Question

As a recent AIT graduate, you have been asked by your employer to consider two possible expansion plans for a small ski resort. In

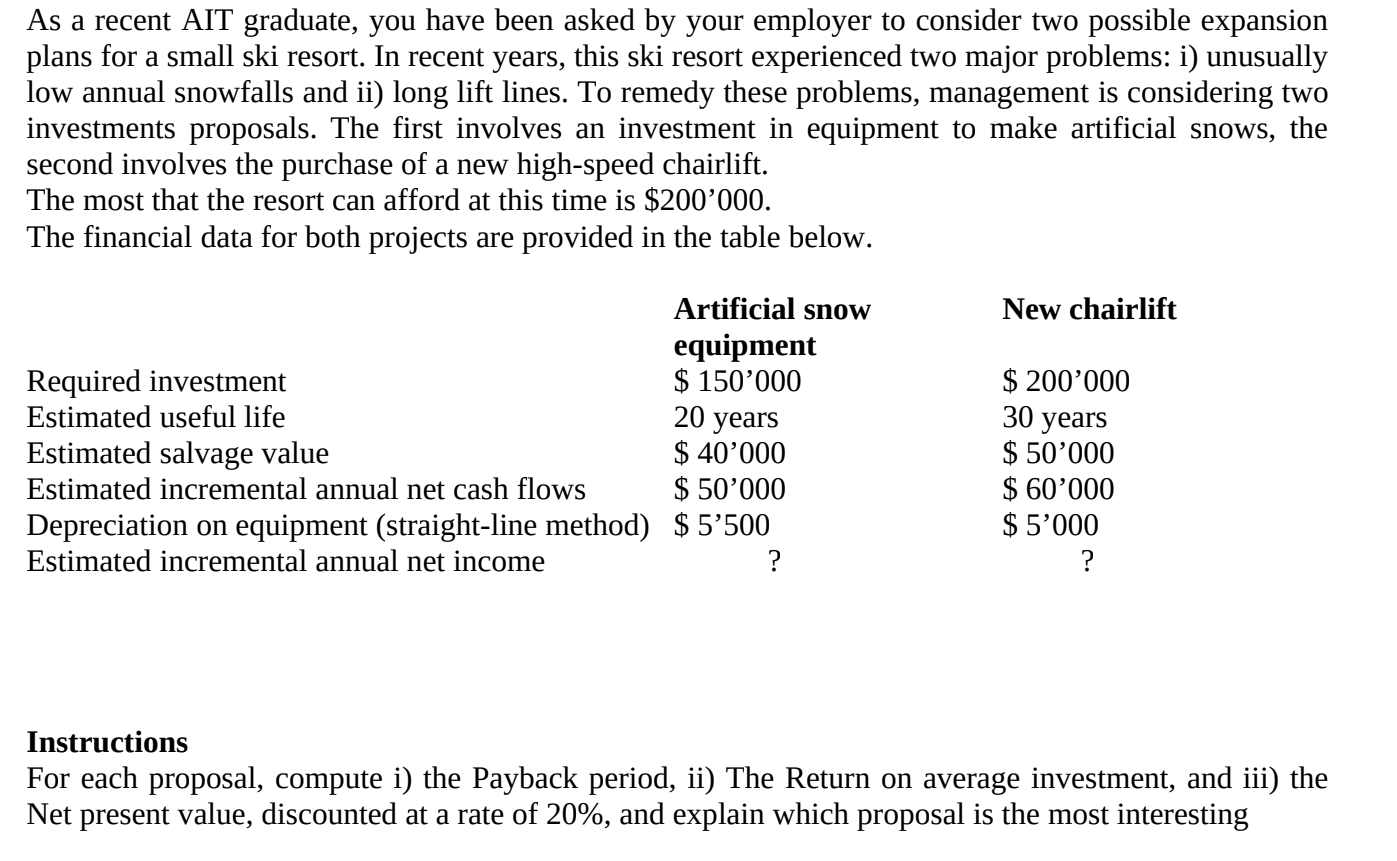

As a recent AIT graduate, you have been asked by your employer to consider two possible expansion plans for a small ski resort. In recent years, this ski resort experienced two major problems: i) unusually low annual snowfalls and ii) long lift lines. To remedy these problems, management is considering two investments proposals. The first involves an investment in equipment to make artificial snows, the second involves the purchase of a new high-speed chairlift. The most that the resort can afford at this time is $200'000. The financial data for both projects are provided in the table below. Artificial snow equipment New chairlift Required investment Estimated useful life Estimated salvage value $ 150'000 20 years $ 40'000 Estimated incremental annual net cash flows $ 50'000 Depreciation on equipment (straight-line method) $ 5'500 Estimated incremental annual net income $ 200'000 30 years $ 50'000 $ 60'000 $ 5'000 ? ? Instructions For each proposal, compute i) the Payback period, ii) The Return on average investment, and iii) the Net present value, discounted at a rate of 20%, and explain which proposal is the most interesting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started