Samsungs statement of cash flows in Appendix A reports the change in cash and equivalents for the

Question:

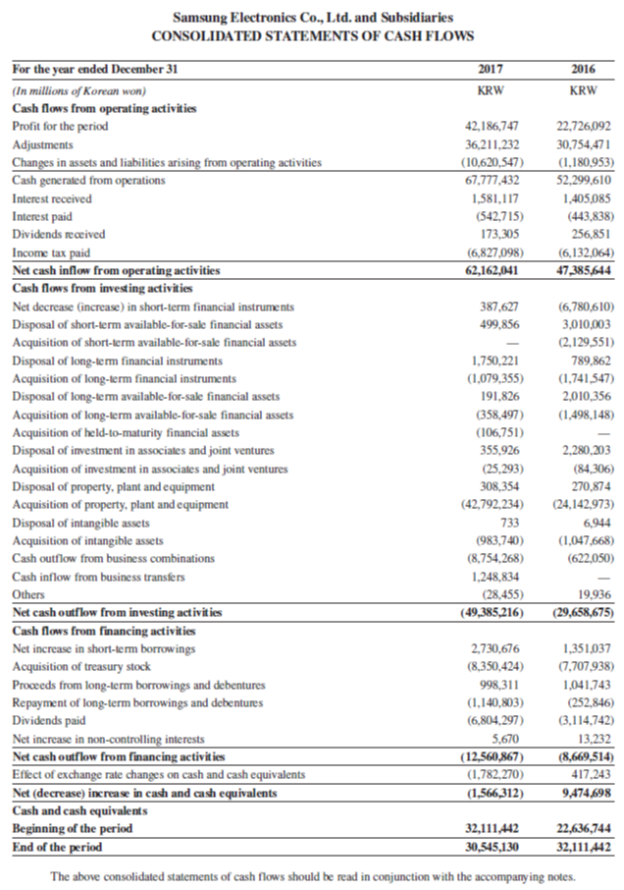

Samsung’s statement of cash flows in Appendix A reports the change in cash and equivalents for the year ended December 31, 2017. Identify the cash generated (or used) by operating activities, by investing activities,and by financing activities.

