Now, let's say you want to plan your retirement years for 20 years to receive this annual income and adjusted for inflation every year,

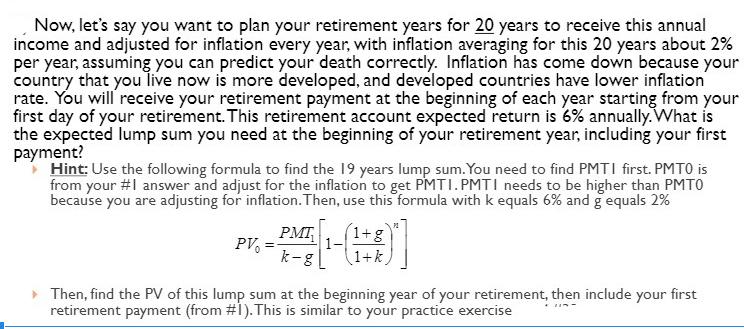

Now, let's say you want to plan your retirement years for 20 years to receive this annual income and adjusted for inflation every year, with inflation averaging for this 20 years about 2% per year, assuming you can predict your death correctly. Inflation has come down because your country that you live now is more developed, and developed countries have lower inflation rate. You will receive your retirement payment at the beginning of each year starting from your first day of your retirement. This retirement account expected return is 6% annually. What is the expected lump sum you need at the beginning of your retirement year, including your first payment? Hint: Use the following formula to find the 19 years lump sum. You need to find PMTI first. PMTO is from your #1 answer and adjust for the inflation to get PMTI. PMTI needs to be higher than PMTO because you are adjusting for inflation. Then, use this formula with k equals 6% and g equals 2% PV= PMT k-g 1- 1+g 1+k Then, find the PV of this lump sum at the beginning year of your retirement, then include your first retirement payment (from #1). This is similar to your practice exercise

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started