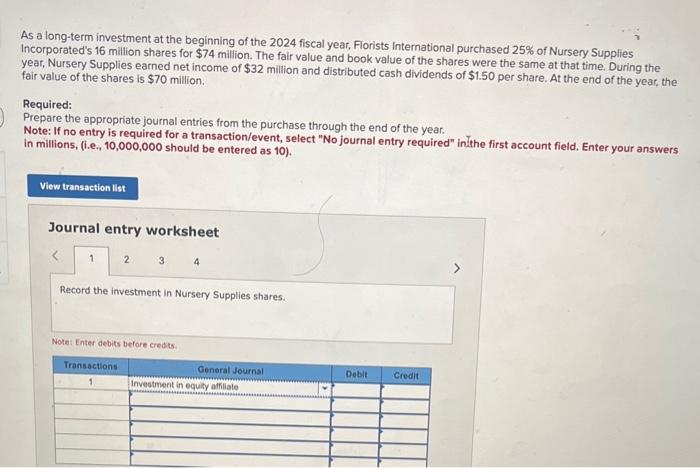

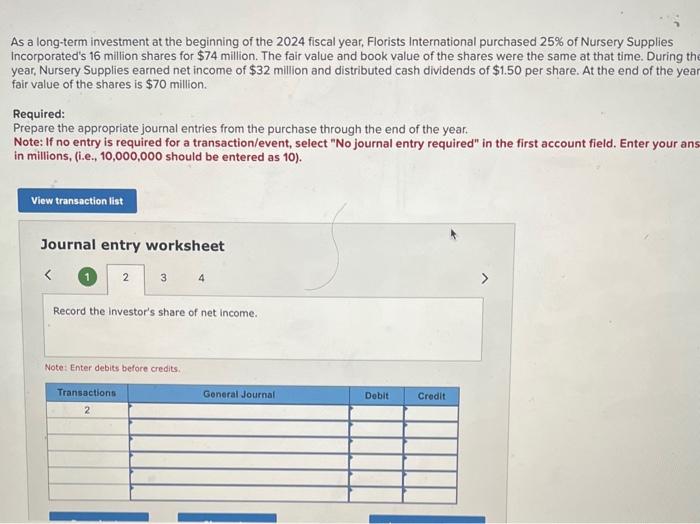

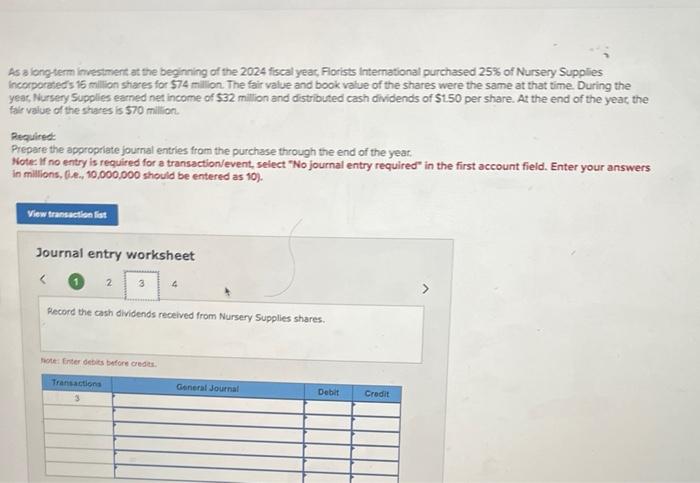

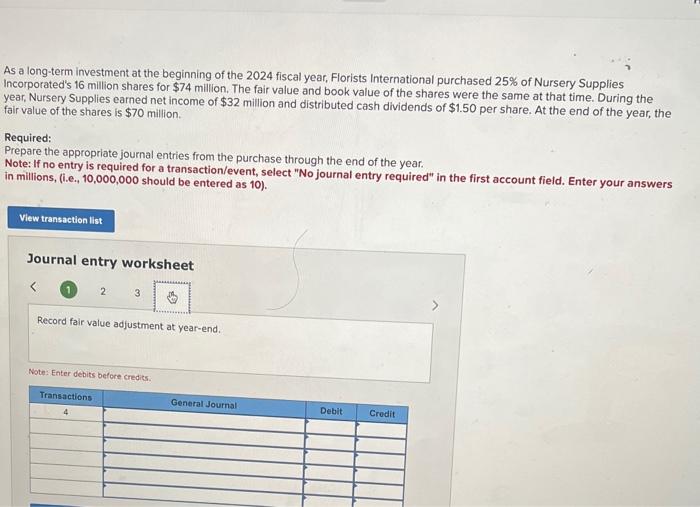

As a long-term investment at the beginning of the 2024 fiscal year, Florists International purchased 25% of Nursery Supplies Incorporated's 16 million shares for $74 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $32 million and distributed cash dividends of $1.50 per share. At the end of the year, the fair value of the shares is $70 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" inithe first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Record the investment in Nursery Supplies shares. Notet Enter debits before credits. As a long-term investment at the beginning of the 2024 fiscal year, Florists International purchased 25% of Nursery Supplies Incorporated's 16 million shares for $74 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $32 million and distributed cash dividends of $1.50 per share. At the end of the year fair value of the shares is $70 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your ans in millions, (i.e., 10,000,000 should be entered as 10 ). Journal entry worksheet As a longterm imestment at the beginning of the 2024 fiscal yeac, Fiorists International purchased 25% of Nursery Supplies Incorporated's 15 milition shares for 574 millon. The fair value and book value of the shares were the same at that time. During the yeac. Nursery Supplies eamed net income of $32 million and distributed cash dividends of $1.50 per share. At the end of the yeac the falr velue of the shares is 570 milion. Required: Prepare the appropriate journal entries from the purchase through the end of the yeat. Note if no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (le., 10,000,000 should be entered as 10 ). Journal entry worksheet Becord the ash dividends received from Nursery Supplies shares. hoth finder debits butors creset. As a long-term investment at the beginning of the 2024 fiscal year, Florists International purchased 25% of Nursery Supplies Incorporated's 16 million shares for $74 million. The fair value and book value of the shares were the same at that time. During the year, Nursery Supplies earned net income of $32 million and distributed cash dividends of $1.50 per share. At the end of the year, the fair value of the shares is $70 million. Required: Prepare the appropriate journal entries from the purchase through the end of the year. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions, (i.e., 10,000,000 should be entered as 10). Journal entry worksheet Record fair value adjustment at year-end. Note: Enter debits before credits