Answered step by step

Verified Expert Solution

Question

1 Approved Answer

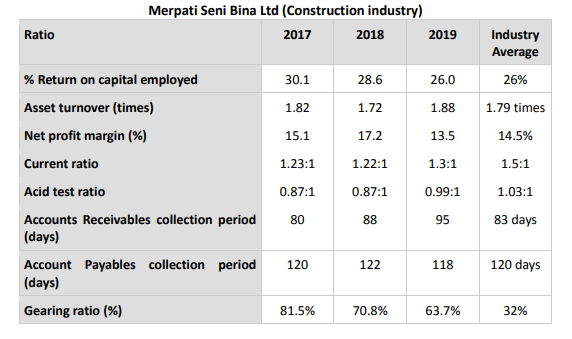

As a Financial Analyst Assistant, you are asked to compare Merpati Seni Bina Ltd's financial information ratios ( refer to attachment ) with a chosen

As a Financial Analyst Assistant, you are asked to compare Merpati Seni Bina Ltd's financial information ratios ( refer to attachment ) with a chosen competitor's company ( IJM Corporation Berhad ) for analysis purposes. You may use the annual report of 2019 from IJM to conduct your comparison.

Annual Report as of 2019 from IJM Corporation Berhad: https://www.ijm.com/sites/default/files/annualreport-pdf/arc_ar_2019_0.pdf

Question: Please construct a detailed comparison between the two companies mentioned in word form.

Merpati Seni Bina Ltd (Construction industry) Ratio 2017 2018 2019 Industry Average % Return on capital employed 30.1 28.6 26.0 26% Asset turnover (times) 1.82 1.72 1.88 1.79 times Net profit margin (%) 15.1 17.2 13.5 14.5% Current ratio 1.23:1 1.22:1 1.3:1 1.5:1 Acid test ratio 0.87:1 0.87:1 0.99:1 1.03:1 Accounts Receivables collection period (days) 80 88 95 83 days Account Payables collection period (days) 120 122 118 120 days Gearing ratio (%) 81.5% 70.8% 63.7% 32%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the financial ratios provided for Merpati Seni Bina Ltd and the industry averages compared to the annual report of IJM Corporation Berhad for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started