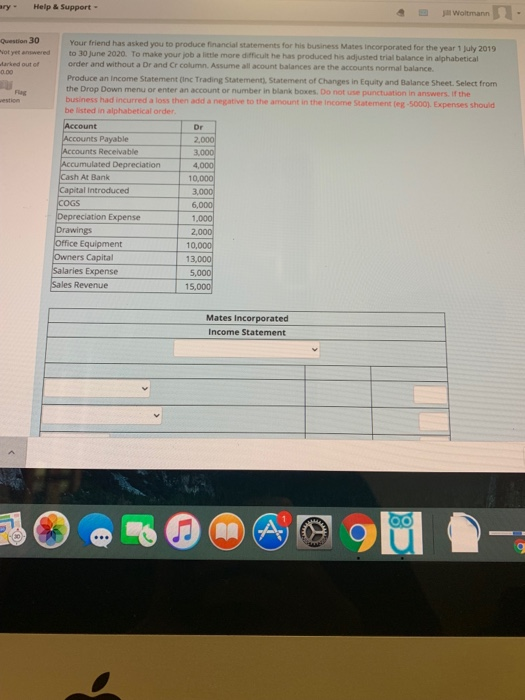

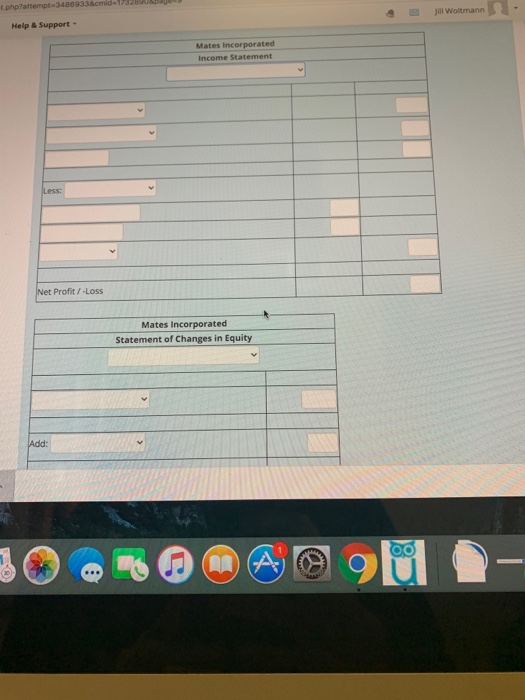

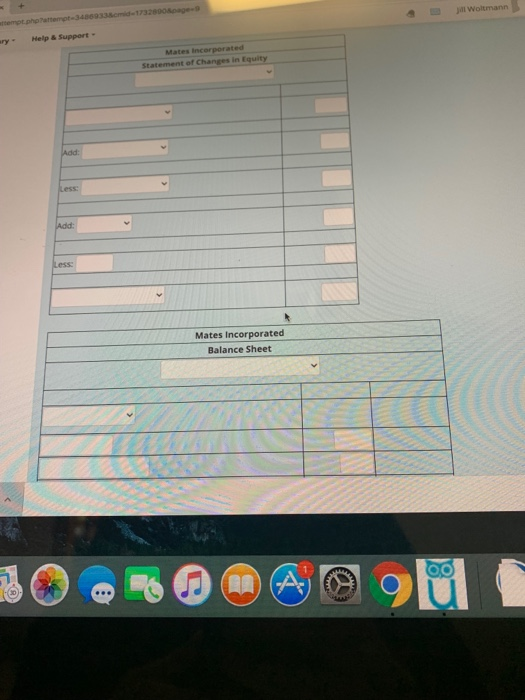

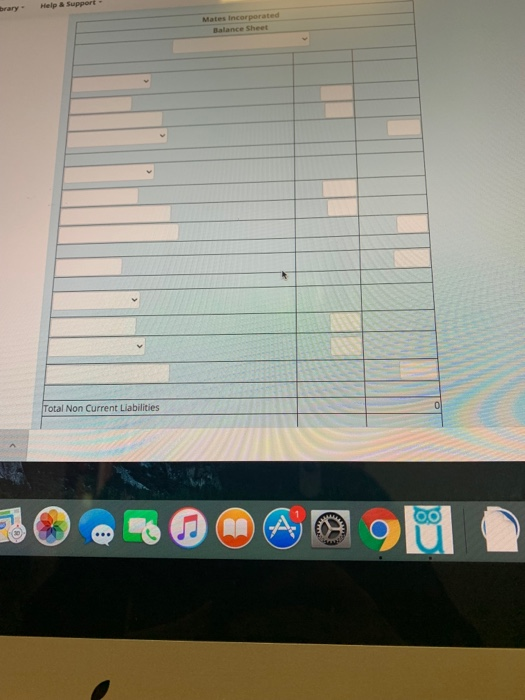

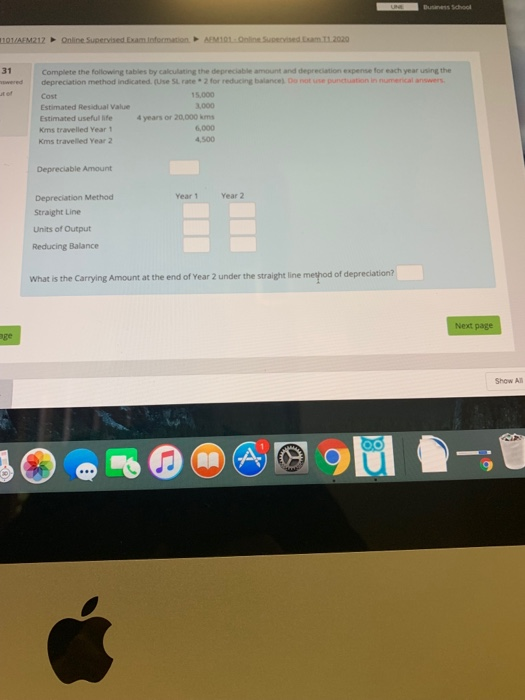

ary - Help & Support - Woltmann Question 30 Your friend has asked you to produce financial statements for his business Mates incorporated for the year 1 July 2019 Not yet answered to 30 June 2020. To make your job a little more difficult he has produced his adjusted trial balance in alphabetical tarked out of order and without a Dr and Cr column. Assume all count balances are the accounts normal balance Produce an income Statement inc Trading Statement. Statement of Changes in Equity and Balance Sheet Select from the Drop Down menu or enter an account or number in blank boxes. Do not use punctuation in answers. If the business had incurred a loss then add a negative to the amount in the income Statement leg-5000). Expenses should be listed in alphabetical order. Account Dr Accounts Payable 2,000 Accounts Receivable 3,000 Accumulated Depreciation 4,000 Cash At Bank 10,000 Capital Introduced 3.000 COGS 6,000 Depreciation Expense 1.000 Drawings 2,000 Office Equipment 10,000 Owners Capital 13,000 Salaries Expense 5,000 Sales Revenue 15,000 Mates Incorporated Income Statement ... (A) t.php?attempt348693 jul Woltmann Help & Support - Mates incorporated Income Statement Less: Net Profit/ -LOSS Mates Incorporated Statement of Changes in Equity Add: OO A Woltmann motomot-3486933cmid1732800 ary Help & Support - Mates incorporated Statement of Changes in Equity Add less Add Less Mates Incorporated Balance Sheet ... Help & Support Mates incorporated Balance Sheet Total Non Current Liabilities ... o Total Non Current Liabilities Total Liabilities and Owners Equity bus page - ol Busch 1101/AEM212 Online Supervised bam information AEM101 Online Subm112020 31 Complete the following tables by calculating the depreciable amount and depreciation expense for each year using the depreciation method indicated. Use Strate2 for reducing balance Date punctuation innumental answers Cost 15.000 Estimated Residual Value 3.000 Estimated useful life 4 years or 20,000 km Kms travelled Year 1 6,000 Kms travelled Year 2 4,500 Depreciable Amount Year 1 Year 2 Depreciation Method Straight Line Units of Output Reducing Balance What is the Carrying Amount at the end of Year 2 under the straight line method of depreciation? Next page Show All 30BWA 90