Data from Samsung

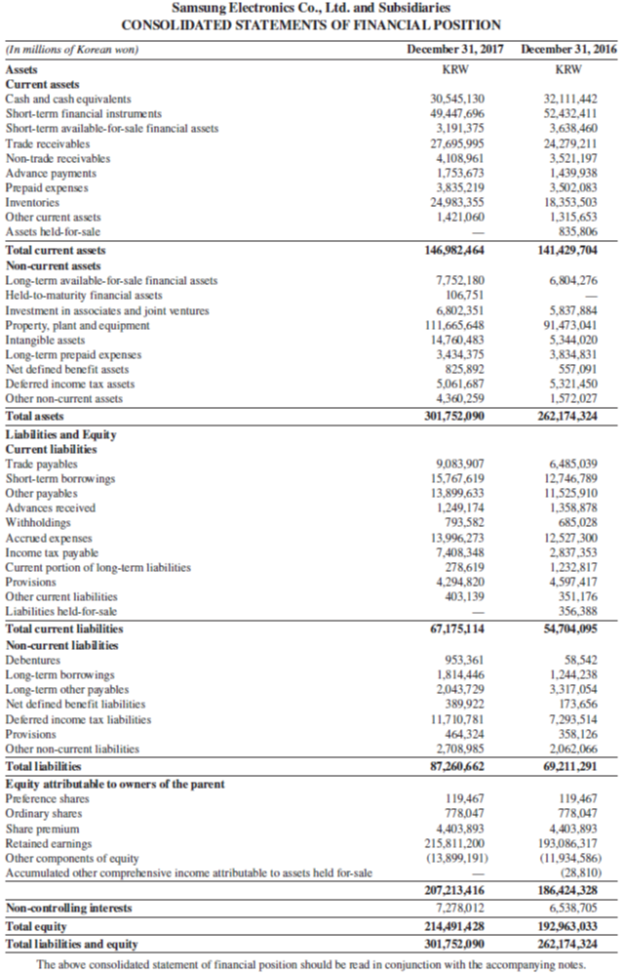

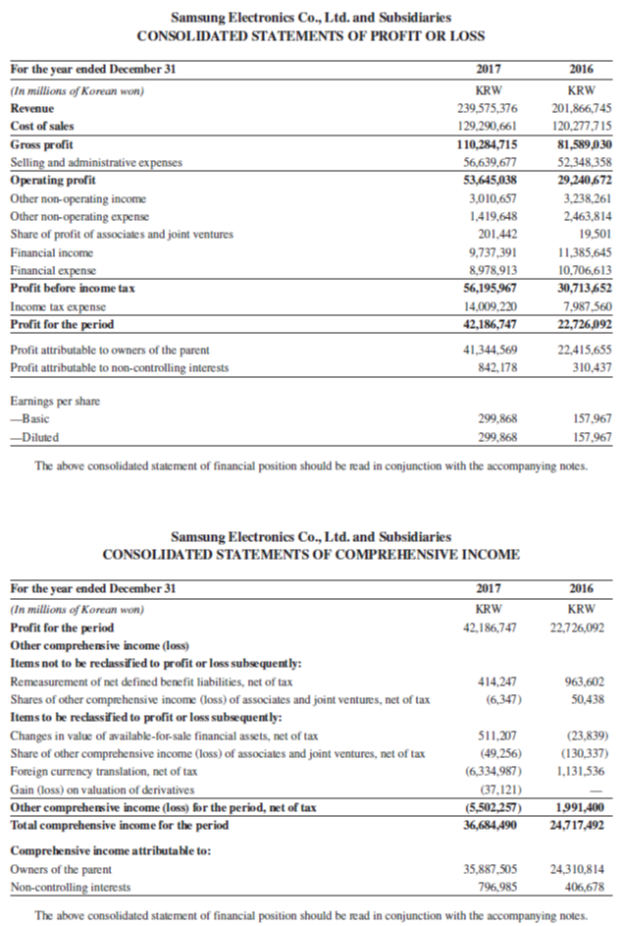

Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF FINANCIAL POSITION December 31, 2017 December 31, 2016 (In millions of Korean won) Assets KRW KRW Current assets 30,545,130 49,447,696 3,191,375 27,695,995 4,108,961 1,753,673 3,835,219 24.983.355 1,421,060 Cash and cash equivalents Short-term financial instruments Short-term available-for-sale financial assets Trade receivables Non-trade receivables Advance payments Prepaid expenses Inventories 32,111,442 52,432,411 3,638,460 24,279,211 3,521,197 1,439,938 3,502,083 18,353,503 1,315,653 835,806 Other current assets Assets held-for-sale Total current assets 146,982,464 141,429,704 Non-current assets 7,752,180 106,751 6,802.351 111,665,648 14,760,483 3,434.375 Long-term available-for-sale financial assets Held-to-maturity financial assets Investment in associates and joint ventures Property, plant and equipment Intangible assets Long-term prepaid expenses Net defined benefit assets 6,804,276 5,837,884 91,473,041 5,344,020 3,834,831 557,091 5,321,450 1,572,027 825,892 5,061,687 4,360,259 301,752,090 Deferred income tax assets Other non-current assets Total assets 262,174,324 Liabilities and Equity Current liabilities Trade payables Short-term borrow ings Other payables Advances received 9,083,907 15,767,619 13,899,633 1,249,174 793,582 6,485,039 12,746,789 11,525,910 1,358,878 685,028 12,527,300 2,837,353 1,232,817 4,597,417 351,176 356,388 54,704,095 Withholdings Accrued expenses Income tax payable Current portion of long-term liabilities Provisions 13,996,273 7,408,348 278,619 4,294,820 403,139 Other current liabilities Liabilities held-for-sake Total current liabilities 67,175,1 14 Non-current liablities Debentures 58,542 1,244,238 3,317,054 173,656 7,293,514 358,126 2,062,066 69,211,291 953,361 1,814,446 2,043,729 389,922 Long-term borrowings Long-term other payables Net defined benefit liabilities 11,710,781 464324 2,708,985 87,260,662 Deferred income tax liabilities Provisions Other non-current liabilities Total liabilities Equity attribut able to owners of the parent Prekrence shares Ordinary shares Share premium Retained earnings Other components of equity Accumulated other comprehensive income attributable to assets held for-sale 119,467 778,047 4,403,893 215,811,200 (13,899,191) 119,467 778,047 4,403,893 193,086,317 (11,934,586) (28,810) 207,213416 186,424,328 Non-controlling interests Total equity Total linbilities and equity 7,278,012 214,491,428 6,538,705 192.963,033 301.752,090 262,174,324 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. ||||| Samsung Electronics Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF PROFIT OR LOSS For the year ended December 31 (In millions of Korean won) 2017 2016 KRW KRW Revenue 239,575,376 201,866,745 Cost of sales 129,290,661 120,277,715 81,589 030 52,348,358 29,240672 Gross profit Selling and administrative ex penses Operating profit Other non-operating income Other non-operating expense Share of profit of associates and joint ventures 110,284,715 56,639,677 53,645,038 3,010,657 3,238,261 1,419,648 2,463,814 201,442 19,501 Financial income 9,737,391 11,385,645 Financial expense Profit before income tax Income tax expense Profit for the period 8,978,913 56,195,967 10,706,613 30,713652 14,009,220 42,186,747 7,987,560 22,726,092 Profit attributable to owners of the parent 41,344,569 22,415,655 Profit attributable to non-controlling interests 842,178 310,437 Earnings per share --Basic 299,868 157,967 -Diluted 299,868 157,967 The above consolidated statement of financial position should be read in conjunction with the accompanying notes. Samsung Electronies Co., Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME For the year ended December 31 (In millions of Korean won) 2017 KRW 2016 KRW Profit for the period 42,186,747 22,726,092 Other comprehensive income (loss) Items not to be reclassified to profit or loss subsequently: Remeasurement of net defined benefit liabilities, net of tax 414,247 963,602 Shares of other comprehensive income (loss) of associates and joint ventures, net of tax Items to be reclassified to profit or loss subsequently: (6,347) 50,438 511,207 (23,839) Changes in value of available-for-sale financial assets, net of tax Share of other comprehensive income (loss) of associates and joint ventures, net of tax Foreign currency translation, net of tax Gain (loss) on valuation of derivatives Other comprehensive income (loss) for the period, net of tax Total comprehensive income for the period (49,256) (6,334,987) (130,337) 1,131,536 (37,121) (5,502,257) 36,684,490 1,991,400 24,717,492 Comprehensive income attributable to: Owners of the parent 35,887,505 24,310,814 Non-controlling interests 796,985 406,678 The above consolidated statement of financial position should be read in conjunction with the accompanying notes.

