Answered step by step

Verified Expert Solution

Question

1 Approved Answer

! Required information [The following information applies to the questions displayed below.] These questions relate to the Integrated Analytics Case: Bene Petit. Select the

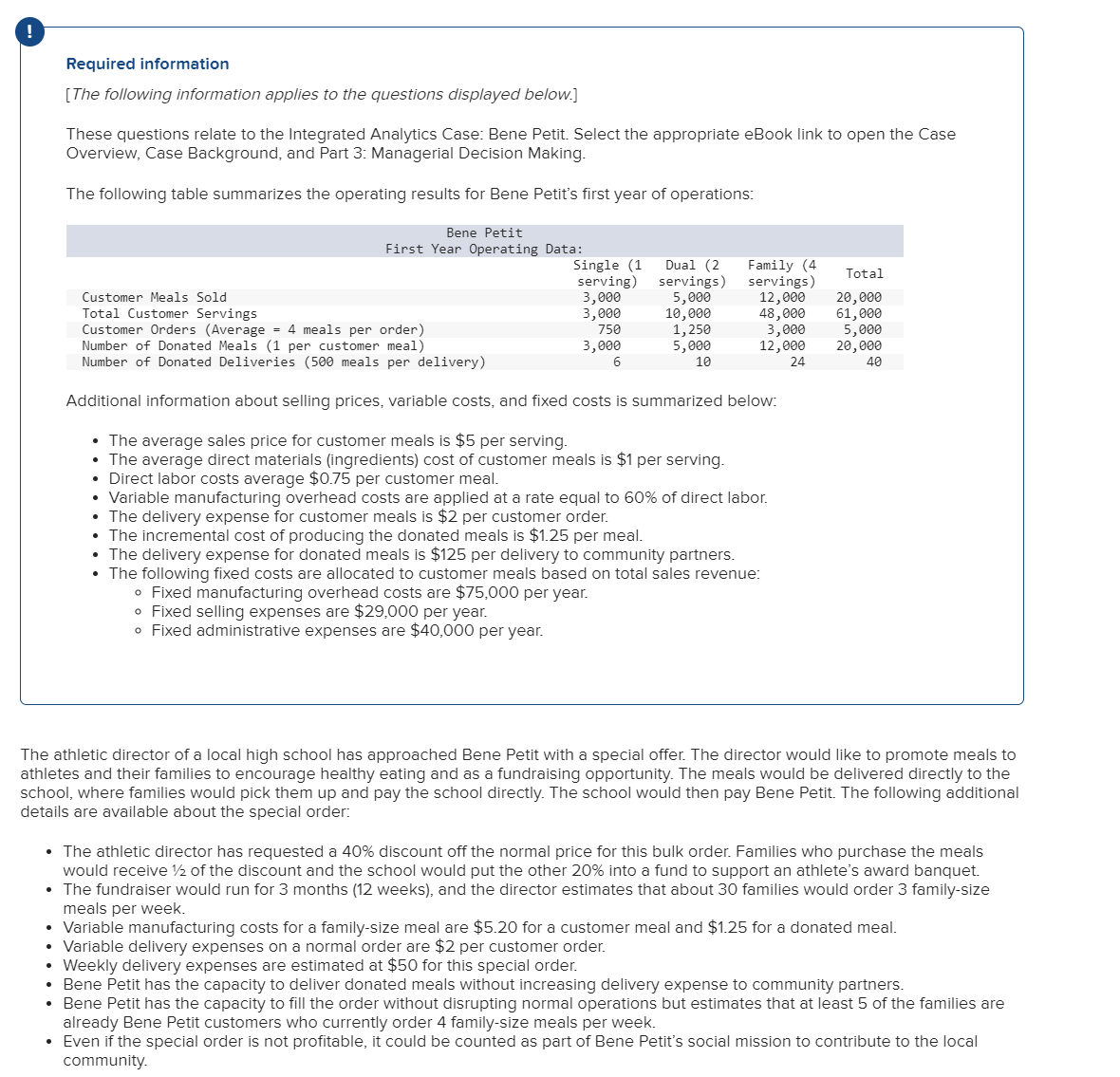

! Required information [The following information applies to the questions displayed below.] These questions relate to the Integrated Analytics Case: Bene Petit. Select the appropriate eBook link to open the Case Overview, Case Background, and Part 3: Managerial Decision Making. The following table summarizes the operating results for Bene Petit's first year of operations: Customer Meals Sold Total Customer Servings Bene Petit First Year Operating Data: Single (1 serving) Dual (2 servings) Family (4 servings) Total 3,000 5,000 12,000 20,000 3,000 10,000 48,000 61,000 750 1,250 3,000 5,000 3,000 5,000 12,000 20,000 6 10 24 40 Customer Orders (Average = 4 meals per order) Number of Donated Meals (1 per customer meal) Number of Donated Deliveries (500 meals per delivery) Additional information about selling prices, variable costs, and fixed costs is summarized below: The average sales price for customer meals is $5 per serving. The average direct materials (ingredients) cost of customer meals is $1 per serving. Direct labor costs average $0.75 per customer meal. Variable manufacturing overhead costs are applied at a rate equal to 60% of direct labor. The delivery expense for customer meals is $2 per customer order. The incremental cost of producing the donated meals is $1.25 per meal. The delivery expense for donated meals is $125 per delivery to community partners. The following fixed costs are allocated to customer meals based on total sales revenue: Fixed manufacturing overhead costs are $75,000 per year. Fixed selling expenses are $29,000 per year. Fixed administrative expenses are $40,000 per year. The athletic director of a local high school has approached Bene Petit with a special offer. The director would like to promote meals to athletes and their families to encourage healthy eating and as a fundraising opportunity. The meals would be delivered directly to the school, where families would pick them up and pay the school directly. The school would then pay Bene Petit. The following additional details are available about the special order: The athletic director has requested a 40% discount off the normal price for this bulk order. Families who purchase the meals would receive 1/2 of the discount and the school would put the other 20% into a fund to support an athlete's award banquet. The fundraiser would run for 3 months (12 weeks), and the director estimates that about 30 families would order 3 family-size meals per week. Variable manufacturing costs for a family-size meal are $5.20 for a customer meal and $1.25 for a donated meal. Variable delivery expenses on a normal order are $2 per customer order. Weekly delivery expenses are estimated at $50 for this special order. Bene Petit has the capacity to deliver donated meals without increasing delivery expense to community partners. Bene Petit has the capacity to fill the order without disrupting normal operations but estimates that at least 5 of the families are already Bene Petit customers who currently order 4 family-size meals per week. Even if the special order is not profitable, it could be counted as part of Bene Petit's social mission to contribute to the local community.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the steps to calculate the financial outcomes for Bene Petit and the local high school fundraising special order 1 Calculate normal sales pri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started