Answered step by step

Verified Expert Solution

Question

1 Approved Answer

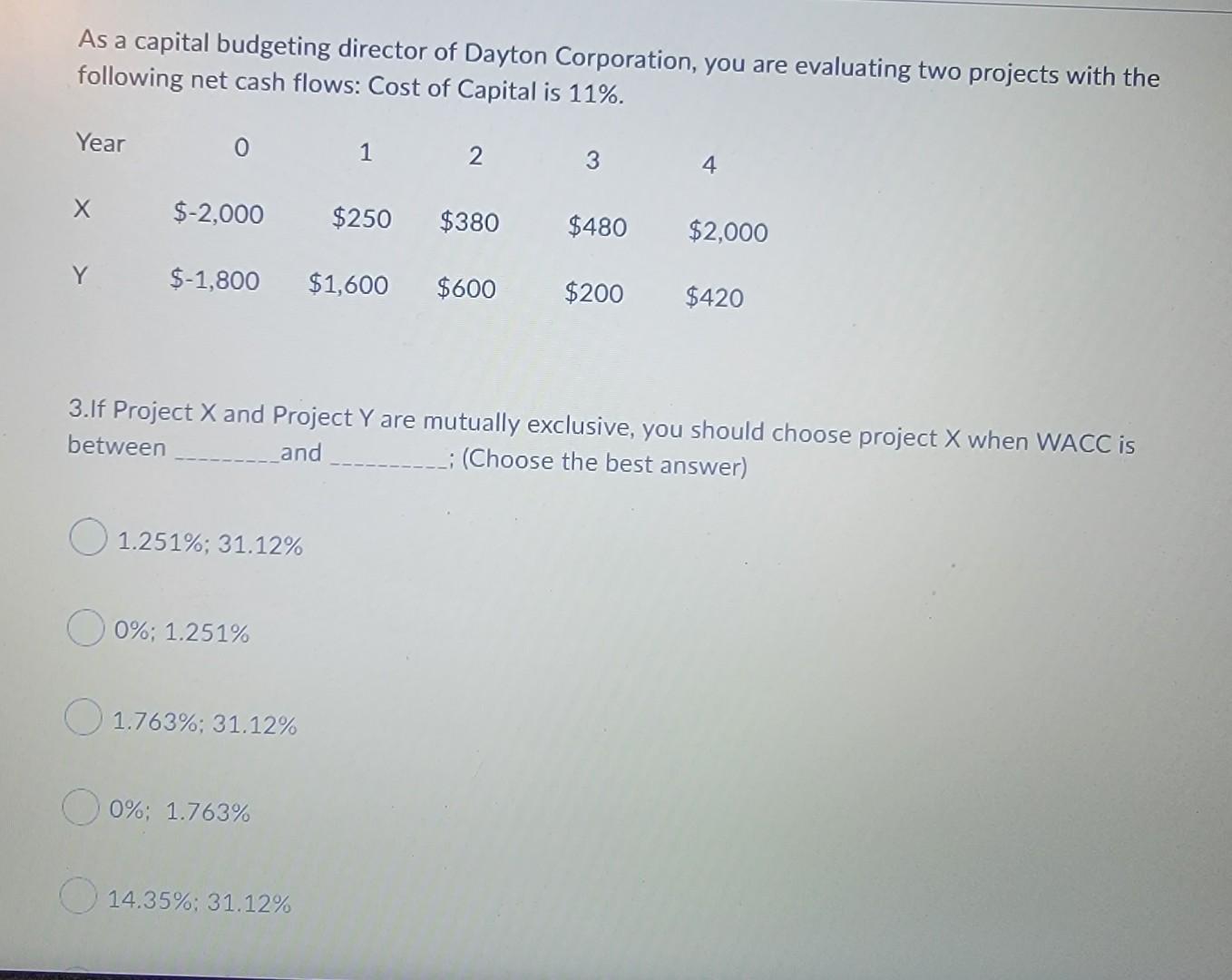

As a capital budgeting director of Dayton Corporation, you are evaluating two projects with the following net cash flows: Cost of Capital is 11%. Year

