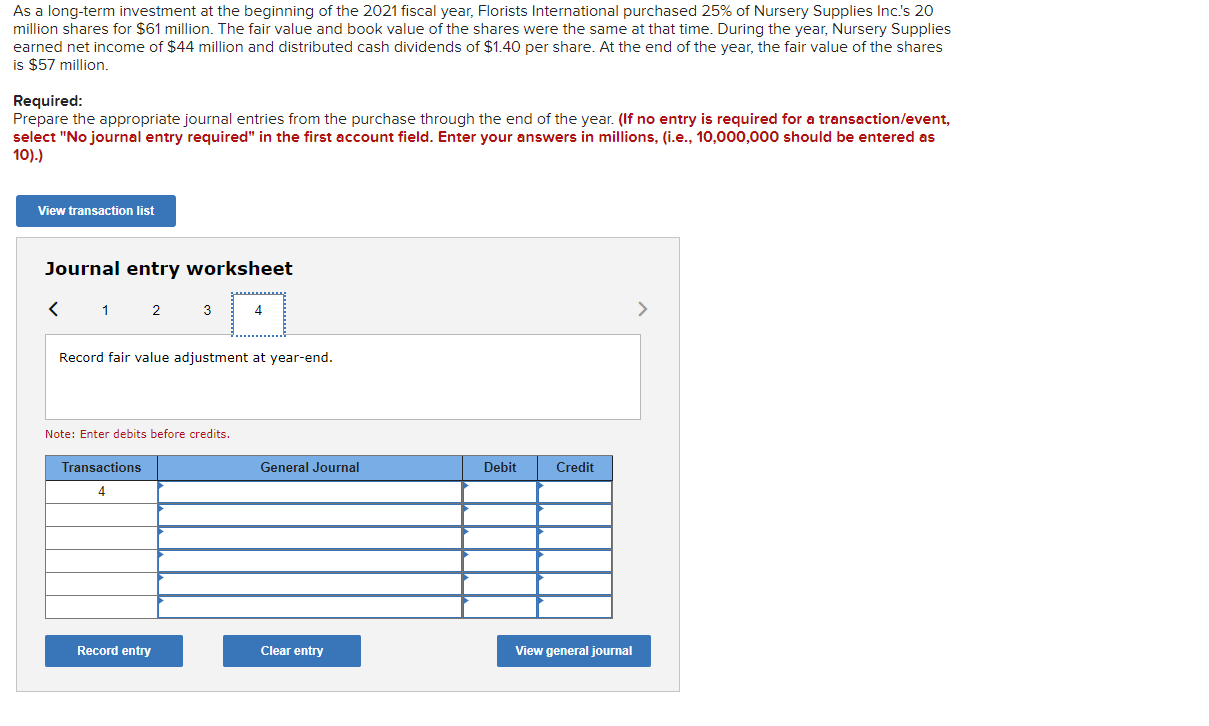

As a long-term investment at the beginning of the 2021 fiscal year, Florists International purchased 25% of Nursery Supplies Inc.'s 20 million shares for $61 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $44 million and distributed cash dividends of $1.40 per share. At the end of the year, the fair value of the shares is $57 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. (If no entry is required for a transaction/event, select "No journal entry required in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record the investment in Nursery Supplies shares. Note: Enter debits before credits. Transactions General Journal Debit Credit 1 Record entry Clear entry View general journal As a long-term investment at the beginning of the 2021 fiscal year, Florists International purchased 25% of Nursery Supplies Inc.'s 20 million shares for $61 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $44 million and distributed cash dividends of $1.40 per share. At the end of the year, the fair value of the shares is $57 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record the investor's share of net income. Note: Enter debits before credits. Transactions General Journal Debit Credit 2 Record entry Clear entry View general journal As a long-term investment at the beginning of the 2021 fiscal year, Florists International purchased 25% of Nursery Supplies Inc's 20 million shares for $61 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $44 million and distributed cash dividends of $1.40 per share. At the end of the year, the fair value of the shares is $57 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record the cash dividends received from Nursery Supplies shares. Note: Enter debits before credits. Transactions General Journal Debit Credit 3 Record entry Clear entry View general journal As a long-term investment at the beginning of the 2021 fiscal year, Florists International purchased 25% of Nursery Supplies Inc.'s 20 million shares for $61 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $44 million and distributed cash dividends of $1.40 per share. At the end of the year, the fair value of the shares is $57 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10).) View transaction list Journal entry worksheet Record fair value adjustment at year-end. Note: Enter debits before credits. Transactions General Journal Debit Credit 4 Record entry Clear entry View general journal