Answered step by step

Verified Expert Solution

Question

1 Approved Answer

AS A FINANCIAL analyst AN INVESTOR CAME TO YOU WIN $10000 ASKING FOR YOUR ADVICE AND HELP. HE WANTED TO INVEST THIS $10000 AND WANTED

AS A FINANCIAL analyst AN INVESTOR CAME TO YOU WIN $10000 ASKING FOR YOUR ADVICE AND HELP. HE WANTED TO INVEST THIS $10000 AND WANTED YOUR ADVICE AND CALCULATION.

THE BOOK WE ARE USING IS

THE SOFTWARE WE USE IS RSTUDIO FOR CHECKING.

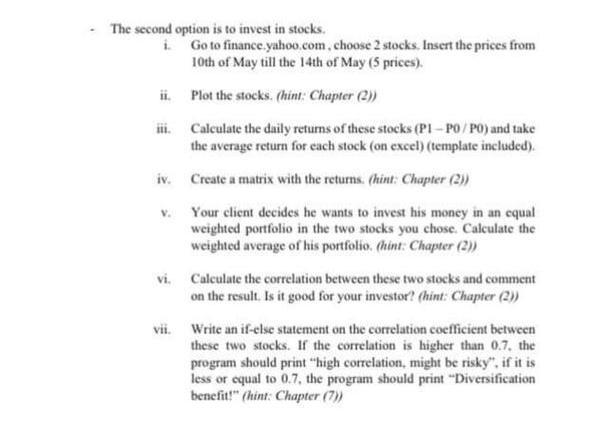

The second option is to invest in stocks, Go to finance.yahoo.com, choose 2 stocks. Insert the prices from 10th of May till the 14th of May (5 prices). ii. Plot the stocks. (hint: Chapter (2) ii. Calculate the daily returns of these stocks (PI - PO/PO) and take the average return for each stock (on excel) (template included). liv. Create a matrix with the returns. (hint. Chapter (2) Your client decides he wants to invest his money in an equal weighted portfolio in the two stocks you chose Calculate the weighted average of his portfolio. (hint. Chapter (2)) vi. Calculate the correlation between these two stocks and comment on the result. Is it good for your investor? (hint. Chapter (2) vii. Write an if-else statement on the correlation coefficient between these two stocks. If the correlation is higher than 0.7, the program should print "high correlation, might be risky". if it is less or equal to 0.7, the program should print "Diversification benefit!" (hint: Chapter (7) TEXTBOOK/S 1. Venables, W. N., Smith, D. M., & R Development Core Team. (2009). An introduction to R. 2. Hafner, S. & Ryan, A. (2019). An Introduction to R for Beginners INDICATIVE BASIC READING LIST None EXTENDED READING LIST None The second option is to invest in stocks, Go to finance.yahoo.com, choose 2 stocks. Insert the prices from 10th of May till the 14th of May (5 prices). ii. Plot the stocks. (hint: Chapter (2) ii. Calculate the daily returns of these stocks (PI - PO/PO) and take the average return for each stock (on excel) (template included). liv. Create a matrix with the returns. (hint. Chapter (2) Your client decides he wants to invest his money in an equal weighted portfolio in the two stocks you chose Calculate the weighted average of his portfolio. (hint. Chapter (2)) vi. Calculate the correlation between these two stocks and comment on the result. Is it good for your investor? (hint. Chapter (2) vii. Write an if-else statement on the correlation coefficient between these two stocks. If the correlation is higher than 0.7, the program should print "high correlation, might be risky". if it is less or equal to 0.7, the program should print "Diversification benefit!" (hint: Chapter (7) TEXTBOOK/S 1. Venables, W. N., Smith, D. M., & R Development Core Team. (2009). An introduction to R. 2. Hafner, S. & Ryan, A. (2019). An Introduction to R for Beginners INDICATIVE BASIC READING LIST None EXTENDED READING LIST NoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started