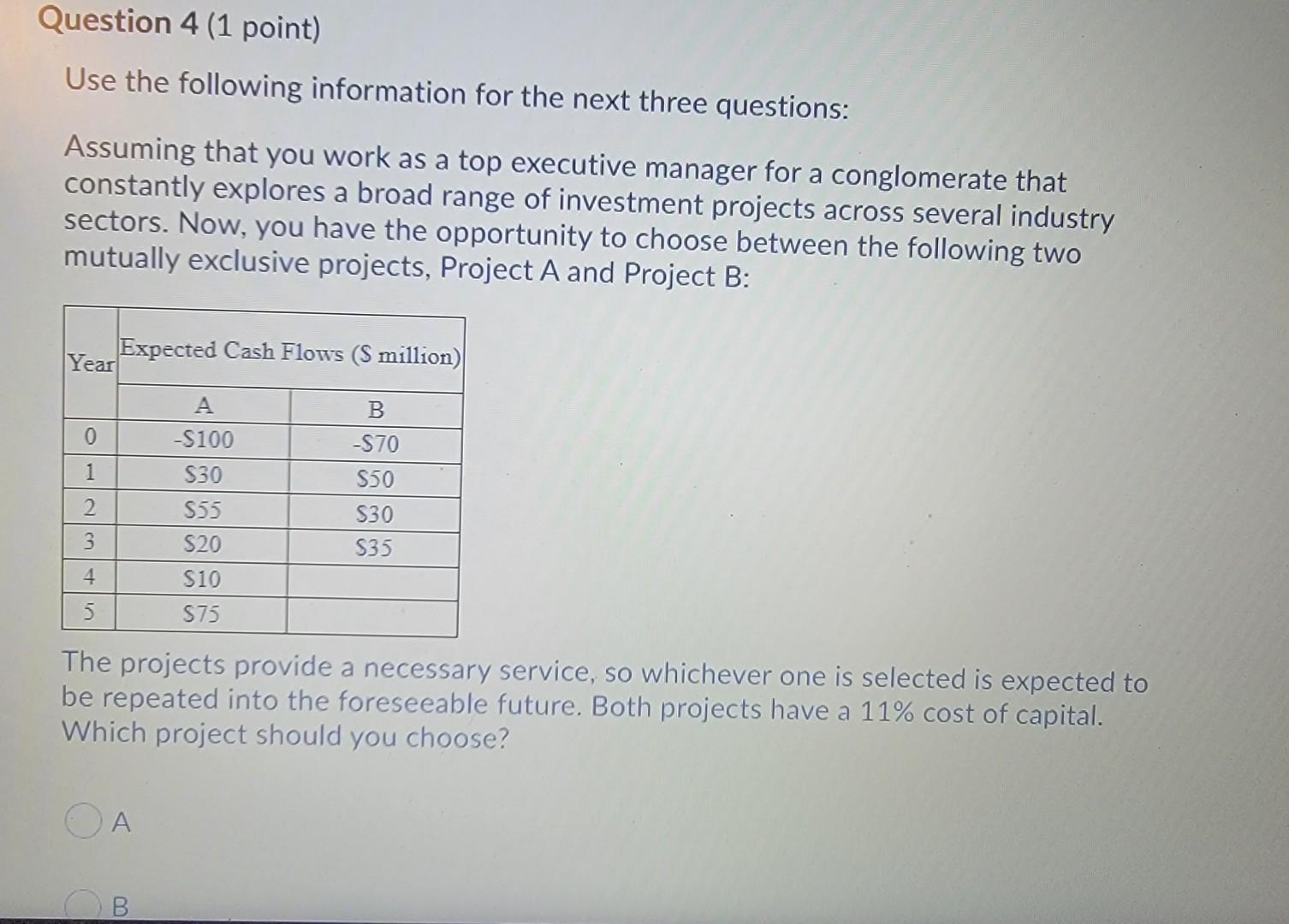

As a capital budgeting director of Dayton Corporation, you are evaluating two projects with the following net cash flows: Cost of Capital is 11%. Year 1 2 3 4 $-2,000 $250 $380 $480 $2,000 Y $-1,800 $1,600 $600 $200 $420 3.If Project X and Project Y are mutually exclusive, you should choose project X when WACC is between __and ; (Choose the best answer) 01.251%; 31.12% O 0%; 1.251% 1.763%; 31.12% 0%; 1.763% 14.35%; 31.12% Question 4 (1 point) Use the following information for the next three questions: Assuming that you work as a top executive manager for a conglomerate that constantly explores a broad range of investment projects across several industry sectors. Now, you have the opportunity to choose between the following two mutually exclusive projects, Project A and Project B: Expected Cash Flows (S million) Year A B 0 1 -S100 $30 555 S20 S10 $75 -S70 $50 $30 S35 2 3 4 The projects provide a necessary service, so whichever one is selected is expected to be repeated into the foreseeable future. Both projects have a 11% cost of capital. Which project should you choose? OA B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started