Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a finance manager for Barry's Superstore, you are required to calculate and briefly explain the meaning of the CURRENT YEAR RATIOS to your top

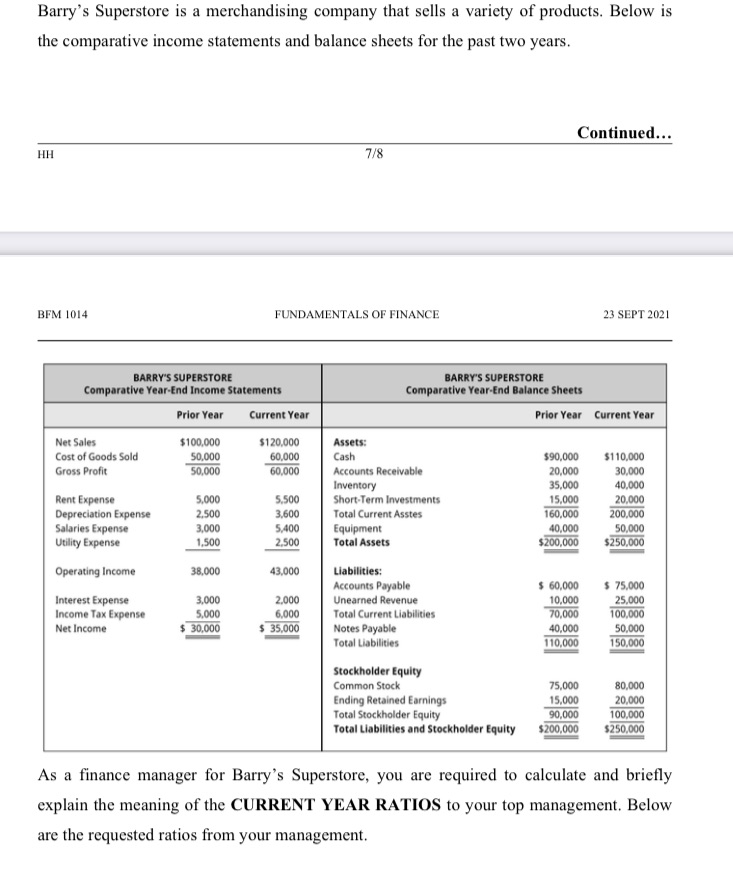

As a finance manager for Barry's Superstore, you are required to calculate and briefly explain the meaning of the CURRENT YEAR RATIOS to your top management. Below are the requested ratios from your management.A. Working Capital Ratio marks)B. Debt RatioC. Day's cost in payableD. Return on Equity (based on DuPont Identity)marks)E. Explain why the DuPont identity is so useful to a financial manager.marks)

Barry's Superstore is a merchandising company that sells a variety of products. Below is the comparative income statements and balance sheets for the past two years. HH BFM 1014 7/8 FUNDAMENTALS OF FINANCE BARRY'S SUPERSTORE Comparative Year-End Income Statements Continued... BARRY'S SUPERSTORE Comparative Year-End Balance Sheets 23 SEPT 2021 Prior Year Current Year Prior Year Current Year Net Sales $100,000 $120,000 Cost of Goods Sold 50,000 60,000 Assets: Cash $90,000 $110,000 Gross Profit 50,000 60,000 Accounts Receivable 20,000 30,000 Inventory 35,000 40,000 Rent Expense 5,000 5,500 Short-Term Investments 15,000 20,000 Depreciation Expense 2,500 3,600 Total Current Asstes 160,000 200,000 Salaries Expense 3,000 5,400 Equipment 40,000 50,000 Utility Expense 1,500 2.500 Total Assets $200,000 $250,000 Operating Income 38,000 43,000 Liabilities: Accounts Payable $ 60,000 $ 75,000 Interest Expense Income Tax Expense Net Income 3,000 5,000 $30,000 2,000 Unearned Revenue 10,000 25,000 6,000 Total Current Liabilities 70,000 100,000 $ 35,000 Notes Payable 40,000 50,000 110,000 150,000 Total Liabilities Stockholder Equity Common Stock Ending Retained Earnings 75,000 80,000 15,000 20,000 Total Stockholder Equity 90,000 100,000 Total Liabilities and Stockholder Equity $200,000 $250,000 As a finance manager for Barry's Superstore, you are required to calculate and briefly explain the meaning of the CURRENT YEAR RATIOS to your top management. Below are the requested ratios from your management.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started