Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you

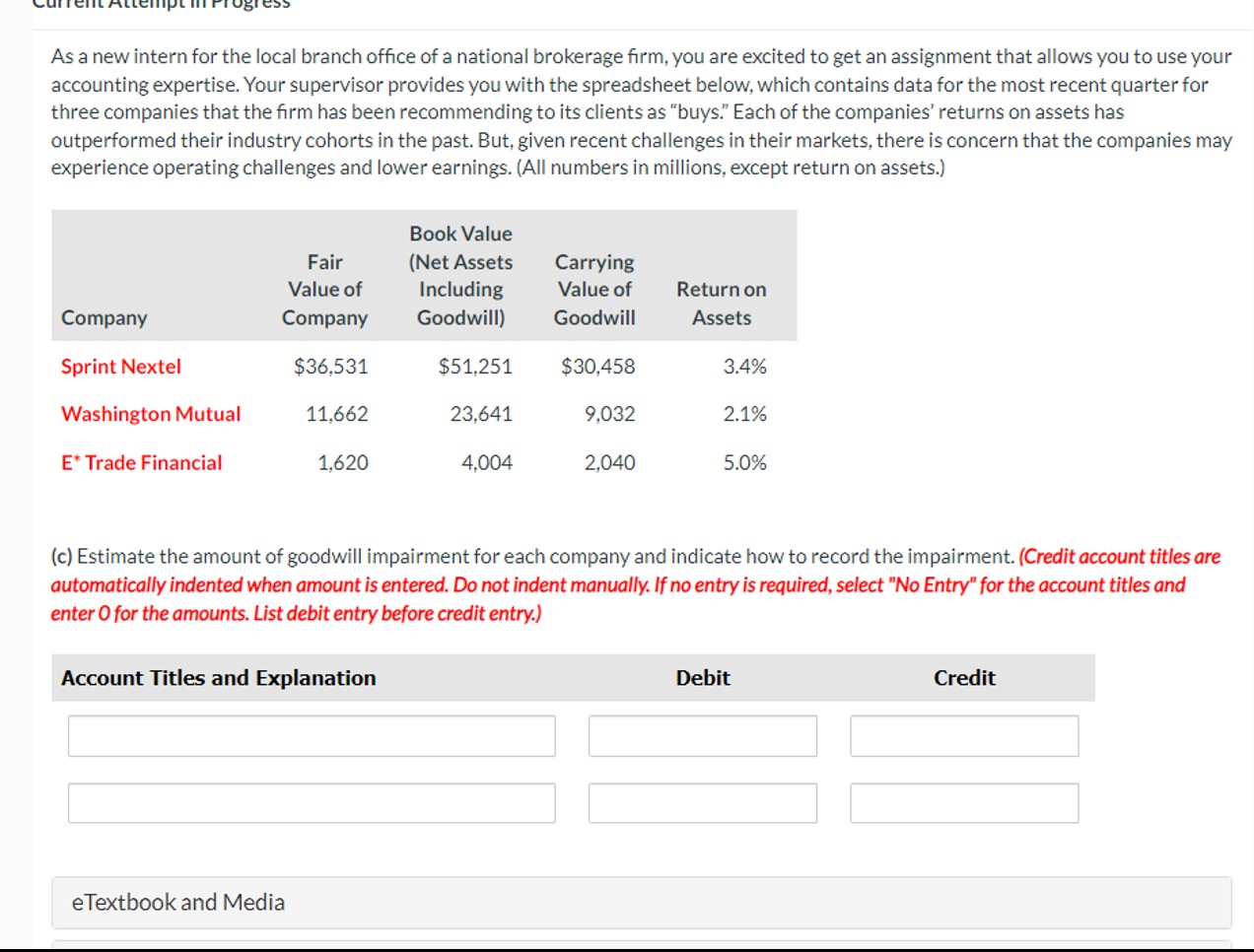

As a new intern for the local branch office of a national brokerage firm, you are excited to get an assignment that allows you to use your accounting expertise. Your supervisor provides you with the spreadsheet below, which contains data for the most recent quarter for three companies that the firm has been recommending to its clients as "buys." Each of the companies' returns on assets has outperformed their industry cohorts in the past. But, given recent challenges in their markets, there is concern that the companies may experience operating challenges and lower earnings. (All numbers in millions, except return on assets.) Book Value Fair Value of (Net Assets Including Company Company Goodwill) Carrying Value of Goodwill Return on Assets Sprint Nextel $36,531 $51,251 $30,458 3.4% Washington Mutual 11,662 23,641 9,032 2.1% E* Trade Financial 1,620 4,004 2,040 5.0% (c) Estimate the amount of goodwill impairment for each company and indicate how to record the impairment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) Account Titles and Explanation eTextbook and Media Debit Credit

Step by Step Solution

★★★★★

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Answer To estimate the amount of goodwill impairment for each company we need to compare the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started