Question

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been

As a recently accredited CPA you have joined a growing firm of CPAs, Cromdex LLP. As the calendar has turned to 2024, you have been asked to attend a meeting with one of the founding partners, Mr. James Cromartie. At the meeting, Mr. Cromartie welcomes you to the firm and hands you a file that contains the following for a long standing client, Standbro Corp.:

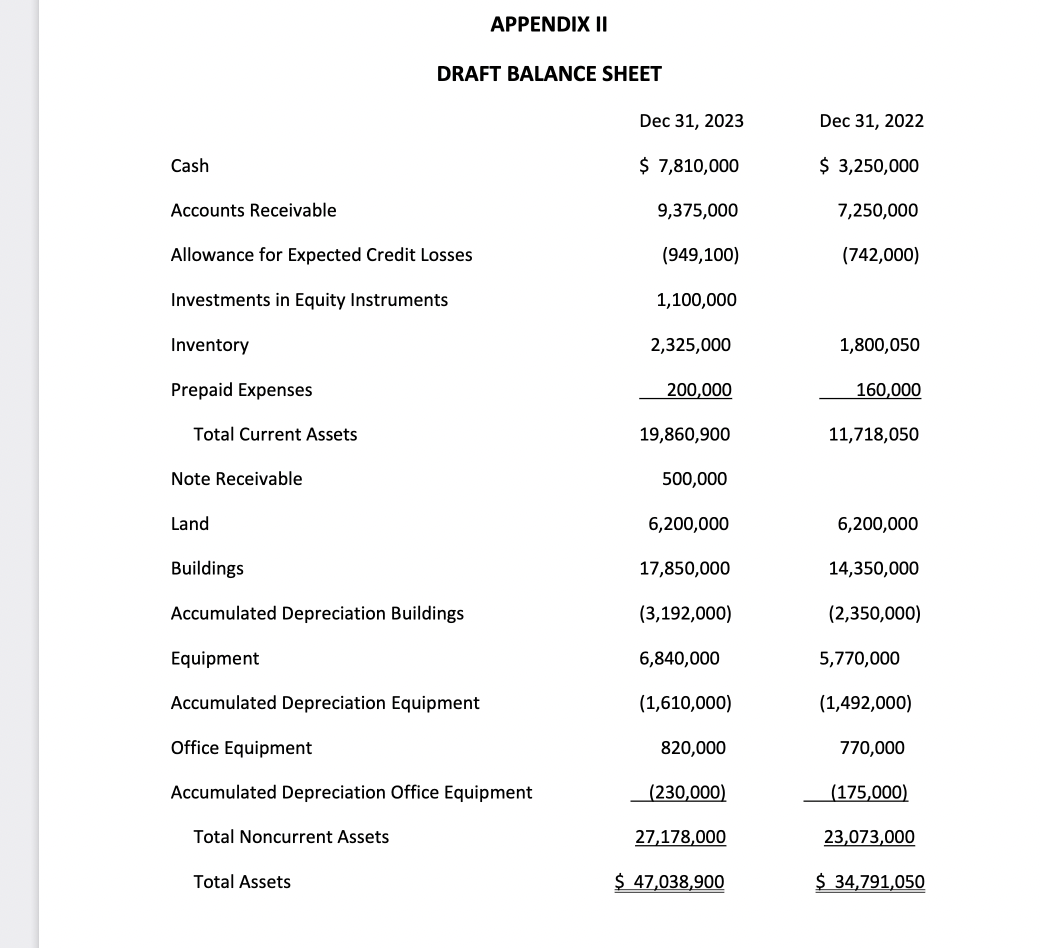

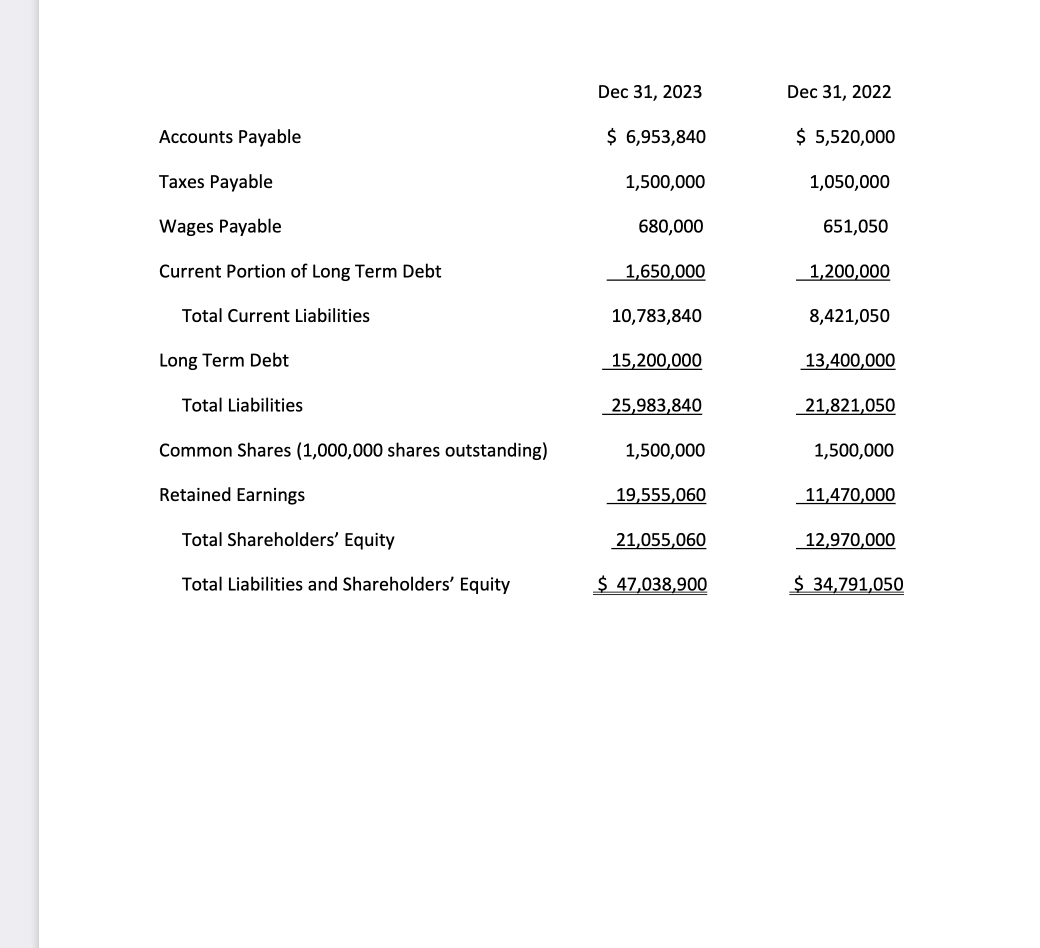

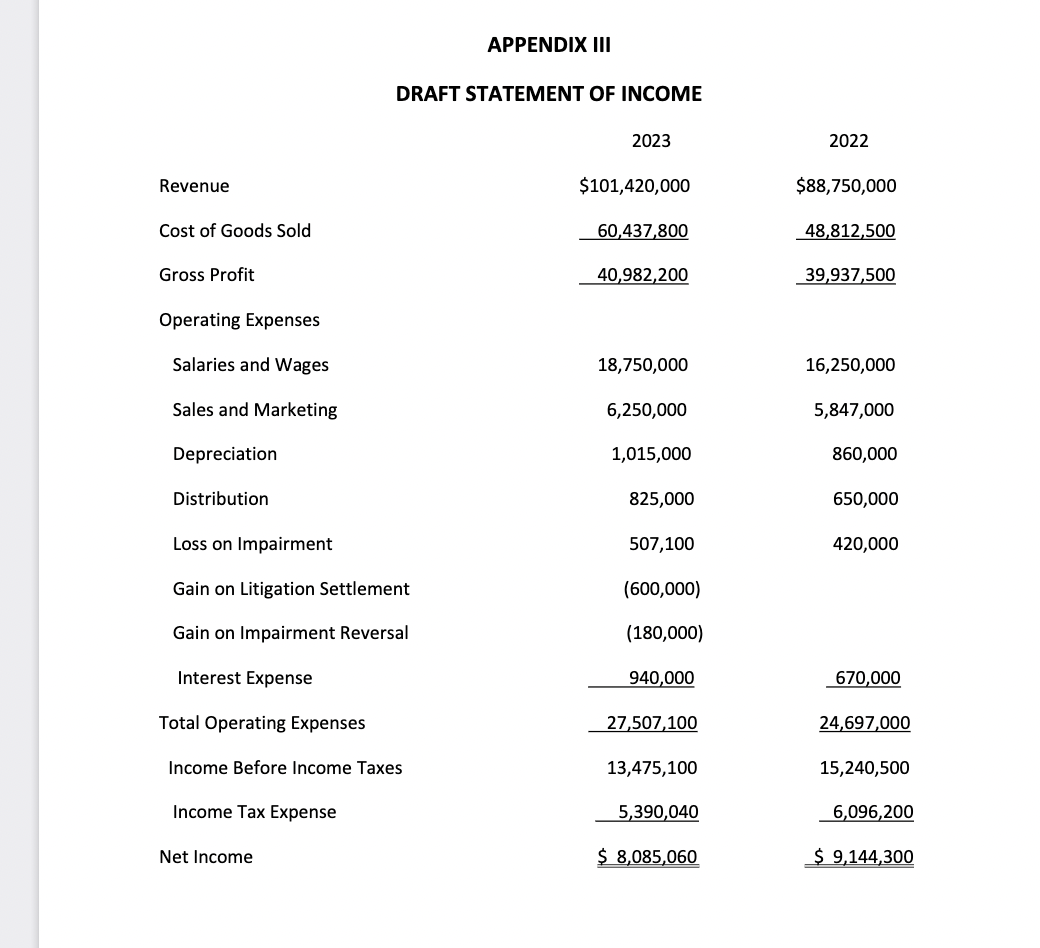

i. Notes of a Meeting with Standbros Management (Appendix I). ii. Draft Statement of Comprehensive Income for the year ended December 31, 2023 (Appendix II). iii. Draft Balance Sheet as at December 31, 2023 (Appendix III).

Standbro Corp. manufactures specialized grinding equipment. The equipment can be ordered by customers from a catalogue or specialized to a customers requirement.

Mr. Cromartie has asked you to review the Notes of the Meeting and prepare a report noting any adjusting journal entries that should be presented to the client. He specifically instructed that When preparing your report, focus on the current year only. We will consider any impact on the comparative numbers later. Also in your report, consider any matters of importance for Mr. Cromartie to review with the client. This report should also include two visualiations to assist in the understanding of the report. Please round any monetary amount to the nearest whole number.

