Question

As a part of the Get Ceres T M program, Ceres Gardening Company started extending an increased credit period to its dealers. Look at the

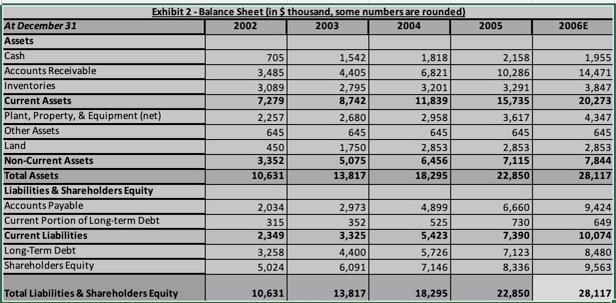

As a part of the Get Ceres T M program, Ceres Gardening Company started extending an increased credit period to its dealers. Look at the operating working capital of the company and analyze the impact of this decision on its operating working capital step by step through the following questions.

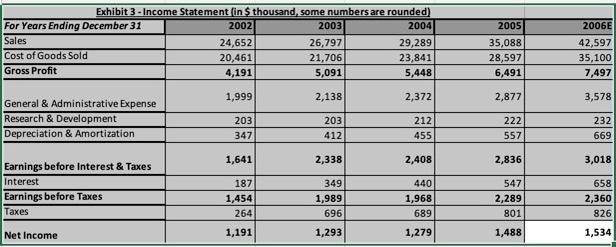

Question 2A: Calculate the operating working capital of Ceres Gardening Company for 2002–2006(E).

Question 2B: Calculate the operating working capital/sales ratio of Ceres Gardening Company for 2002 to 2006(E).

Question 2C: Calculate the DIO, DSO and DPO for the company from 2002 to 2006(E).

Question 2D: What is the implication of the long credit period given to dealers by Ceres Gardening Limited on its working capital? Explain your answer by specifying at least one reason.

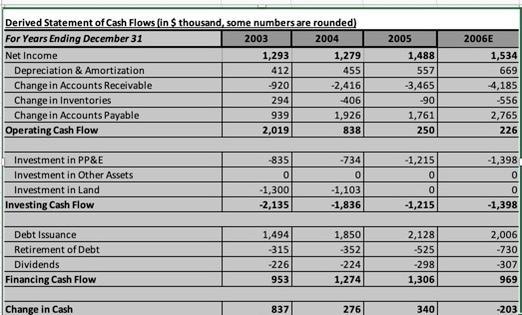

Derived Statement of Cash Flows (in $ thousand, some numbers are rounded) For Years Ending December 31 2003 2004 2005 2006E Net Income 1,293 1,279 1,488 1,534 Depreciation & Amortization Change in Accounts Receivable Change in Inventories Change in Accounts Payable Operating Cash Flow 412 455 557 669 -920 -2,416 -3,465 -4,185 294 406 -90 -556 939 1,926 1,761 2,765 2,019 838 250 226 Investment in PP&E -835 -734 -1,215 -1,398 Investment in Other Assets Investment in Land -1,300 -2,135 -1,103 Investing Cash Flow -1,836 -1,215 -1,398 Debt Issuance 1,494 1,850 2,128 2,006 Retirement of Debt -315 -352 -525 -730 Dividends -226 -224 -298 -307 Financing Cash Flow 953 1,274 1,306 969 Change in Cash 837 276 340 -203

Step by Step Solution

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

2A Operating Working Capital 2002 2003 2004 2005 2006 Current Assets 727900 874200 1183900 1573500 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started