Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a finance teacher, illustrate how question c and e get to the answer please. The provided answers are correct, and I will just need

As a finance teacher, illustrate how question c and e get to the answer please. The provided answers are correct, and I will just need the calculation process. WIll rate.

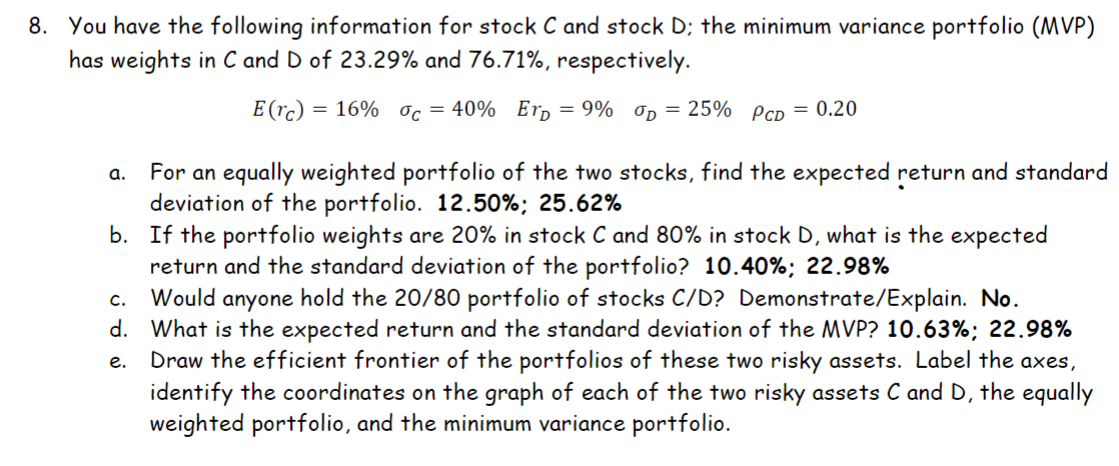

8. You have the following information for stock C and stock D; the minimum variance portfolio (MVP) has weights in C and D of 23.29% and 76.71%, respectively. E(rC)=16%C=40%ErD=9%D=25%CD=0.20 a. For an equally weighted portfolio of the two stocks, find the expected return and standard deviation of the portfolio. 12.50%;25.62% b. If the portfolio weights are 20% in stock C and 80% in stock D, what is the expected return and the standard deviation of the portfolio? 10.40%;22.98% c. Would anyone hold the 20/80 portfolio of stocks C/D? Demonstrate/Explain. No. d. What is the expected return and the standard deviation of the MVP? 10.63%;22.98% e. Draw the efficient frontier of the portfolios of these two risky assets. Label the axes, identify the coordinates on the graph of each of the two risky assets C and D, the equally weighted portfolio, and the minimum variance portfolioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started