Answered step by step

Verified Expert Solution

Question

1 Approved Answer

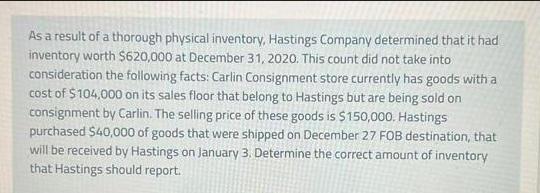

As a result of a thorough physical inventory, Hastings Company determined that it had inventory worth $620,000 at December 31, 2020. This count did

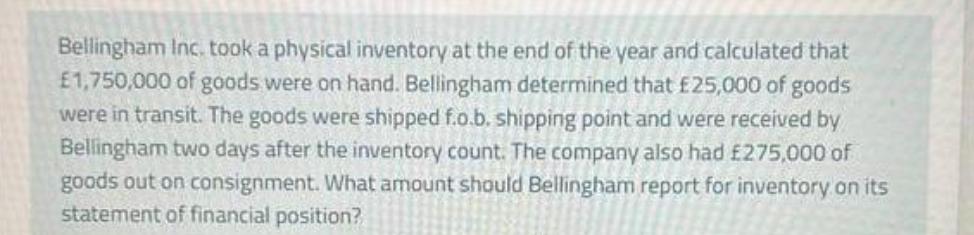

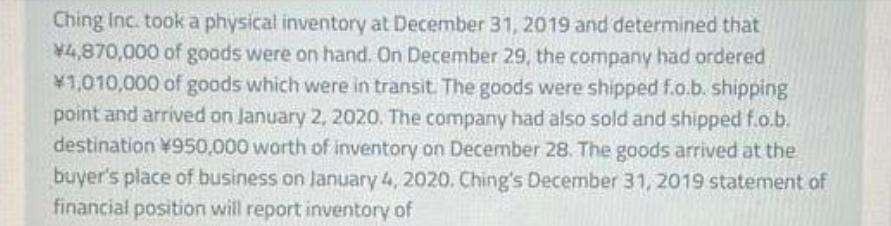

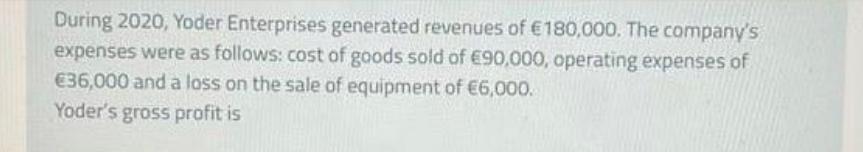

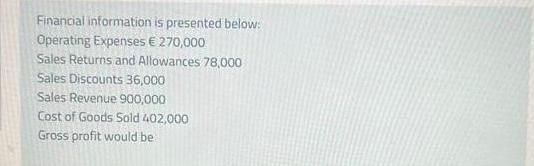

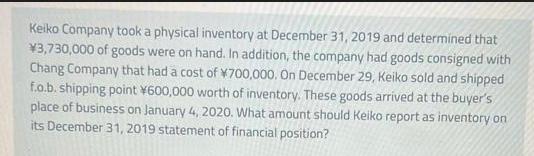

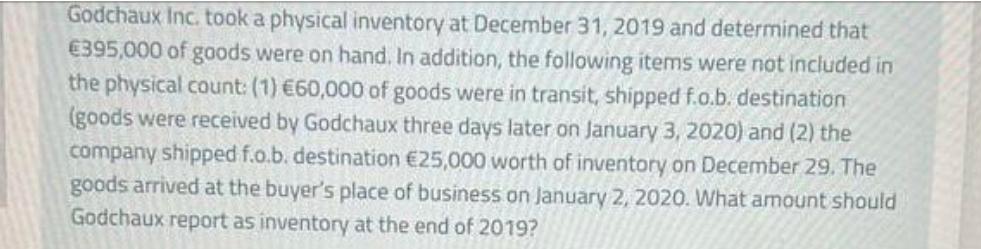

As a result of a thorough physical inventory, Hastings Company determined that it had inventory worth $620,000 at December 31, 2020. This count did not take into consideration the following facts: Carlin Consignment store currently has goods with a cost of $104,000 on its sales floor that belong to Hastings but are being sold on consignment by Carlin. The selling price of these goods is $150,000. Hastings purchased $40,000 of goods that were shipped on December 27 FOB destination, that will be received by Hastings on January 3. Determine the correct amount of inventory that Hastings should report. Bellingham Inc. took a physical inventory at the end of the year and calculated that 1,750,000 of goods were on hand. Bellingham determined that 25,000 of goods were in transit. The goods were shipped f.o.b. shipping point and were received by Bellingham two days after the inventory count. The company also had 275,000 of goods out on consignment. What amount should Bellingham report for inventory on its statement of financial position? Ching Inc. took a physical inventory at December 31, 2019 and determined that 4,870,000 of goods were on hand. On December 29, the company had ordered 1,010,000 of goods which were in transit. The goods were shipped f.o.b. shipping point and arrived on January 2, 2020. The company had also sold and shipped f.o.b. destination 950,000 worth of inventory on December 28. The goods arrived at the buyer's place of business on January 4, 2020. Ching's December 31, 2019 statement of financial position will report inventory of During 2020, Yoder Enterprises generated revenues of 180,000. The company's expenses were as follows: cost of goods sold of 90,000, operating expenses of 36,000 and a loss on the sale of equipment of 6,000. Yoder's gross profit is Financial information Operating Expenses 270,000 Sales Returns and Allowances 78,000 Sales Discounts 36,000 Sales Revenue 900,000 Cost of Goods Sold 402,000 Gross profit would be is presented below: Keiko Company took a physical inventory at December 31, 2019 and determined that 3,730,000 of goods were on hand. In addition, the company had goods consigned with Chang Company that had a cost of 700,000. On December 29, Keiko sold and shipped f.a.b. shipping point 600,000 worth of inventory. These goods arrived at the buyer's place of business on January 4, 2020. What amount should Keiko report as inventory on its December 31, 2019 statement of financial position? Godchaux Inc. took a physical inventory at December 31, 2019 and determined that 395,000 of goods were on hand. In addition, the following items were not included in the physical count: (1) 60,000 of goods were in transit, shipped f.o.b. destination (goods were received by Godchaux three days later on January 3, 2020) and (2) the company shipped f.o.b. destination 25,000 worth of inventory on December 29. The goods arrived at the buyer's place of business on January 2, 2020. What amount should Godchaux report as inventory at the end of 2019?

Step by Step Solution

★★★★★

3.58 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Determine the correct amount of inventory that Hastings should report Consignment Goods Carlin Consignment Store has goods with a cost of 104000 on its sales floor that belong to Hastings However si...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started