Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a fixed-income specialist, you've been asked to estimate the (risk-neutral) probability of default of RSG's bond maturing in 2 years with yearly coupon

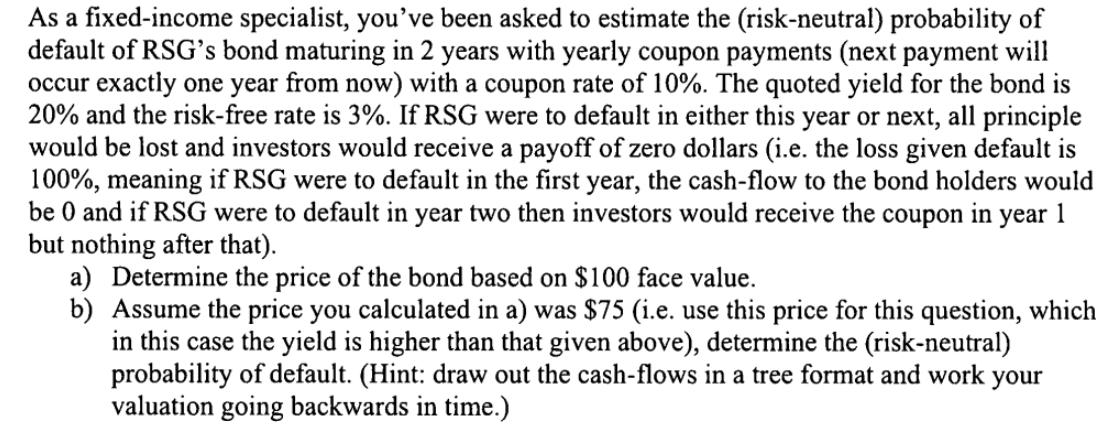

As a fixed-income specialist, you've been asked to estimate the (risk-neutral) probability of default of RSG's bond maturing in 2 years with yearly coupon payments (next payment will occur exactly one year from now) with a coupon rate of 10%. The quoted yield for the bond is 20% and the risk-free rate is 3%. If RSG were to default in either this year or next, all principle would be lost and investors would receive a payoff of zero dollars (i.e. the loss given default is 100%, meaning if RSG were to default in the first year, the cash-flow to the bond holders would be 0 and if RSG were to default in year two then investors would receive the coupon in year 1 but nothing after that). a) Determine the price of the bond based on $100 face value. b) Assume the price you calculated in a) was $75 (i.e. use this price for this question, which in this case the yield is higher than that given above), determine the (risk-neutral) probability of default. (Hint: draw out the cash-flows in a tree format and work your valuation going backwards in time.)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the price of the bond based on a 100 face value we can use the formula for the price ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started