On June 30, 2023 the Company sold a NX35462 grinding machine to a customer for the list price of $500,000. The customer has signed a 6-year note receivable for $500,000. The note has a rate of interest of 2% instead of the prevailing market rate of 5% as an incentive for the customer to complete the purchase. The note requires interest payments every 6 months with the principal due at the maturity of the note. The customer has provided audited financial statements which show the companys strong financial position so it is reasonable to conclude there is no collection risk. The interest payment was received at December 31, 2023 and was included in the draft financial statements.

Please help answer this case question and site Gaap.

APPENDIX II DRAFT BALANCE SHEET \begin{tabular}{|c|c|c|} \hline & Dec 31, 2023 & Dec 31, 2022 \\ \hline Cash & $7,810,000 & $3,250,000 \\ \hline Accounts Receivable & 9,375,000 & 7,250,000 \\ \hline Allowance for Expected Credit Losses & (949,100) & (742,000) \\ \hline Investments in Equity Instruments & 1,100,000 & \\ \hline Inventory & 2,325,000 & 1,800,050 \\ \hline Prepaid Expenses & 200,000 & 160,000 \\ \hline Total Current Assets & 19,860,900 & 11,718,050 \\ \hline Note Receivable & 500,000 & \\ \hline Land & 6,200,000 & 6,200,000 \\ \hline Buildings & 17,850,000 & 14,350,000 \\ \hline Accumulated Depreciation Buildings & (3,192,000) & (2,350,000) \\ \hline Equipment & 6,840,000 & 5,770,000 \\ \hline Accumulated Depreciation Equipment & (1,610,000) & (1,492,000) \\ \hline Office Equipment & 820,000 & 770,000 \\ \hline Accumulated Depreciation Office Equipment & (230,000) & (175,000) \\ \hline Total Noncurrent Assets & 27,178,000 & 23,073,000 \\ \hline Total Assets & $47,038,900 & $34,791,050 \\ \hline \end{tabular} \begin{tabular}{lrr} & Dec 31, 2023 & Dec 31, 2022 \\ Accounts Payable & $6,953,840 & $5,520,000 \\ Taxes Payable & 1,500,000 & 1,050,000 \\ Wages Payable & 680,000 & 651,050 \\ Current Portion of Long Term Debt & 1,650,000 & 1,200,000 \\ Total Current Liabilities & 10,783,840 & 8,421,050 \\ Long Term Debt & 15,200,000 & 13,400,000 \\ 25,983,840 & 21,821,050 \\ Total Liabilities & 1,500,000 & 1,500,000 \\ Common Shares (1,000,000 shares outstanding) & 19,555,060 & 11,470,000 \\ Retained Earnings & 21,055,060 & 12,970,000 \\ Total Shareholders' Equity & 44,038,900 & 34,791,050 \end{tabular} APPENDIX III DRAFT STATEMENT OF INCOME 2023 Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Sales and Marketing Depreciation Distribution Loss on Impairment Gain on Litigation Settlement Gain on Impairment Reversal Interest Expense Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income \begin{tabular}{cc} 2023 & 2022 \\ $101,420,000 & $88,750,000 \\ 60,437,800 & 48,812,500 \\ \hline 40,982,200 & 39,937,500 \\ \hline \end{tabular} \begin{tabular}{rr} 18,750,000 & 16,250,000 \\ 6,250,000 & 5,847,000 \\ 1,015,000 & 860,000 \\ 825,000 & 650,000 \\ 507,100 & 420,000 \end{tabular} (600,000) (180,000) \begin{tabular}{rr} \hline 940,000 & 670,000 \\ \hline 27,507,100 & 24,697,000 \\ \hline 13,475,100 & 15,240,500 \\ 5,390,040 & 6,096,200 \\ \hline$8,085,060 & $9,144,300 \\ \hline \end{tabular}

APPENDIX II DRAFT BALANCE SHEET \begin{tabular}{|c|c|c|} \hline & Dec 31, 2023 & Dec 31, 2022 \\ \hline Cash & $7,810,000 & $3,250,000 \\ \hline Accounts Receivable & 9,375,000 & 7,250,000 \\ \hline Allowance for Expected Credit Losses & (949,100) & (742,000) \\ \hline Investments in Equity Instruments & 1,100,000 & \\ \hline Inventory & 2,325,000 & 1,800,050 \\ \hline Prepaid Expenses & 200,000 & 160,000 \\ \hline Total Current Assets & 19,860,900 & 11,718,050 \\ \hline Note Receivable & 500,000 & \\ \hline Land & 6,200,000 & 6,200,000 \\ \hline Buildings & 17,850,000 & 14,350,000 \\ \hline Accumulated Depreciation Buildings & (3,192,000) & (2,350,000) \\ \hline Equipment & 6,840,000 & 5,770,000 \\ \hline Accumulated Depreciation Equipment & (1,610,000) & (1,492,000) \\ \hline Office Equipment & 820,000 & 770,000 \\ \hline Accumulated Depreciation Office Equipment & (230,000) & (175,000) \\ \hline Total Noncurrent Assets & 27,178,000 & 23,073,000 \\ \hline Total Assets & $47,038,900 & $34,791,050 \\ \hline \end{tabular} \begin{tabular}{lrr} & Dec 31, 2023 & Dec 31, 2022 \\ Accounts Payable & $6,953,840 & $5,520,000 \\ Taxes Payable & 1,500,000 & 1,050,000 \\ Wages Payable & 680,000 & 651,050 \\ Current Portion of Long Term Debt & 1,650,000 & 1,200,000 \\ Total Current Liabilities & 10,783,840 & 8,421,050 \\ Long Term Debt & 15,200,000 & 13,400,000 \\ 25,983,840 & 21,821,050 \\ Total Liabilities & 1,500,000 & 1,500,000 \\ Common Shares (1,000,000 shares outstanding) & 19,555,060 & 11,470,000 \\ Retained Earnings & 21,055,060 & 12,970,000 \\ Total Shareholders' Equity & 44,038,900 & 34,791,050 \end{tabular} APPENDIX III DRAFT STATEMENT OF INCOME 2023 Revenue Cost of Goods Sold Gross Profit Operating Expenses Salaries and Wages Sales and Marketing Depreciation Distribution Loss on Impairment Gain on Litigation Settlement Gain on Impairment Reversal Interest Expense Total Operating Expenses Income Before Income Taxes Income Tax Expense Net Income \begin{tabular}{cc} 2023 & 2022 \\ $101,420,000 & $88,750,000 \\ 60,437,800 & 48,812,500 \\ \hline 40,982,200 & 39,937,500 \\ \hline \end{tabular} \begin{tabular}{rr} 18,750,000 & 16,250,000 \\ 6,250,000 & 5,847,000 \\ 1,015,000 & 860,000 \\ 825,000 & 650,000 \\ 507,100 & 420,000 \end{tabular} (600,000) (180,000) \begin{tabular}{rr} \hline 940,000 & 670,000 \\ \hline 27,507,100 & 24,697,000 \\ \hline 13,475,100 & 15,240,500 \\ 5,390,040 & 6,096,200 \\ \hline$8,085,060 & $9,144,300 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started