Question

As a portfolio manager and Given the following graphs, how could you use them to select the best portfolio for your client? You should talk

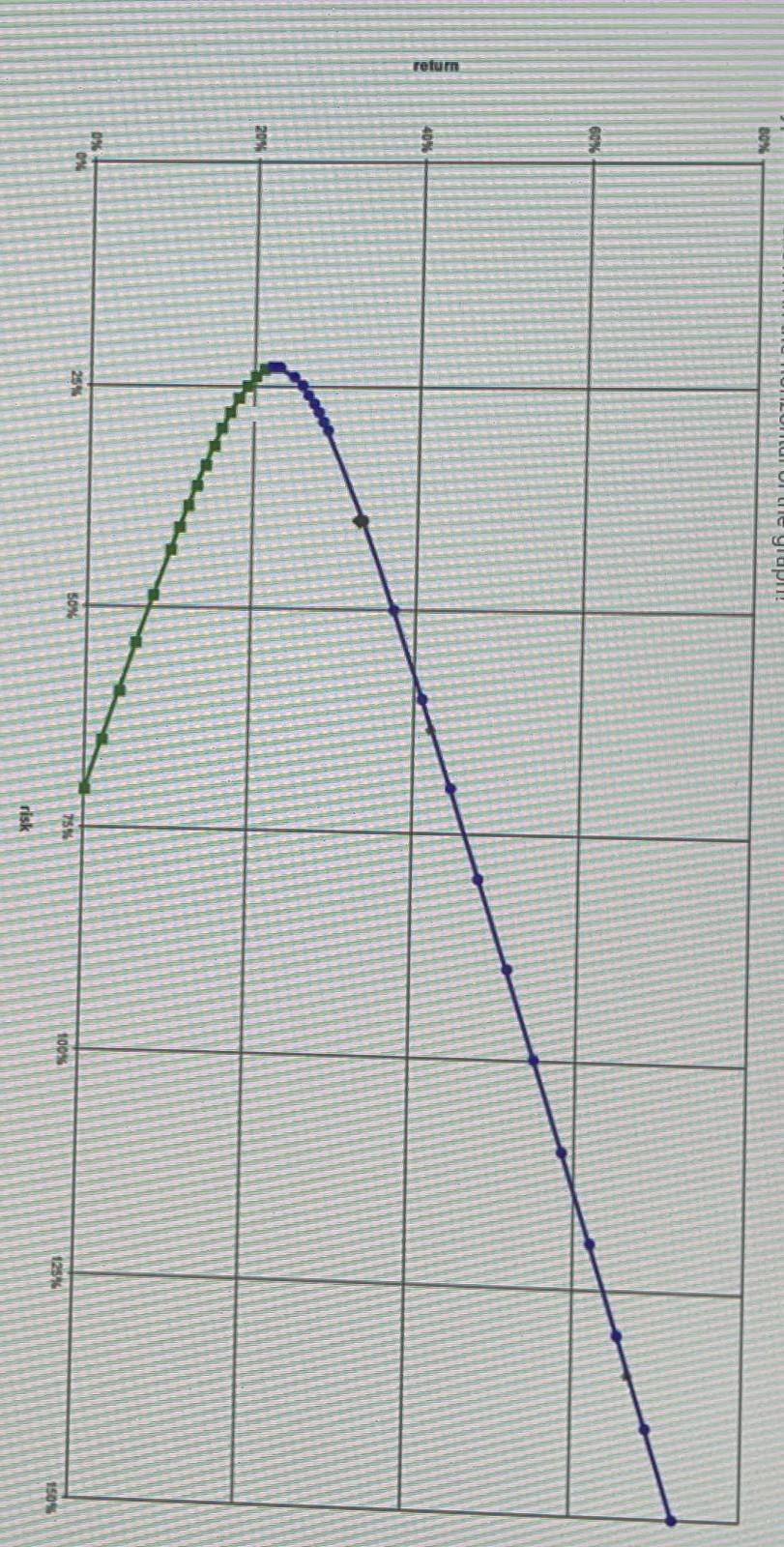

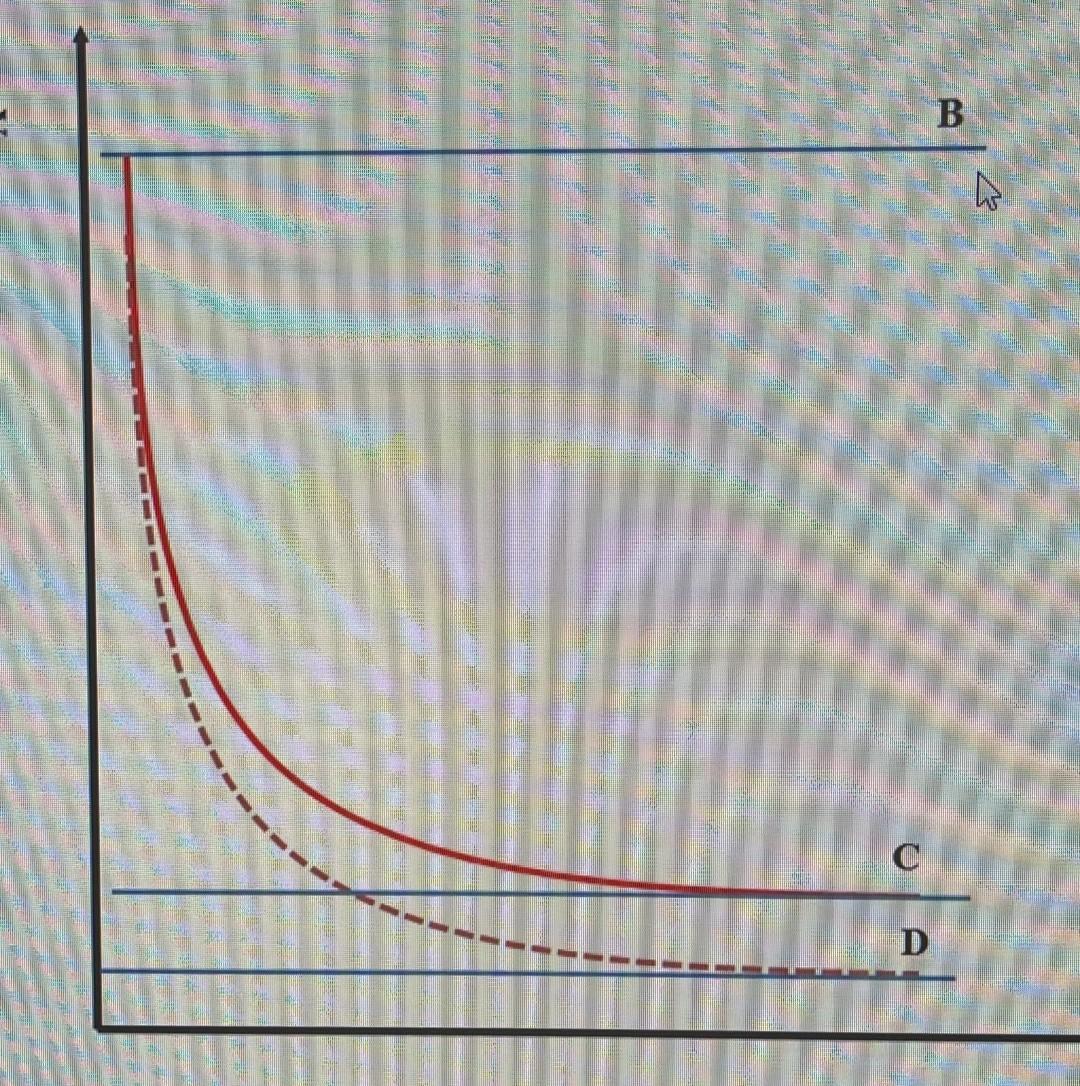

As a portfolio manager and Given the following graphs, how could you use them to select the best portfolio for your client? You should talk about the . ( using graph 1) the total risk Ans its components ( unsystematic risk and Systematic risk) . why and How can you avoid the unsystematic risk. 1.3 Then why and how you can reduce the systematic risk? . Then the second graph where you can get the efficient frontier And what does it mean. . why you are not going to select inefficient portfolio which it below the blow line? . why you cannot invest in a portfolio above the blow line, unattainable portfolio? . why you are only going to invest in the blow line, the efficient frontier? . Where you are going to invest in the blow line if your client is . risk averse? . risk neutral? . risk seeker? Define them.

Answer this question

B W C D B W C DStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started