Step by Step Answer:

Samsungs cash and equivalents decreased by 1566312 million specifically from 32111442 to ...View the full answer

Related Video

Financial statements of a business having numerous divisions or subsidiaries are called consolidated financial statements. Companies frequently refer to the aggregated reporting of their entire firm together when using the term \"consolidated\" in financial statement reporting. Consolidated financial statement reporting, on the other hand, is defined by the Financial Accounting Standards Board as the reporting of an entity that is organized with a parent company and subsidiaries.

Students also viewed these Business questions

-

Record the journal entry for Sales and for Cash Over and Short for each of the following separate situations. a. The cash registers record shows $420 of cash sales, but the count of cash in the...

-

Refer to the balance sheet of Google in Appendix A. Does it use the direct write-off method or allowance method in accounting for its accounts receivable? What is the realizable value of its...

-

Key figures for Samsung follow. 1. Compute its accounts receivable turnover for the current year. 2. How long does it take on average for Samsung to collect receivables in the current year? 3. In the...

-

A firm pays a $1.50 dividend at the end of year one (0). has a stock price of $141 (Pa), and a constant growth rate (g) of 9 percent. a. Compute the required rate of return (ke). (Do not round...

-

(a) Given two identical, ideal batteries (emf = ) and two identical light bulbs (resistance = R assumed constant), design a circuit to make both bulbs glow as brightly as possible. (b) What is the...

-

Identify the incorrect statements among the following descriptions and provide correct statements: (a) Oxidation of the halides is the only commercial method of preparing the halogens from F 2 to I 2...

-

Refer to the information in Problem 6-1B and assume the periodic inventory system is used. Required 1. Compute cost of goods available for sale and the number of units available for sale. 2. Compute...

-

Using the information provided in P4- 6, perform the following steps for Tides Tea Company: In P4-6 Required a. Journalize and post adjusting journal entries based on the following additional...

-

Suppose rRF = 4%, rM = 9%, and rA = 12%. Calculate Stock A's beta. Round your answer to one decimal place. 1.6 If Stock A's beta were 2.0, then what would be A's new required rate of return? Round...

-

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditional cast iron engine block. It is estimated that at least $2,500 in life-cycle costs...

-

Refer to Samsungs balance sheet in Appendix A. How does its cash (titled Cash and cash equivalents)compare with its other current assets (in both amount and percent) as of December 31, 2017? Compare...

-

COSO lists five components of internal control: control environment, risk assessment, control activities, information and communication, and monitoring. Indicate the COSO component that matches with...

-

I:7-42 Travel and Entertainment. Monique is a self-employed manufacturers representative (i.e., an independent contractor) who solicits business for numerous clients and receives a commission based...

-

The Purple Company This project will give you an opportunity to apply your knowledge of accounting principles and procedures to a corporation. You will handle the accounting work of The Purple...

-

Comprehensive Problem Bug-Off Exterminators (Algo) Bug-Off Exterminators provides pest control services and sells extermination products manufactured by other companies. Following is the company's...

-

The Michigan Company has made the following information available for its production facility for the month of June. Fixed overhead was estimated at 19,000 machine hours for the production cycle....

-

Question 1 Copper Explorations recently acquired the rights to mine a new site. Machinery, equipment and a truck were purchased to begin the mining operations at the site. Details of the assets for...

-

Large Data Sets from Appendix B. In Exercises 25-28, refer to the indicated data set in Appendix B. Use software or a calculator to find the means and medians. [Data Set] Weights Use the weights of...

-

Find the probabilities in Problem by referring to the tree diagram below. P(C) -C A D Start - C 3 D 5

-

An annual report of The Campbell Soup Company reported on its income statement $2.4 million as equity in earnings of affiliates. Journalize the entry that Campbell would have made to record this...

-

Compute trend percents for the following accounts using 2017 as the base year. For each of the three accounts, state whether the situation as revealed by the trend percents appears to be favorable or...

-

Each team is to select a different industry, and each team member is to select a different company in that industry and acquire its financial statements. Use those statements to analyze the company,...

-

Key figures for Apple and Google follow. Required 1. Compute common-size percents for each company using the data given. Round percents to one decimal. 2. If Google paid a dividend, would retained...

-

Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows:...

-

1-When accounting for an acquisition, goodwill is the difference between what two things? 2- What factors should be considered when deciding whether an acquisition should be financed with cash or...

-

What is the main friction Fluidity aims to address? REAL STATE

Study smarter with the SolutionInn App