return on equity?

Artz Inc., Income Statement for the Year Ended 12/31/2015 Sales Cost of goods sold Gross profits Operating expenses Marketing, and general and administrative expenses S4,500 (2,800) $1.700 Total operating expenses Operating income (earnings before interest and taxes) Interest expense Earnings before taxes taxble income) Income taxes Net income (1,000) (200) S(1,200) S500 (60); S440 (125) S315 Artz, Inc., Balance Sheet for 12/31/2015 ASSETS Cash Accounts receivable Inventory Total curent assets Gross fixed assets Accumulated depreciation Net fixed assets Total assets LIABILITIES AND OWNERS EOUITY Accounts payable Short-term notes payable Total curent liabilities Long-term debt Total liabilities Common equity: Common stock (par and paid-in capital) Retained earnings Total common equity Total liabilities and equity 2015 $500 600 900 S2,000 $2,100 (800) S1,300 S3,300 $500 300 $800 400 S1,200 $500 1,600 $2,100 S3,300 RATIO INDUSTRY 3.0 Current ratio Acid-test ratio Days in receivables Days in inventories Operating return on assets Operating profit margin Total asset turnover Fixed asset turnover Debt ratio Times interest earned Return on equity 40.0 70.2 12.5% 8.0% 33.0% 6.0 1.0%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started