As all the sub questions were *****interrelated**** - Posted as a single question and also verified with Chegg.

**********Please answer all the questions with the excel formula*****************************

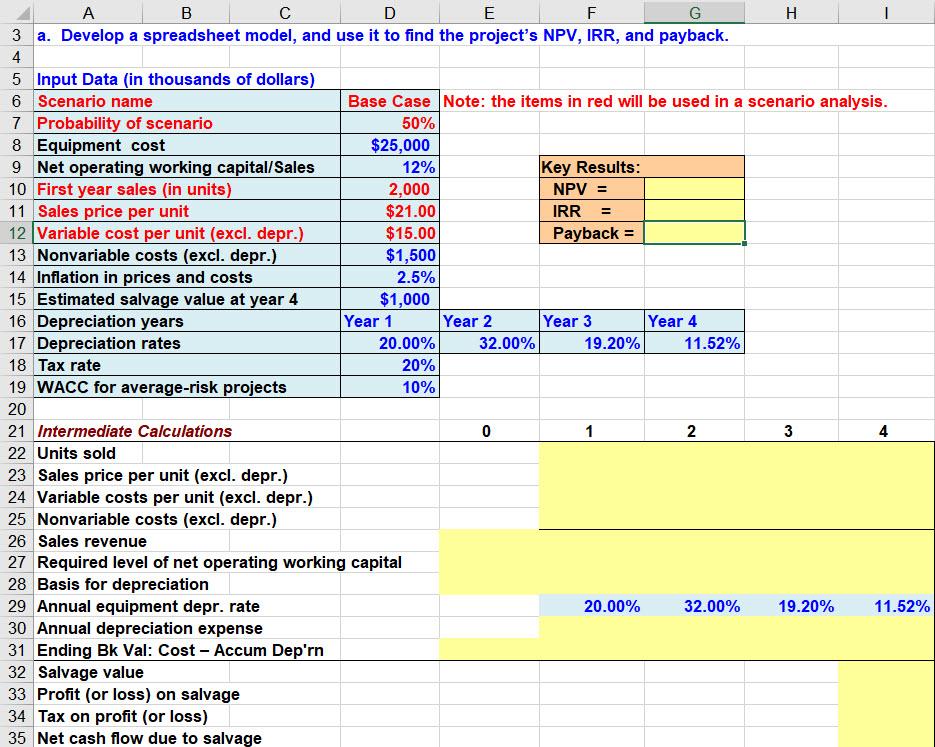

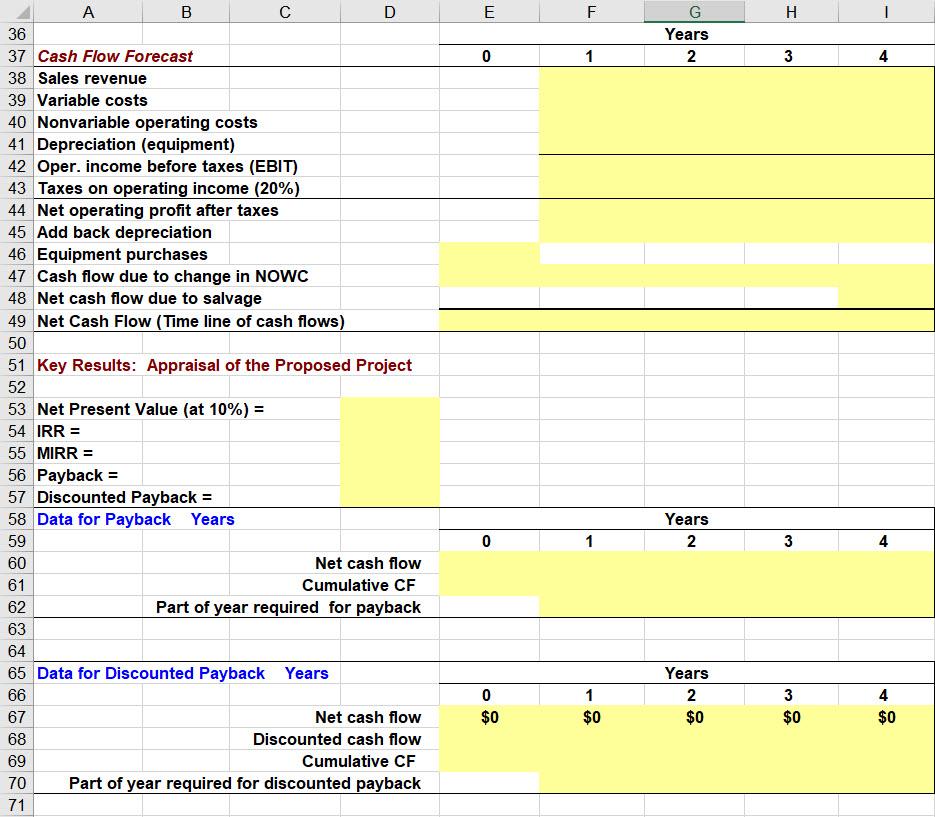

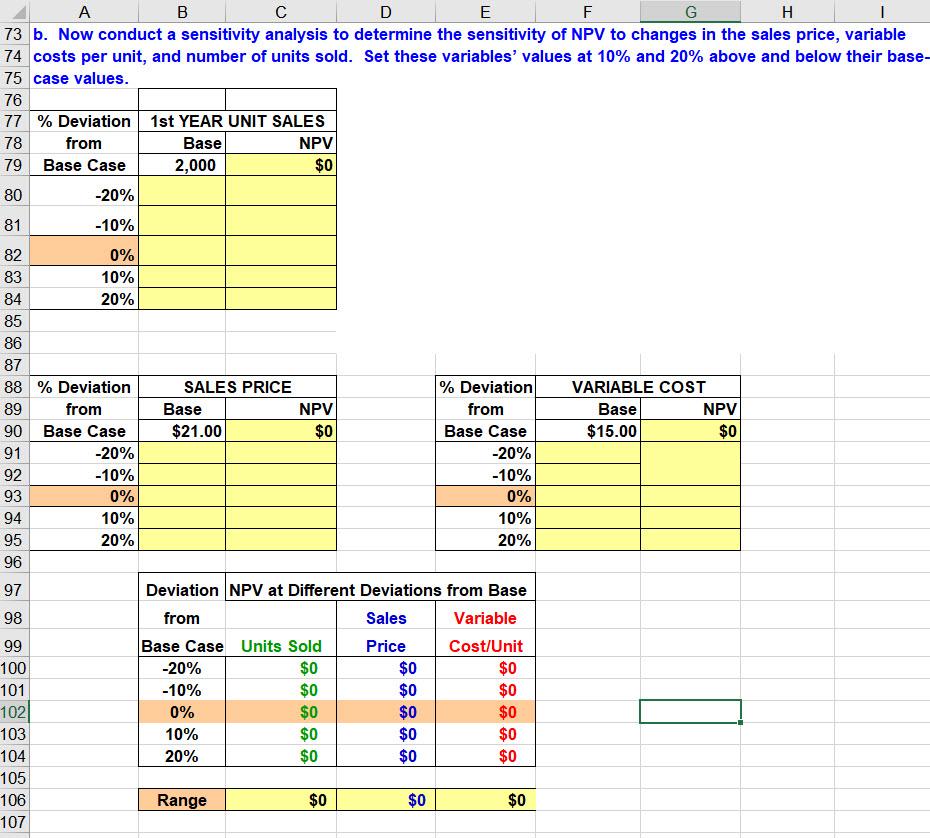

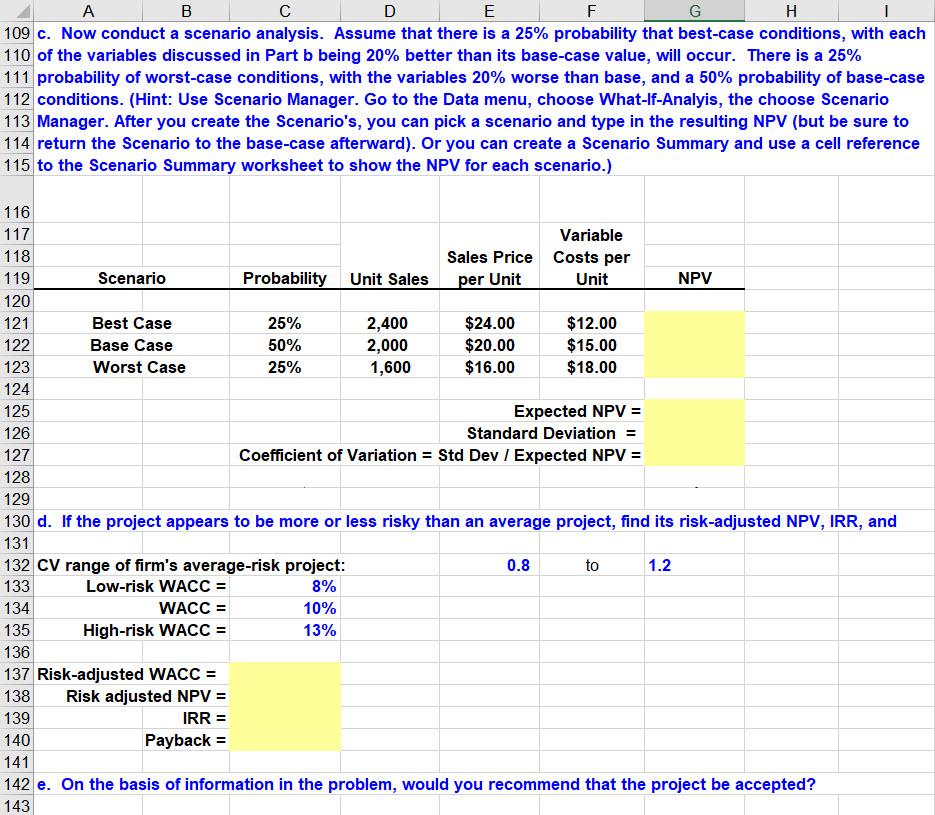

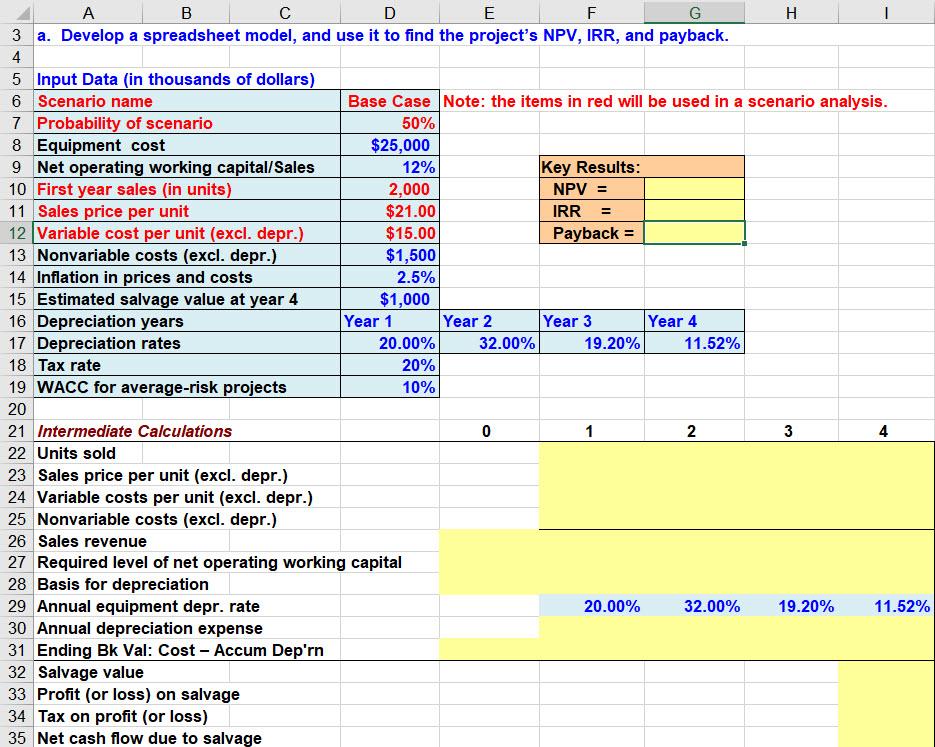

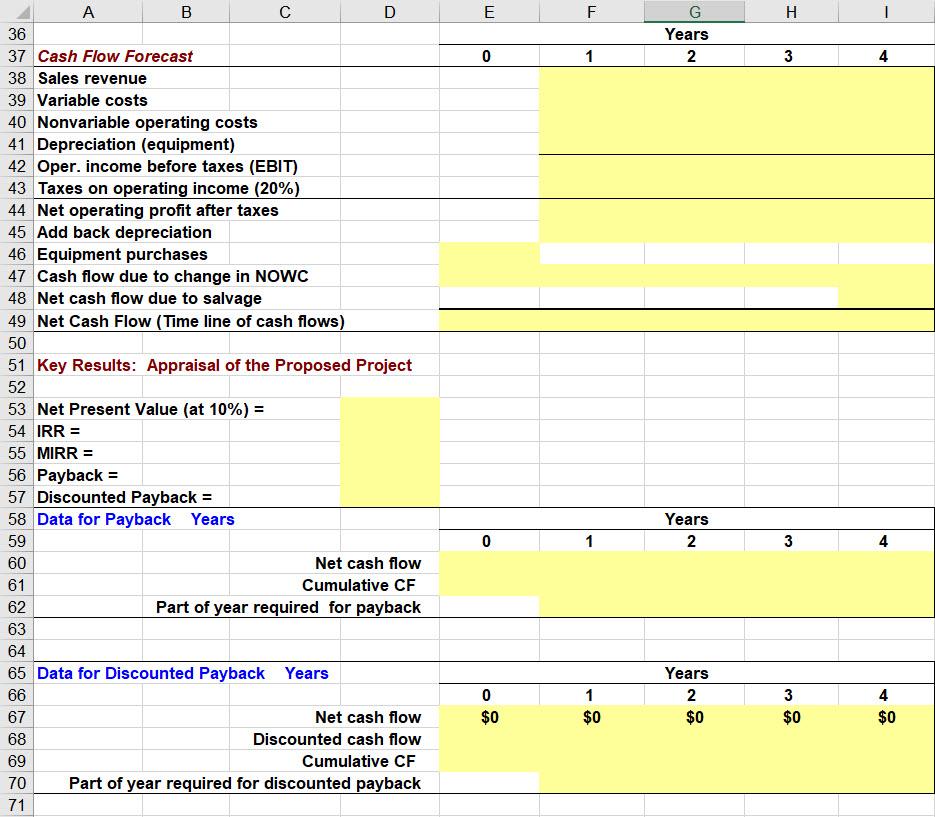

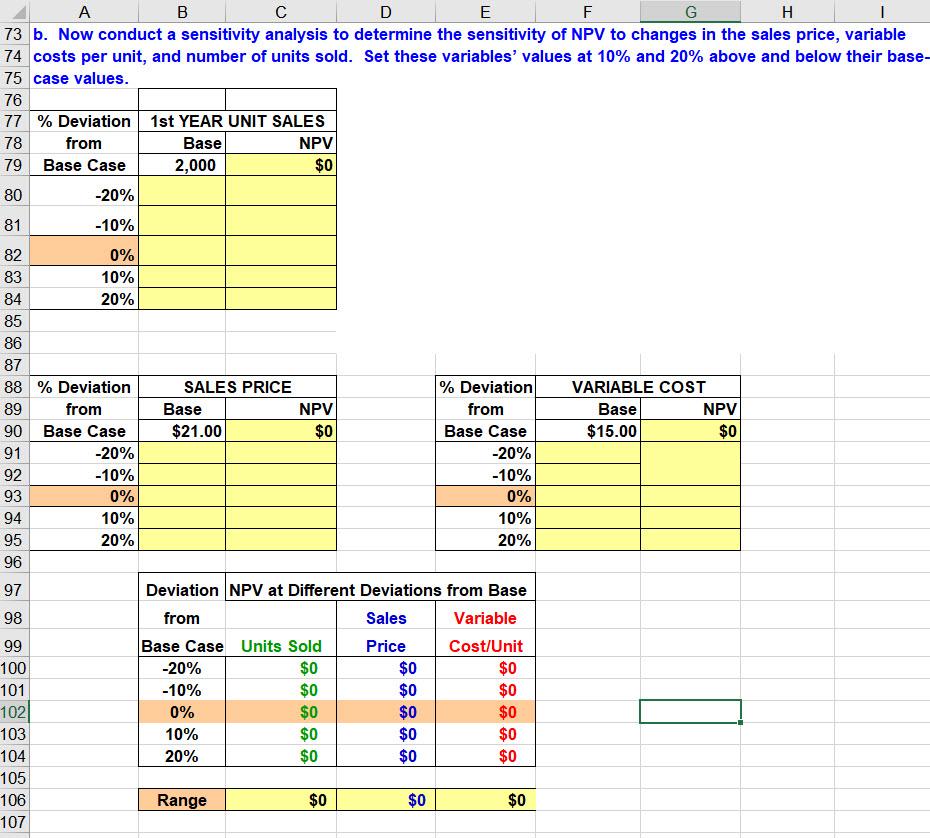

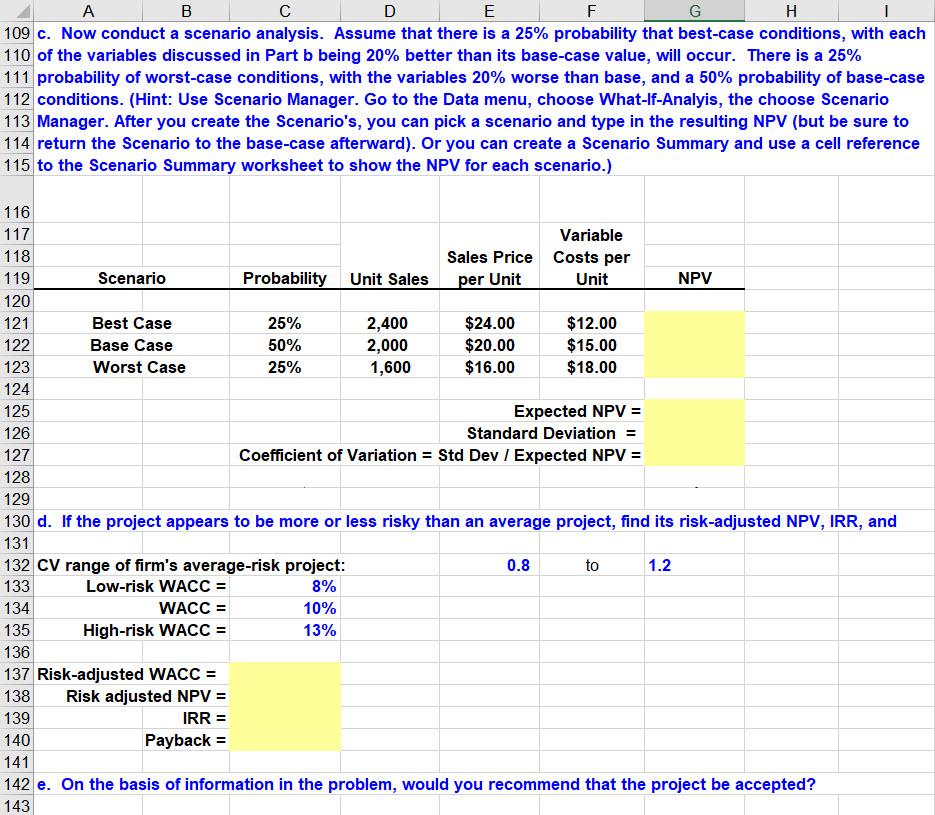

= B D E F G H 3 a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, and payback. 4 5 Input Data (in thousands of dollars) 6 Scenario name Base Case Note: the items in red will be used in a scenario analysis. 7 Probability of scenario 50% 8 Equipment cost $25,000 9 Net operating working capital/Sales 12% Key Results: 10 First year sales (in units) 2,000 NPV = 11 Sales price per unit $21.00 IRR 12 Variable cost per unit (excl. depr.) $15.00 Payback = 13 Nonvariable costs (excl. depr.) $1,500 14 Inflation in prices and costs 2.5% 15 Estimated salvage value at year 4 $1,000 16 Depreciation years Year 1 Year 2 Year 3 Year 4 17 Depreciation rates 20.00% 32.00% 19.20% 11.52% 18 Tax rate 20% 19 WACC for average-risk projects 10% 20 21 Intermediate Calculations 0 1 2 3 4 22 Units