Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a book keeper for the Small company next door LTD your duties include doing the monthly payroll. The Small company next door Ltd

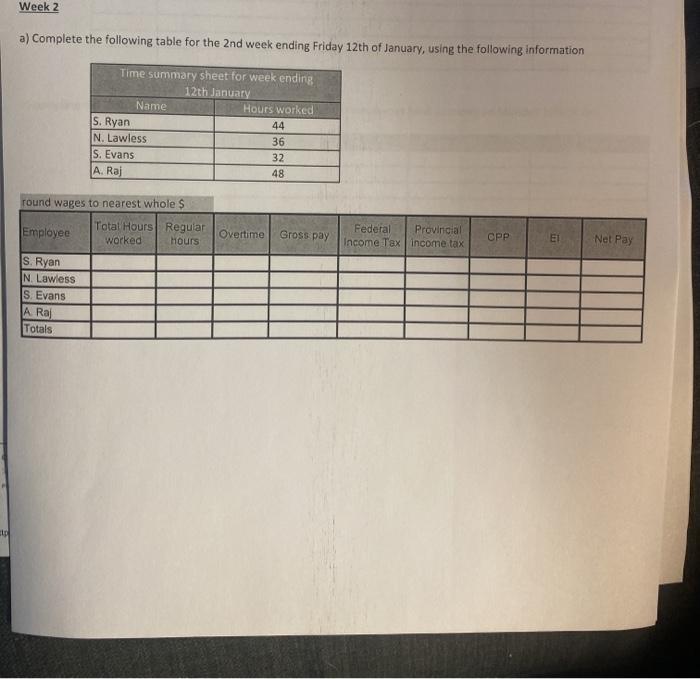

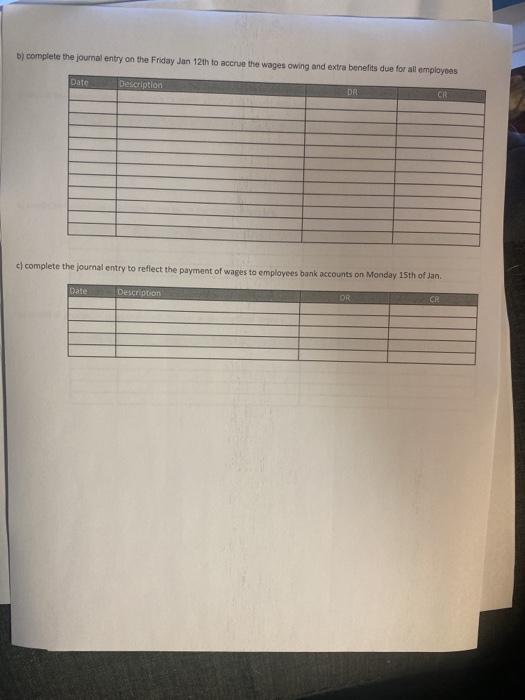

As a book keeper for the "Small company next door LTD" your duties include doing the monthly payroll. The "Small company next door Ltd" employees 4 people. 4 of the employees are paid hourly and paid weekly. The 4 employees are paid the following hourly wage, which is based on length of service Name wage S. Ryan N. Lawless 5. Evans $ 15.00 per hour $13.50 per hour $ 12.00 per hour A. Raj $ 10.25 per hour Overtime is time and a half and starts after the 44 hours worked in a regular week The company pays weekly. The company calculates what is owing to employees on the Friday of each week and then deposits the money into the employees accounts via direct debit on the following Monday. The company remits El and CPP collected on the 20th day of the month. Year 5.25% with a annual excemption of $3,500.00 2020 CPP is calcuated at El is calcuated at 1.58% 2020 Or you may use the Tables in AME The employer is required to contribute a) 100% of the CPP premium b) 140% of the El premuim In order to determine the federal and provincial income, your company uses current 2020 Tax tables provided by the Canadian reveune agency, or the Payroll Online Calculator (POC). See link below Your task is to a) calculate the net pay of each employee for the first 2 pay periods b) complete all required payroll transactions for the first 2 pay period of the new year, to get the tax tables for income tax/cpp/ei (2020 Archived) https://www.canada.ca/en/revenue-agency/services/forms-publications/payroll/14032-payroll-deductions tables-previous-vears/14032on-january-2020.html tables All employees have filed for Claim code CC 1 Be sure to calculate regular time and overtime values separately and then add the results together for gross pay for each employee and if using the PR tables, ranges of pay are listed in such a way that the ending number for one range and the beginning number for the next range may be the same, say 2009. This means the first range actually ends at 2008.99, so it would be for less than 2009. Week 1 stp Week 2 a) Complete the following table for the 2nd week ending Friday 12th of January, using the following information Time summary sheet for week ending 12th January Name Hours worked 44 36 32 48 Federal Provincial Income Tax income tax CPP S. Ryan N. Lawless S. Evans A. Raj round wages to nearest whole $ Employee S. Ryan N. Lawless S. Evans A. Raj Totals Total Hours Regular worked hours Overtime Gross pay Net Pay b) complete the journal entry on the Friday Jan 12th to accrue the wages owing and extra benefits due for all employees Date Description DR CR c) complete the journal entry to reflect the payment of wages to employees bank accounts on Monday 15th of Jan. Date Description DR CR

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Employee SRiyan NLawless SEvans ARaj Total Employee Hours Overtime 34 44 6 28 44 3 150 9 From online ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started