As a part of credit analysis, you want to evaluate the financial statement of AusGroup Limited and Woolworth Limited for the year 2018. Before starting financial statement analysis, you need to go through the audit report of the companies. Based on your own reading and analysis of audit opinion, is it worthwhile to evaluate financial statements of the above companies? Justify your opinion. (2+2 marks)

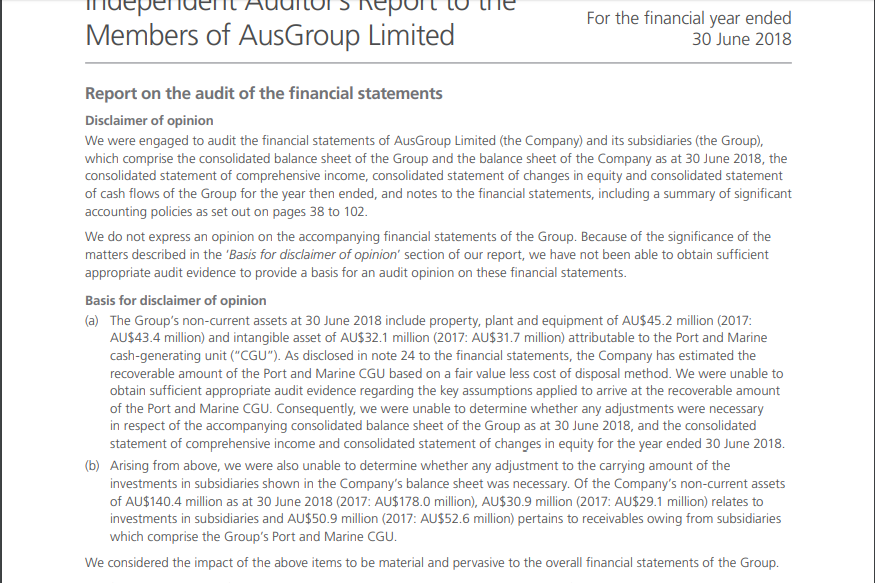

AusGroup Limited

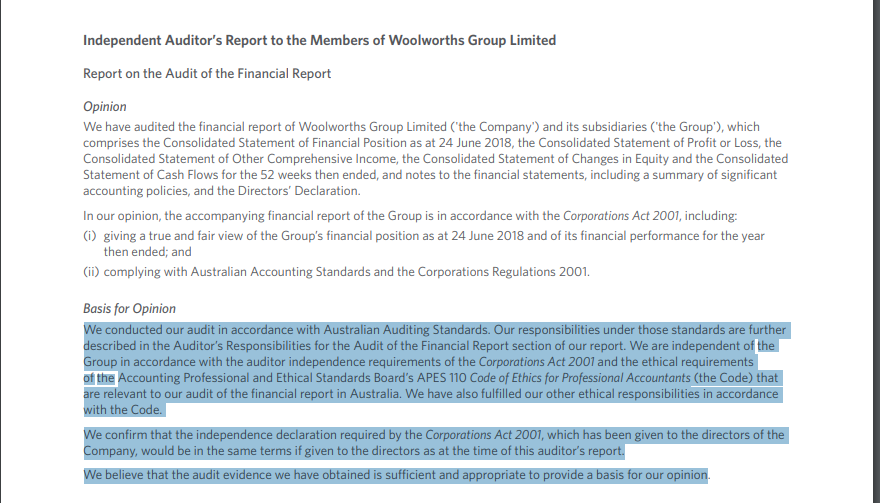

Woolworth Limited

Illueperuenil AuUILUIS REPUIC IU lile Members of AusGroup Limited For the financial year ended 30 June 2018 Report on the audit of the financial statements Disclaimer of opinion We were engaged to audit the financial statements of AusGroup Limited (the Company) and its subsidiaries (the Group), which comprise the consolidated balance sheet of the Group and the balance sheet of the Company as at 30 June 2018, the consolidated statement of comprehensive income, consolidated statement of changes in equity and consolidated statement of cash flows of the Group for the year then ended, and notes to the financial statements, including a summary of significant accounting policies as set out on pages 38 to 102. We do not express an opinion on the accompanying financial statements of the Group. Because of the significance of the matters described in the 'Basis for disclaimer of opinion' section of our report, we have not been able to obtain sufficient appropriate audit evidence to provide a basis for an audit opinion on these financial statements. Basis for disclaimer of opinion (a) The Group's non-current assets at 30 June 2018 include property, plant and equipment of AU$45.2 million (2017: AU$43.4 million) and intangible asset of AU$32.1 million (2017: AU$31.7 million) attributable to the Port and Marine cash-generating unit ("CGU"). As disclosed in note 24 to the financial statements, the Company has estimated the recoverable amount of the Port and Marine CGU based on a fair value less cost of disposal method. We were unable to obtain sufficient appropriate audit evidence regarding the key assumptions applied to arrive at the recoverable amount of the Port and Marine CGU. Consequently, we were unable to determine whether any adjustments were necessary in respect of the accompanying consolidated balance sheet of the Group as at 30 June 2018, and the consolidated statement of comprehensive income and consolidated statement of changes in equity for the year ended 30 June 2018. (b) Arising from above, we were also unable to determine whether any adjustment to the carrying amount of the investments in subsidiaries shown in the Company's balance sheet was necessary. Of the Company's non-current assets of AU$140.4 million as at 30 June 2018 (2017: AU$178.0 million), AU$30.9 million (2017: AU$29.1 million) relates to investments in subsidiaries and AU$50.9 million (2017: AU$52.6 million) pertains to receivables owing from subsidiaries which comprise the Group's Port and Marine CGU. We considered the impact of the above items to be material and pervasive to the overall financial statements of the Group. Independent Auditor's Report to the Members of Woolworths Group Limited Report on the Audit of the Financial Report Opinion We have audited the financial report of Woolworths Group Limited ("the Company') and its subsidiaries (the Group'), which comprises the Consolidated Statement of Financial Position as at 24 June 2018, the Consolidated Statement of Profit or Loss, the Consolidated Statement of Other Comprehensive Income, the Consolidated Statement of Changes in Equity and the Consolidated Statement of Cash Flows for the 52 weeks then ended, and notes to the financial statements, including a summary of significant accounting policies, and the Directors' Declaration. In our opinion, the accompanying financial report of the Group is in accordance with the Corporations Act 2001, including: (1) giving a true and fair view of the Group's financial position as at 24 June 2018 and of its financial performance for the year then ended; and (ii) complying with Australian Accounting Standards and the Corporations Regulations 2001. Basis for Opinion We conducted our audit in accordance with Australian Auditing Standards. Our responsibilities under those standards are further described in the Auditor's Responsibilities for the Audit of the Financial Report section of our report. We are independent of the Group in accordance with the auditor independence requirements of the Corporations Act 2001 and the ethical requirements of the Accounting Professional and Ethical Standards Board's APES 110 Code of Ethics for Professional Accountants (the Code) that are relevant to our audit of the financial report in Australia. We have also fulfilled our other ethical responsibilities in accordance with the Code. We confirm that the independence declaration required by the Corporations Act 2001, which has been given to the directors of the Company, would be in the same terms if given to the directors as at the time of this auditor's report We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion