Question

As a tax consultant Waleed asks you to help his in calculating her tax return. Waleed is single taxpayer with gross income of 6,000,000 Egyptian

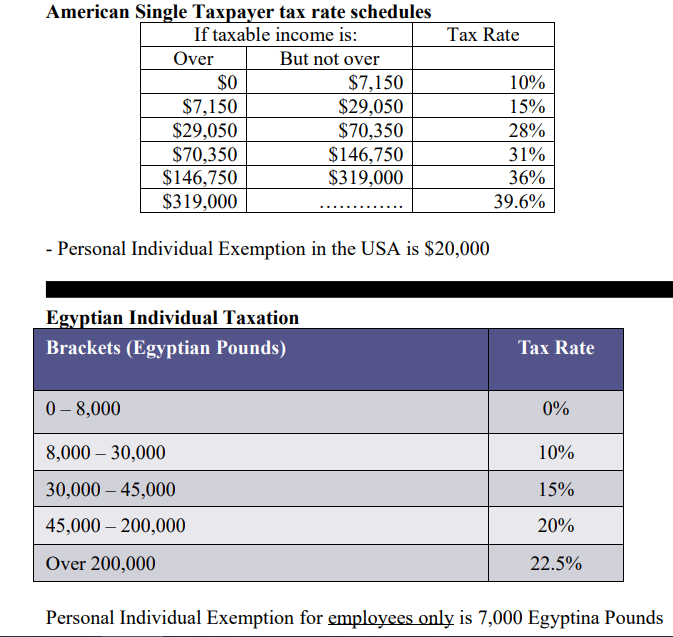

As a tax consultant Waleed asks you to help his in calculating her tax return. Waleed is single taxpayer with gross income of 6,000,000 Egyptian Pounds and a taxable income of 4,800,000 Egyptian pounds. In calculating his taxable income, Waleed properly excluded 1,200,000 Egyptian pounds of her tax exempt income. Use the accompanying Egyptian tax schedules to calculate (a) Waleed's Total Tax payable, (b) Waleed's average tax rate (c) effective tax rate, and (d) which one would normally be higher than the other?

If Waleed's is an American citizen who lives in America calculate his taxable income and tax from the data. (Assume an exchange rate of 20 LE per Dollar).

LE per Dollar).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started