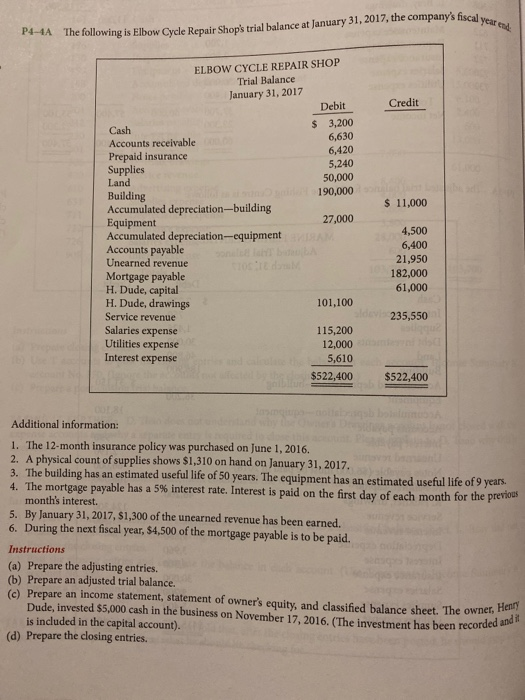

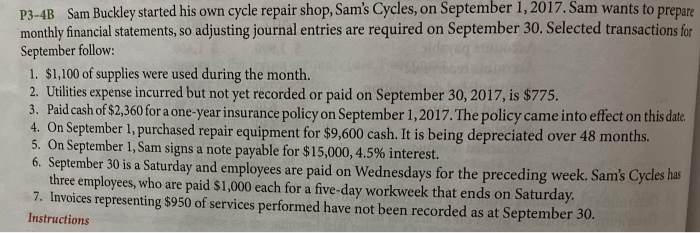

ary 31, 2017, the company's fiscal year The following is Elbow Cycle Repair Shop's trial balance at January 31, 2017 P4-4A Credit 6,630 6,420 $ 11,000 ELBOW CYCLE REPAIR SHOP Trial Balance January 31, 2017 Debit $ 3,200 Cash Accounts receivable Prepaid insurance Supplies 5,240 Land 50,000 Building 190,000 Accumulated depreciation-building Equipment 27,000 Accumulated depreciation--equipment Accounts payable Unearned revenue Mortgage payable H. Dude, capital H. Dude, drawings 101,100 Service revenue Salaries expense 115,200 Utilities expense 12,000 Interest expense 5,610 $522,400 4,500 6,400 21,950 182,000 61,000 235,550 $522,400 Additional information: 1. The 12-month insurance policy was purchased on June 1, 2016. 2. A physical count of supplies shows $1,310 on hand on January 31, 2017. 3. The building has an estimated useful life of 50 years. The equipment has an estimated useful life of 9 years. 4. The mortgage payable has a 5% interest rate. Interest is paid on the first day of each month for the pre month's interest. 5. By January 31, 2017, $1,300 of the unearned revenue has been earned. 6. During the next fiscal year, $4,500 of the mortgage payable is to be paid. Instructions (a) Prepare the adjusting entries. (b) Prepare an adjusted trial balance. ( Prepare an income statement, statement of owner's equity, and classified balance sheet. The own Dude, invested $5,000 cash in the business on November 17, 2016. The investment has been record is included in the capital account). (d) Prepare the closing entries. recorded and a P3-4B Sam Buckley started his own cycle repair shop, Sam's Cycles, on September 1, 2017. Sam wants to prepare monthly financial statements, so adjusting journal entries are required on September 30. Selected transactions for September follow: 1. $1,100 of supplies were used during the month. 2. Utilities expense incurred but not yet recorded or paid on September 30, 2017, is $775. 3. Paid cash of $2,360 for a one-year insurance policy on September 1, 2017. The policy came into effect on this date. 4. On September 1, purchased repair equipment for $9,600 cash. It is being depreciated over 48 months. 5. On September 1, Sam signs a note payable for $15,000, 4.5% interest. 6. September 30 is a Saturday and employees are paid on Wednesdays for the preceding week. Sam's Cycles has three employees, who are paid $1,000 each for a five-day workweek that ends on Saturday. 7. Invoices representing $950 of services performed have not been recorded as at September 30. Instructions ary 31, 2017, the company's fiscal year The following is Elbow Cycle Repair Shop's trial balance at January 31, 2017 P4-4A Credit 6,630 6,420 $ 11,000 ELBOW CYCLE REPAIR SHOP Trial Balance January 31, 2017 Debit $ 3,200 Cash Accounts receivable Prepaid insurance Supplies 5,240 Land 50,000 Building 190,000 Accumulated depreciation-building Equipment 27,000 Accumulated depreciation--equipment Accounts payable Unearned revenue Mortgage payable H. Dude, capital H. Dude, drawings 101,100 Service revenue Salaries expense 115,200 Utilities expense 12,000 Interest expense 5,610 $522,400 4,500 6,400 21,950 182,000 61,000 235,550 $522,400 Additional information: 1. The 12-month insurance policy was purchased on June 1, 2016. 2. A physical count of supplies shows $1,310 on hand on January 31, 2017. 3. The building has an estimated useful life of 50 years. The equipment has an estimated useful life of 9 years. 4. The mortgage payable has a 5% interest rate. Interest is paid on the first day of each month for the pre month's interest. 5. By January 31, 2017, $1,300 of the unearned revenue has been earned. 6. During the next fiscal year, $4,500 of the mortgage payable is to be paid. Instructions (a) Prepare the adjusting entries. (b) Prepare an adjusted trial balance. ( Prepare an income statement, statement of owner's equity, and classified balance sheet. The own Dude, invested $5,000 cash in the business on November 17, 2016. The investment has been record is included in the capital account). (d) Prepare the closing entries. recorded and a P3-4B Sam Buckley started his own cycle repair shop, Sam's Cycles, on September 1, 2017. Sam wants to prepare monthly financial statements, so adjusting journal entries are required on September 30. Selected transactions for September follow: 1. $1,100 of supplies were used during the month. 2. Utilities expense incurred but not yet recorded or paid on September 30, 2017, is $775. 3. Paid cash of $2,360 for a one-year insurance policy on September 1, 2017. The policy came into effect on this date. 4. On September 1, purchased repair equipment for $9,600 cash. It is being depreciated over 48 months. 5. On September 1, Sam signs a note payable for $15,000, 4.5% interest. 6. September 30 is a Saturday and employees are paid on Wednesdays for the preceding week. Sam's Cycles has three employees, who are paid $1,000 each for a five-day workweek that ends on Saturday. 7. Invoices representing $950 of services performed have not been recorded as at September 30. Instructions