sold 23 Sales price per unit (excl. depr.) 24 Variable costs per unit (excl. depr.) 25 Nonvariable costs (excl. depr.) 26 Sales revenue 27 Required level of net operating working capital 28 Basis for depreciation 29 Annual equipment depr. rate 20.00% 32.00% 19.20% 11.52% 30 Annual depreciation expense 31 Ending Bk Val: Cost - Accum Dep'rn 32 Salvage value 33 Profit (or loss) on salvage 34 Tax on profit (or loss) 35 Net cash flow due to salvage 3 E F H G Years 2 0 1 3 4 A B D 36 37 Cash Flow Forecast 38 Sales revenue 39 Variable costs 40 Nonvariable operating costs 41 Depreciation (equipment) 42 Oper. income before taxes (EBIT) 43 Taxes on operating income (20%) 44 Net operating profit after taxes 45 Add back depreciation 46 Equipment purchases 47 Cash flow due to change in NOWC 48 Net cash flow due to salvage 49 Net Cash Flow (Time line of cash flows) 50 51 Key Results: Appraisal of the Proposed Project 52 53 Net Present Value (at 10%) = 54 IRR = 55 MIRR = 56 Payback = 57 Discounted Payback = 58 Data for Payback Years 59 60 Net cash flow 61 Cumulative CF 62 Part of year required for payback 63 64 65 Data for Discounted Payback Years 66 67 Net cash flow 68 Discounted cash flow 69 Cumulative CF 70 Part of year required for discounted payback 71 Years 2 0 1 3 4 Years 2 4 0 $0 1 $0 3 $0 $0 $0 A B D E F G H 73 b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, variable 74 costs per unit, and number of units sold. Set these variables' values at 10% and 20% above and below their base- 75 case values. 76 77 % Deviation 1st YEAR UNIT SALES 78 from Base NPV 79 Base Case 2,000 $0 80 -20% 84 VARIABLE COST Base NPV $15.00 $0 81 -10% 82 0% 83 10% 20% 85 86 87 88 % Deviation SALES PRICE % Deviation 89 from Base NPV from 90 Base Case $21.00 $0 Base Case 91 -20% -20% 92 -10% -10% 93 0% 0% 94 10% 10% 95 20% 20% 96 97 Deviation NPV at Different Deviations from Base 98 from Sales Variable Base Case Units Sold Price Cost/Unit 100 -20% $0 $0 $0 101 -10% $0 $0 102 0% $0 $0 $0 103 10% $0 104 20% $0 $0 $0 105 106 Range $0 $0 $0 107 99 $0 $0 $0 A B D E F G H 109 c. Now conduct a scenario analysis. Assume that there is a 25% probability that best-case conditions, with each 110 of the variables discussed in Part b being 20% better than its base-case value, will occur. There is a 25% 111 probability of worst-case conditions, with the variables 20% worse than base, and a 50% probability of base-case 112 conditions. (Hint: Use Scenario Manager. Go to the Data menu, choose What-If-Analyis, the choose Scenario 113 Manager. After you create the Scenario's, you can pick a scenario and type in the resulting NPV (but be sure to 114 return the Scenario to the base-case afterward). Or you can create a Scenario Summary and use a cell reference 115 to the Scenario Summary worksheet to show the NPV for each scenario.) 