Question

As a Corporate Finance advisor for UPI Company, your task is to assist them in acquiring B Company. This will require conducting a financial ratio

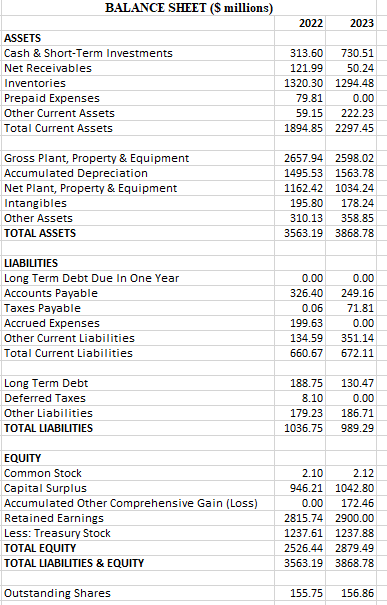

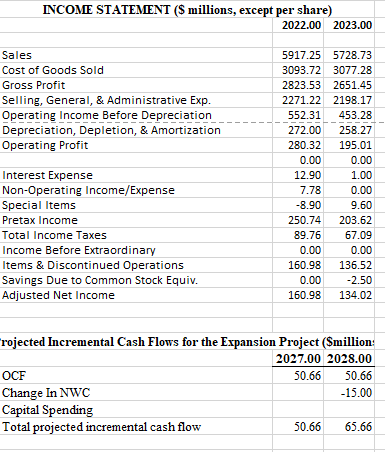

As a Corporate Finance advisor for UPI Company, your task is to assist them in acquiring B Company. This will require conducting a financial ratio analysis and providing a comprehensive analytical report based on financial reports. To accomplish this, you will need to complete the following tasks:

A-Construct Cash Flows Statement for 2023.

B- Calculate the following profitability, turnover-control, and leverage and liquidity ratios for five years.

1- Profitability Ratios (Return on equity, Return on assets, Return on invested capital, Profit margin, and Basic EPS.)

2- Turnover-Control Ratios (Asset turnover, Fixed-asset turnover, Inventory turnover, Collection period (days), Days' sales in cash, and Payables period.)

3- Leverage and Liquidity Ratios (Assets to equity, Debt to assets, Debt to equity, Current ratio, and Acid test.)

4- Solvency Ratios (Total liabilities-to-equity, Times-interest-earned)

C- Considering the above ratios, conduct trend-analysis (horizontal ratio analysis) fo the period shown.

D- Convert Income Statement and Balance Sheet to standardized form, using Common Size method.

E- Given incremental cash flows and cost of capital of 14%, calculate the PV of the Expansion Project.

INCOME STATEMENT (\$ millions, except per share) \begin{tabular}{|l|r|r|} \hline & 2022.00 & 2023.00 \\ \hline Sales & 5917.25 & 5728.73 \\ \hline Cost of Goods Sold & 3093.72 & 3077.28 \\ \hline Gross Profit & 2823.53 & 2651.45 \\ \hline Selling, General, \& Administrative Exp. & 2271.22 & 2198.17 \\ \hline Operating Income Before Depreciation & 552.31 & 453.28 \\ \hline Depreciation, Depletion, \& Amortization & 272.00 & 258.27 \\ \hline Operating Profit & 280.32 & 195.01 \\ \hline & 0.00 & 0.00 \\ \hline Interest Expense & 12.90 & 1.00 \\ \hline Non-Operating Income/Expense & 7.78 & 0.00 \\ \hline Special Items & -8.90 & 9.60 \\ \hline Pretax Income & 250.74 & 203.62 \\ \hline Total Income Taxes & 89.76 & 67.09 \\ \hline Income Before Extraordinary & 0.00 & 0.00 \\ \hline Items \& Discontinued Operations & 160.98 & 136.52 \\ \hline Savings Due to Common Stock Equiv. & 0.00 & -2.50 \\ \hline Adjusted Net Income & 160.98 & 134.02 \\ \hline & & \\ \hline rojected Incremental Cash Flows for the Expansion Project (\$million \\ \hline Och & 2027.00 & 2028.00 \\ \hline Changital Spending & 50.66 & 50.66 \\ \hline Total projected incremental cash flow & & -15.00 \\ \hline \end{tabular} INCOME STATEMENT (\$ millions, except per share) \begin{tabular}{|l|r|r|} \hline & 2022.00 & 2023.00 \\ \hline Sales & 5917.25 & 5728.73 \\ \hline Cost of Goods Sold & 3093.72 & 3077.28 \\ \hline Gross Profit & 2823.53 & 2651.45 \\ \hline Selling, General, \& Administrative Exp. & 2271.22 & 2198.17 \\ \hline Operating Income Before Depreciation & 552.31 & 453.28 \\ \hline Depreciation, Depletion, \& Amortization & 272.00 & 258.27 \\ \hline Operating Profit & 280.32 & 195.01 \\ \hline & 0.00 & 0.00 \\ \hline Interest Expense & 12.90 & 1.00 \\ \hline Non-Operating Income/Expense & 7.78 & 0.00 \\ \hline Special Items & -8.90 & 9.60 \\ \hline Pretax Income & 250.74 & 203.62 \\ \hline Total Income Taxes & 89.76 & 67.09 \\ \hline Income Before Extraordinary & 0.00 & 0.00 \\ \hline Items \& Discontinued Operations & 160.98 & 136.52 \\ \hline Savings Due to Common Stock Equiv. & 0.00 & -2.50 \\ \hline Adjusted Net Income & 160.98 & 134.02 \\ \hline & & \\ \hline rojected Incremental Cash Flows for the Expansion Project (\$million \\ \hline Och & 2027.00 & 2028.00 \\ \hline Changital Spending & 50.66 & 50.66 \\ \hline Total projected incremental cash flow & & -15.00 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started