Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a group, you will find a budget for a company of your interest (any company), and you will evaluate the budget using both the

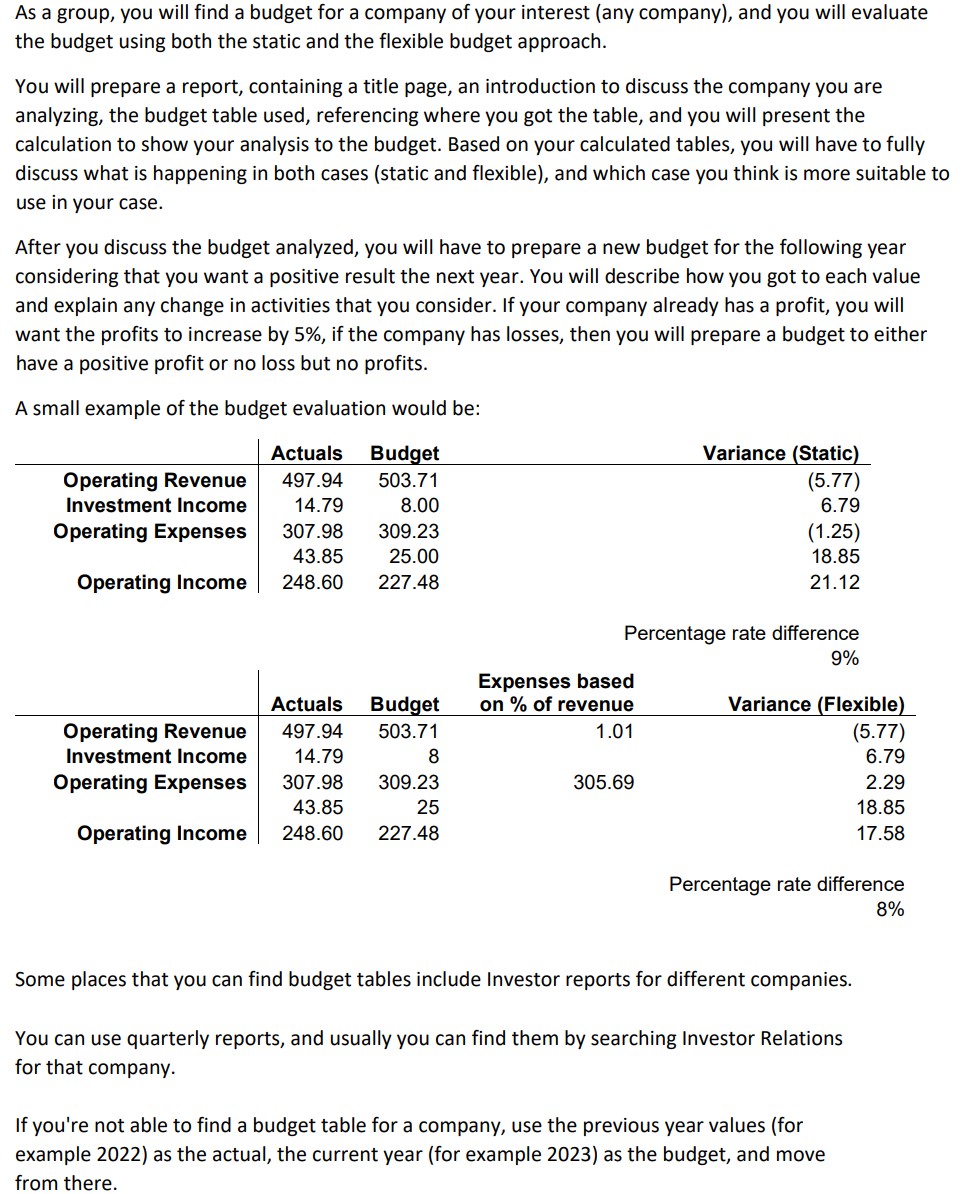

As a group, you will find a budget for a company of your interest (any company), and you will evaluate the budget using both the static and the flexible budget approach. You will prepare a report, containing a title page, an introduction to discuss the company you are analyzing, the budget table used, referencing where you got the table, and you will present the calculation to show your analysis to the budget. Based on your calculated tables, you will have to fully discuss what is happening in both cases (static and flexible), and which case you think is more suitable to use in your case. After you discuss the budget analyzed, you will have to prepare a new budget for the following year considering that you want a positive result the next year. You will describe how you got to each value and explain any change in activities that you consider. If your company already has a profit, you will want the profits to increase by 5%, if the company has losses, then you will prepare a budget to either have a positive profit or no loss but no profits. A small example of the budget evaluation would be: Percentage rate difference 9% Percentage rate difference 8% Some places that you can find budget tables include Investor reports for different companies. You can use quarterly reports, and usually you can find them by searching Investor Relations for that company. If you're not able to find a budget table for a company, use the previous year values (for example 2022) as the actual, the current year (for example 2023) as the budget, and move from there

As a group, you will find a budget for a company of your interest (any company), and you will evaluate the budget using both the static and the flexible budget approach. You will prepare a report, containing a title page, an introduction to discuss the company you are analyzing, the budget table used, referencing where you got the table, and you will present the calculation to show your analysis to the budget. Based on your calculated tables, you will have to fully discuss what is happening in both cases (static and flexible), and which case you think is more suitable to use in your case. After you discuss the budget analyzed, you will have to prepare a new budget for the following year considering that you want a positive result the next year. You will describe how you got to each value and explain any change in activities that you consider. If your company already has a profit, you will want the profits to increase by 5%, if the company has losses, then you will prepare a budget to either have a positive profit or no loss but no profits. A small example of the budget evaluation would be: Percentage rate difference 9% Percentage rate difference 8% Some places that you can find budget tables include Investor reports for different companies. You can use quarterly reports, and usually you can find them by searching Investor Relations for that company. If you're not able to find a budget table for a company, use the previous year values (for example 2022) as the actual, the current year (for example 2023) as the budget, and move from there Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started