116 117 Variable 118 Sales Price Costs per 119 Scenario Probability Unit Sales per Unit Unit NPV 120 121 Best Case 25% 2,400 $24.00 $12.00 122 Base Case 50% 2,000 $20.00 $15.00 123 Worst Case 25% 1,600 $16.00 $18.00 124 125 Expected NPV = 126 Standard Deviation = 127 Coefficient of Variation = Std Dev / Expected NPV = 128 129 130 d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and 131 132 CV range of firm's average-risk project: to 1.2 133 Low-risk WACC = 8% 134 WACC = 10% 135 High-risk WACC = 13% 136 137 Risk-adjusted WACC = 138 Risk adjusted NPV = 139 IRR = 140 Payback = 141 142 e. On the basis of information in the problem, would you recommend that the project be accepted? 143 0.8 = B D E F G H 3 a. Develop a spreadsheet model, and use it to find the project's NPV, IRR, and payback. 4 5 Input Data (in thousands of dollars) 6 Scenario name Base Case Note: the items in red will be used in a scenario analysis. 7 Probability of scenario 50% 8 Equipment cost $25,000 9 Net operating working capital/Sales 12% Key Results: 10 First year sales (in units) 2,000 NPV = 11 Sales price per unit $21.00 IRR 12 Variable cost per unit (excl. depr.) $15.00 Payback = 13 Nonvariable costs (excl. depr.) $1,500 14 Inflation in prices and costs 2.5% 15 Estimated salvage value at year 4 $1,000 16 Depreciation years Year 1 Year 2 Year 3 Year 4 17 Depreciation rates 20.00% 32.00% 19.20% 11.52% 18 Tax rate 20% 19 WACC for average-risk projects 10% 20 21 Intermediate Calculations 0 1 2 3 4 22 Units sold 23 Sales price per unit (excl. depr.) 24 Variable costs per unit (excl. depr.) 25 Nonvariable costs (excl. depr.) 26 Sales revenue 27 Required level of net operating working capital 28 Basis for depreciation 29 Annual equipment depr. rate 20.00% 32.00% 19.20% 11.52% 30 Annual depreciation expense 31 Ending Bk Val: Cost - Accum Dep'rn 32 Salvage value 33 Profit (or loss) on salvage 34 Tax on profit (or loss) 35 Net cash flow due to salvage 3 E F H G Years 2 0 1 3 4 A B D 36 37 Cash Flow Forecast 38 Sales revenue 39 Variable costs 40 Nonvariable operating costs 41 Depreciation (equipment) 42 Oper. income before taxes (EBIT) 43 Taxes on operating income (20%) 44 Net operating profit after taxes 45 Add back depreciation 46 Equipment purchases 47 Cash flow due to change in NOWC 48 Net cash flow due to salvage 49 Net Cash Flow (Time line of cash flows) 50 51 Key Results: Appraisal of the Proposed Project 52 53 Net Present Value (at 10%) = 54 IRR = 55 MIRR = 56 