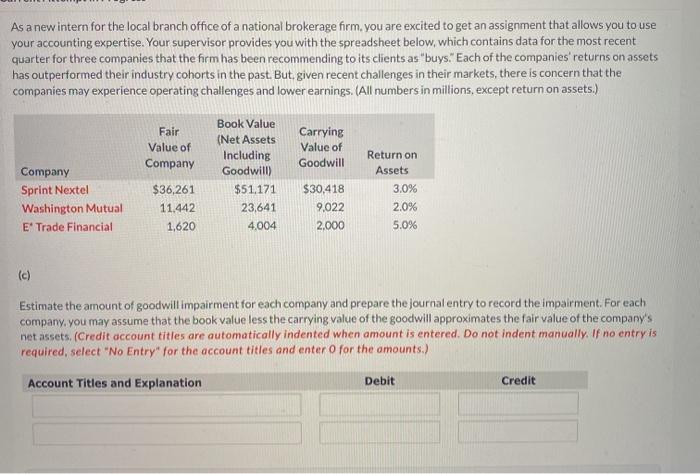

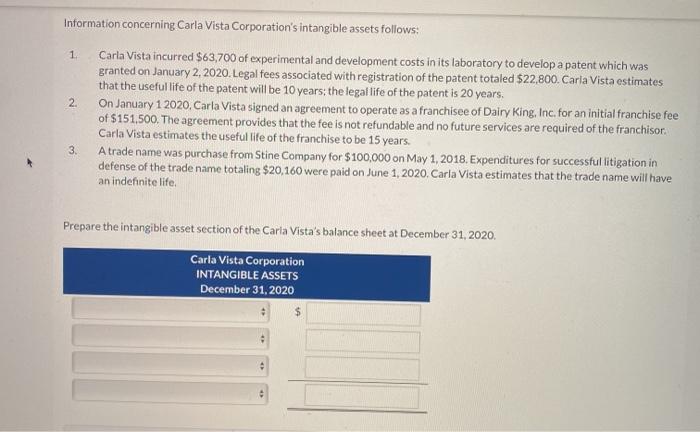

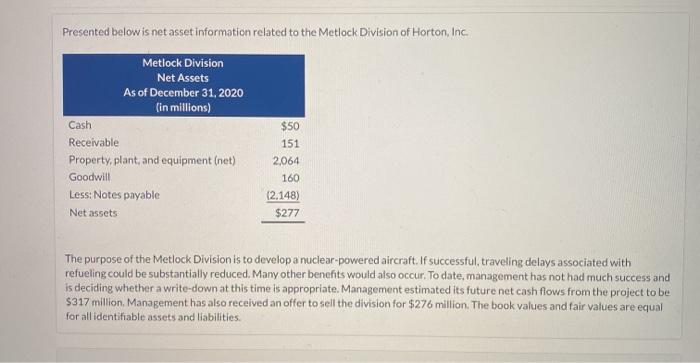

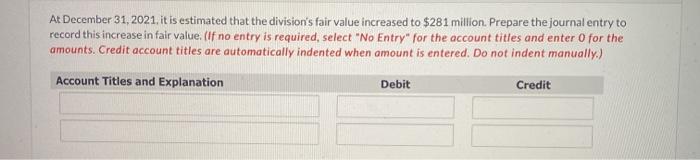

As a new intern for the local branch office of a national brokerage firm. you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you with the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past. But given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) Fair Value of Company Carrying Value of Goodwill Company Sprint Nextel Washington Mutual E' Trade Financial Book Value (Net Assets Including Goodwill) $51,171 23,641 4,004 $36,261 11,442 1,620 $30,418 9,022 2.000 Return on Assets 3.0% 2.0% 5.0% (c) Estimate the amount of goodwill impairment for each company and prepare the journal entry to record the impairment. For each company, you may assume that the book value less the carrying value of the goodwill approximates the fair value of the company's net assets. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Information concerning Carla Vista Corporation's intangible assets follows: 1 Carla Vista incurred $63,700 of experimental and development costs in its laboratory to develop a patent which was granted on January 2, 2020. Legal fees associated with registration of the patent totaled $22,800. Carla Vista estimates that the useful life of the patent will be 10 years, the legal life of the patent is 20 years. 2. On January 1 2020, Carla Vista signed an agreement to operate as a franchisee of Dairy King, Inc. for an initial franchise fee of $151.500. The agreement provides that the fee is not refundable and no future services are required of the franchisor. Carla Vista estimates the useful life of the franchise to be 15 years. 3. Atrade name was purchase from Stine Company for $100,000 on May 1, 2018. Expenditures for successful litigation in defense of the trade name totaling $20,160 were paid on June 1, 2020. Carla Vista estimates that the trade name will have an indefinite life Prepare the intangible asset section of the Carla Vista's balance sheet at December 31, 2020. Carla Vista Corporation INTANGIBLE ASSETS December 31, 2020 $ Presented below is net asset information related to the Metlock Division of Horton, Inc Metlock Division Net Assets As of December 31, 2020 (in millions) Cash Receivable Property, plant, and equipment (net) Goodwill Less: Notes payable Net assets $50 151 2,064 160 (2.148) $277 The purpose of the Metlock Division is to develop a nuclear-powered aircraft. If successful traveling delays associated with refueling could be substantially reduced. Many other benefits would also occur. To date, management has not had much success and is deciding whether a write-down at this time is appropriate. Management estimated its future net cash flows from the project to be $317 million Management has also received an offer to sell the division for $276 million. The book values and fair values are equal for all identifiable assets and liabilities At December 31, 2021, it is estimated that the division's fair value increased to $281 million. Prepare the journal entry to record this increase in fair value. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit