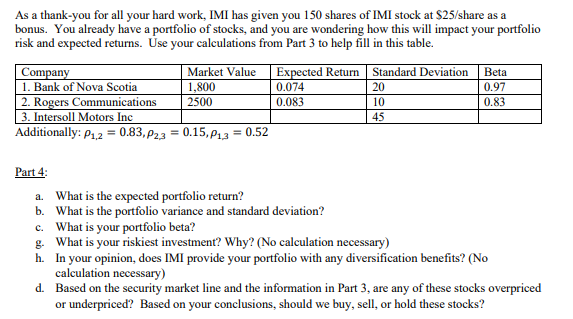

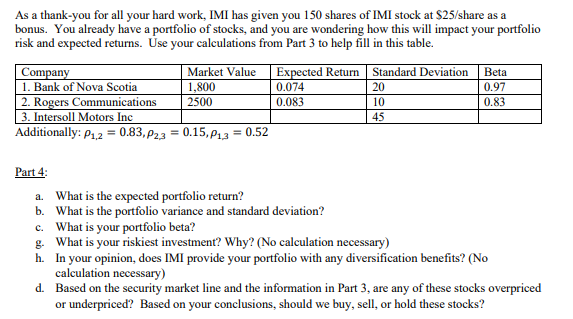

As a thank-you for all your hard work, IMI has given you 150 shares of IMI stock at $25/share as a bonus. You already have a portfolio of stocks, and you are wondering how this will impact your portfolio risk and expected returns. Use your calculations from Part 3 to help fill in this table. Company Market Value 1. Bank of Nova Scotia 1,800 2. Rogers Communications 2500 3. Intersoll Motors Inc Additionally: P1,2 = 0.83, P23 = 0.15, P13 = 0.52 Expected Return 0.074 0.083 Standard Deviation 20 10 Beta 0.97 0.83 Part 4 What is the expected portfolio return? b. What is the portfolio variance and standard deviation? c. What is your portfolio beta? g. What is your riskiest investment? Why? (No calculation necessary) h. In your opinion, does IMI provide your portfolio with any diversification benefits? (No calculation necessary) d. Based on the security market line and the information in Part 3, are any of these stocks overpriced or underpriced? Based on your conclusions, should we buy, sell, or hold these stocks? As a thank-you for all your hard work, IMI has given you 150 shares of IMI stock at $25/share as a bonus. You already have a portfolio of stocks, and you are wondering how this will impact your portfolio risk and expected returns. Use your calculations from Part 3 to help fill in this table. Company Market Value 1. Bank of Nova Scotia 1,800 2. Rogers Communications 2500 3. Intersoll Motors Inc Additionally: P1,2 = 0.83, P23 = 0.15, P13 = 0.52 Expected Return 0.074 0.083 Standard Deviation 20 10 Beta 0.97 0.83 Part 4 What is the expected portfolio return? b. What is the portfolio variance and standard deviation? c. What is your portfolio beta? g. What is your riskiest investment? Why? (No calculation necessary) h. In your opinion, does IMI provide your portfolio with any diversification benefits? (No calculation necessary) d. Based on the security market line and the information in Part 3, are any of these stocks overpriced or underpriced? Based on your conclusions, should we buy, sell, or hold these stocks