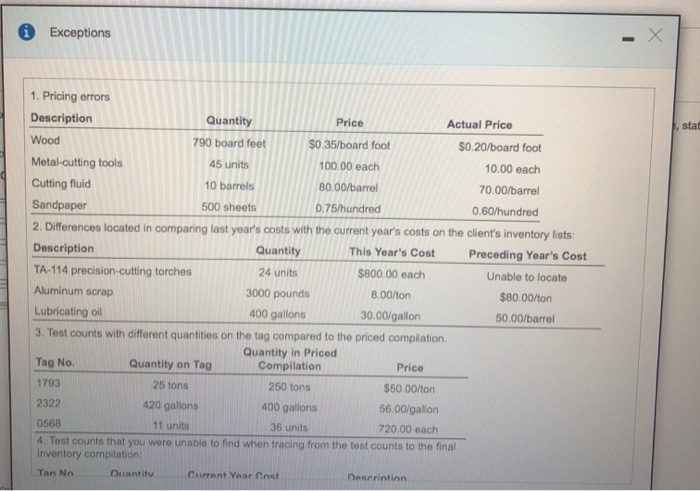

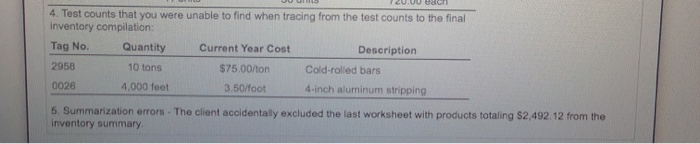

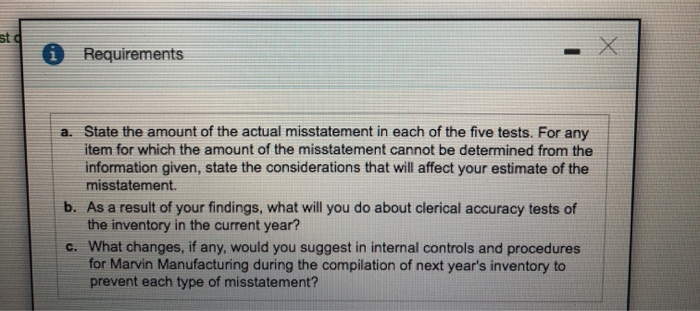

As a part of your clerical tests of inventory for Marvin Manufacturing, you have losted about 20 percent of the dollar items and have found the following exceptions: (Click the icon to view the exceptions.) Read the requirements Requirement a State the amount of the actual misstatement in each of the five tests. For any item for which the amount of the missta hematon a n 0 Exceptions stal 1. Pricing errors Description Quantity Price Actual Price Wood 790 board feet $0 35/board foot $0.20/board foot Metal-cutting tools 45 units 100.00 each 10.00 each Cutting fluid 10 barrels 80.00/barrel 70.00/barrel Sandpaper 500 sheets 0.75/hundred 0.60/hundred 2. Differences located in comparing last year's costs with the current year's costs on the client's inventory lists: Description Quantity This Year's Cost Preceding Year's Cost TA-114 precision-cutting torches 24 units $800.00 each Unable to locate Aluminum scrap 3000 pounds 8.00/ton $80.00/ton Lubricating oil 400 gallons 30.00/gallon 50.00/barrel 3. Test counts with different quantities on the tag compared to the priced compilation Quantity in Priced Tag No. Quantity on Tag Compilation Price 1793 25 tons 250 tons $50.00/ton 2322 420 gallons 400 gallons 56.00/gallon 0568 11 units 36 units 720.00 each 4. Test counts that you were unable to find when tracing from the test counts to the final inventory compilation Tan No Cuantity Current Year Cat Descrintinn 4. Test counts that you were unable to find when tracing from the test counts to the final inventory compilation: Tag No. Quantity Current Year Cost Description 2958 10 tons $75.00/ton Cold-rolled bars 0026 4,000 feet 3.50/foot 4-inch aluminum stripping 5. Summarization errors. The client accidentaly excluded the last worksheet with products totaling $2,492.12 from the inventory summary i Requirements State the amount of the actual misstatement in each of the five tests. For any item for which the amount of the misstatement cannot be determined from the information given, state the considerations that will affect your estimate of the misstatement b. As a result of your findings, what will you do about clerical accuracy tests of the inventory in the current year? c. What changes, if any, would you suggest in internal controls and procedures for Marvin Manufacturing during the compilation of next year's inventory to prevent each type of misstatement? As a part of your clerical tests of inventory for Marvin Manufacturing, you have losted about 20 percent of the dollar items and have found the following exceptions: (Click the icon to view the exceptions.) Read the requirements Requirement a State the amount of the actual misstatement in each of the five tests. For any item for which the amount of the missta hematon a n 0 Exceptions stal 1. Pricing errors Description Quantity Price Actual Price Wood 790 board feet $0 35/board foot $0.20/board foot Metal-cutting tools 45 units 100.00 each 10.00 each Cutting fluid 10 barrels 80.00/barrel 70.00/barrel Sandpaper 500 sheets 0.75/hundred 0.60/hundred 2. Differences located in comparing last year's costs with the current year's costs on the client's inventory lists: Description Quantity This Year's Cost Preceding Year's Cost TA-114 precision-cutting torches 24 units $800.00 each Unable to locate Aluminum scrap 3000 pounds 8.00/ton $80.00/ton Lubricating oil 400 gallons 30.00/gallon 50.00/barrel 3. Test counts with different quantities on the tag compared to the priced compilation Quantity in Priced Tag No. Quantity on Tag Compilation Price 1793 25 tons 250 tons $50.00/ton 2322 420 gallons 400 gallons 56.00/gallon 0568 11 units 36 units 720.00 each 4. Test counts that you were unable to find when tracing from the test counts to the final inventory compilation Tan No Cuantity Current Year Cat Descrintinn 4. Test counts that you were unable to find when tracing from the test counts to the final inventory compilation: Tag No. Quantity Current Year Cost Description 2958 10 tons $75.00/ton Cold-rolled bars 0026 4,000 feet 3.50/foot 4-inch aluminum stripping 5. Summarization errors. The client accidentaly excluded the last worksheet with products totaling $2,492.12 from the inventory summary i Requirements State the amount of the actual misstatement in each of the five tests. For any item for which the amount of the misstatement cannot be determined from the information given, state the considerations that will affect your estimate of the misstatement b. As a result of your findings, what will you do about clerical accuracy tests of the inventory in the current year? c. What changes, if any, would you suggest in internal controls and procedures for Marvin Manufacturing during the compilation of next year's inventory to prevent each type of misstatement