Payback = 57 Discounted Payback = 58 Data for Payback Years 59 60 Net cash flow 61 Cumulative CF 62 Part of year required for payback 63 64 65 Data for Discounted Payback Years 66 67 Net cash flow 68 Discounted cash flow 69 Cumulative CF 70 Part of year required for discounted payback 71 Years 2 0 1 3 4 Years 2 4 0 $0 1 $0 3 $0 $0 $0 A B D E F G H 73 b. Now conduct a sensitivity analysis to determine the sensitivity of NPV to changes in the sales price, variable 74 costs per unit, and number of units sold. Set these variables' values at 10% and 20% above and below their base- 75 case values. 76 77 % Deviation 1st YEAR UNIT SALES 78 from Base NPV 79 Base Case 2,000 $0 80 -20% 84 VARIABLE COST Base NPV $15.00 $0 81 -10% 82 0% 83 10% 20% 85 86 87 88 % Deviation SALES PRICE % Deviation 89 from Base NPV from 90 Base Case $21.00 $0 Base Case 91 -20% -20% 92 -10% -10% 93 0% 0% 94 10% 10% 95 20% 20% 96 97 Deviation NPV at Different Deviations from Base 98 from Sales Variable Base Case Units Sold Price Cost/Unit 100 -20% $0 $0 $0 101 -10% $0 $0 102 0% $0 $0 $0 103 10% $0 104 20% $0 $0 $0 105 106 Range $0 $0 $0 107 99 $0 $0 $0 A B D E F G H 109 c. Now conduct a scenario analysis. Assume that there is a 25% probability that best-case conditions, with each 110 of the variables discussed in Part b being 20% better than its