Answered step by step

Verified Expert Solution

Question

1 Approved Answer

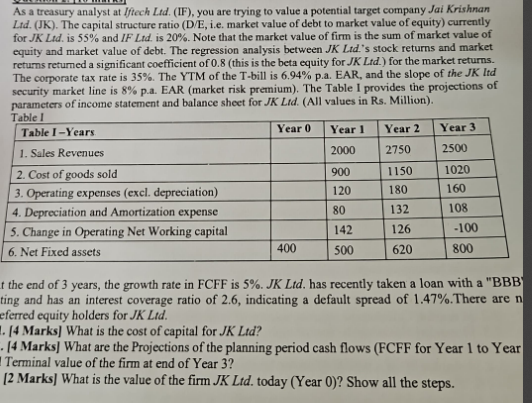

As a treasury analyst at Iftech Ltd . ( IF ) , you are trying to value a potential target company Jai Krishnan Ltd .

As a treasury analyst at Iftech LtdIF you are trying to value a potential target company Jai Krishnan LtdJK The capital structure ratio DE ie market value of debt to market value of equity currently for is and IFLtd. is Note that the market value of firm is the sum of market value of equity and market value of debt. The regression analysis between Ltds stock returns and market returns returned a significant coefficient of this is the beta equity for for the market returns. The corporate tax rate is The YTM of the Tbill is pa EAR, and the slope of the JK Itd security market line is pa EAR market risk premium The Table I provides the projections of parameters of income statement and balance sheet for JK LtdAll values in Rs Million

Table I

tableTable I Years,Year Year Year Year Sales Revenues,, Cost of goods sold,, Operating expenses excl depreciation Depreciation and Amortization expense,, Change in Operating Net Working capital,, Net Fixed assets,

t the end of years, the growth rate in FCFF is has recently taken a loan with a BBB ting and has an interest coverage ratio of indicating a default spread of There are eferred equity holders for Ltd

Marks What is the cost of capital for

Marks What are the Projections of the planning period cash flows FCFF for Year to Year Terminal value of the firm at end of Year

Marks What is the value of the firm today Year Show all the steps.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started