Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As a result of MEXIT, Telford Engineering had lost 3 0 % of its pre - MEXIT export sales to CETA customers, due to increased

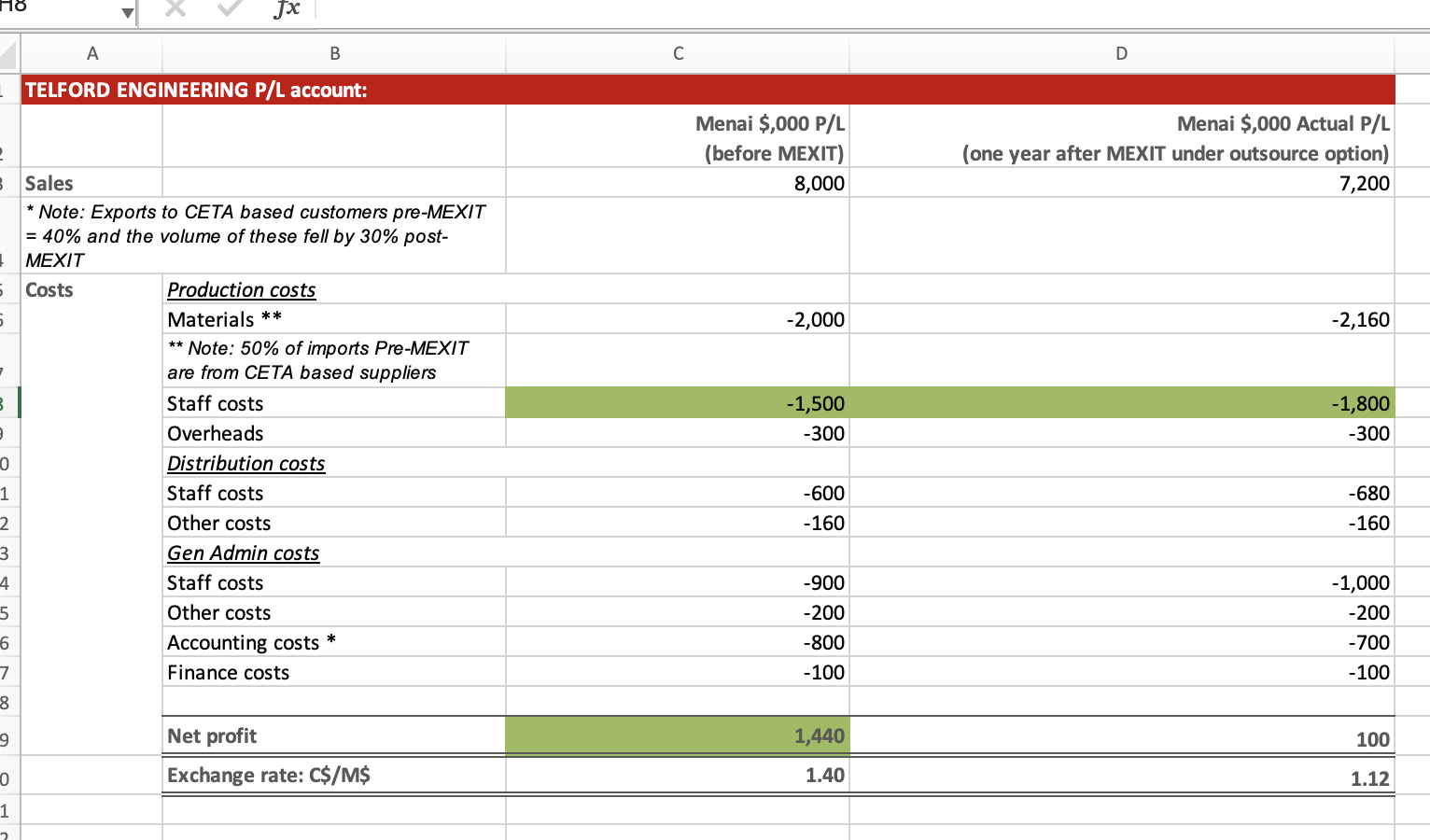

As a result of MEXIT, Telford Engineering had lost of its preMEXIT export sales to CETA customers, due to increased trade and tariff barriers with CETA. See PL account before MEXIT in the spreadsheet A new opportunity has now been negotiated to sell the original postMEXIT loss in CETA exports to a range of customers in alternative export markets on another continent. These can be sold at the same price, bringing the factory back to full capacity. The materials cost of these additional sales, as a percentage of sales to the nearest whole percentage, will be the same as it is currently See PL account one year after MEXIT under the outsource option in the spreadsheet

calculate the effect on net profit to the nearest $M For your answer only provide the first three numbers and do not include any symbols, for example, TELFORD ENGINEERING PL account:

tabletableMenai $ PLbefore MEXITtableMenai $ Actual PLone year after MEXIT under outsource optionSalestable Note: Exports to CETA based customers preMEXIT and the volume of these fell by postMEXITCostsProduction costs,Materialstable Note: of imports PreMEXITare from CETA based suppliersStaff costs,OverheadsDistribution costs,Staff costs,Other costs,Gen Admin costs,Staff costs,Other costs,Accounting costs Finance costs,Net profit,Exchange rate: C$M$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started