base-case value, will occur. There is a 25% 111 probability of worst-case conditions, with the variables 20% worse than base, and a 50% probability of base-case 112 conditions. (Hint: Use Scenario Manager. Go to the Data menu, choose What-If-Analyis, the choose Scenario 113 Manager. After you create the Scenario's, you can pick a scenario and type in the resulting NPV (but be sure to 114 return the Scenario to the base-case afterward). Or you can create a Scenario Summary and use a cell reference 115 to the Scenario Summary worksheet to show the NPV for each scenario.) 116 117 Variable 118 Sales Price Costs per 119 Scenario Probability Unit Sales per Unit Unit NPV 120 121 Best Case 25% 2,400 $24.00 $12.00 122 Base Case 50% 2,000 $20.00 $15.00 123 Worst Case 25% 1,600 $16.00 $18.00 124 125 Expected NPV = 126 Standard Deviation = 127 Coefficient of Variation = Std Dev / Expected NPV = 128 129 130 d. If the project appears to be more or less risky than an average project, find its risk-adjusted NPV, IRR, and 131 132 CV range of firm's average-risk project: to 1.2 133 Low-risk WACC = 8% 134 WACC = 10% 135 High-risk WACC = 13% 136 137 Risk-adjusted WACC = 138 Risk adjusted NPV = 139 IRR = 140 Payback = 141 142 e. On the basis of information in the problem, would you recommend that the project be accepted? 143 0.8