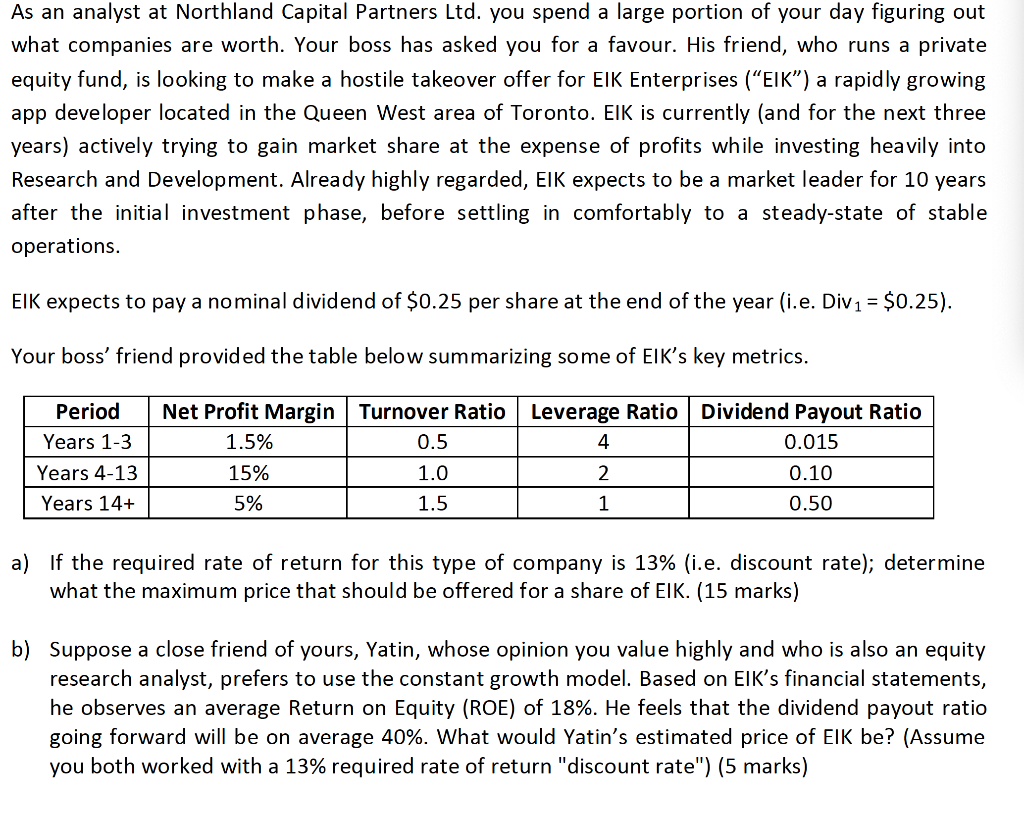

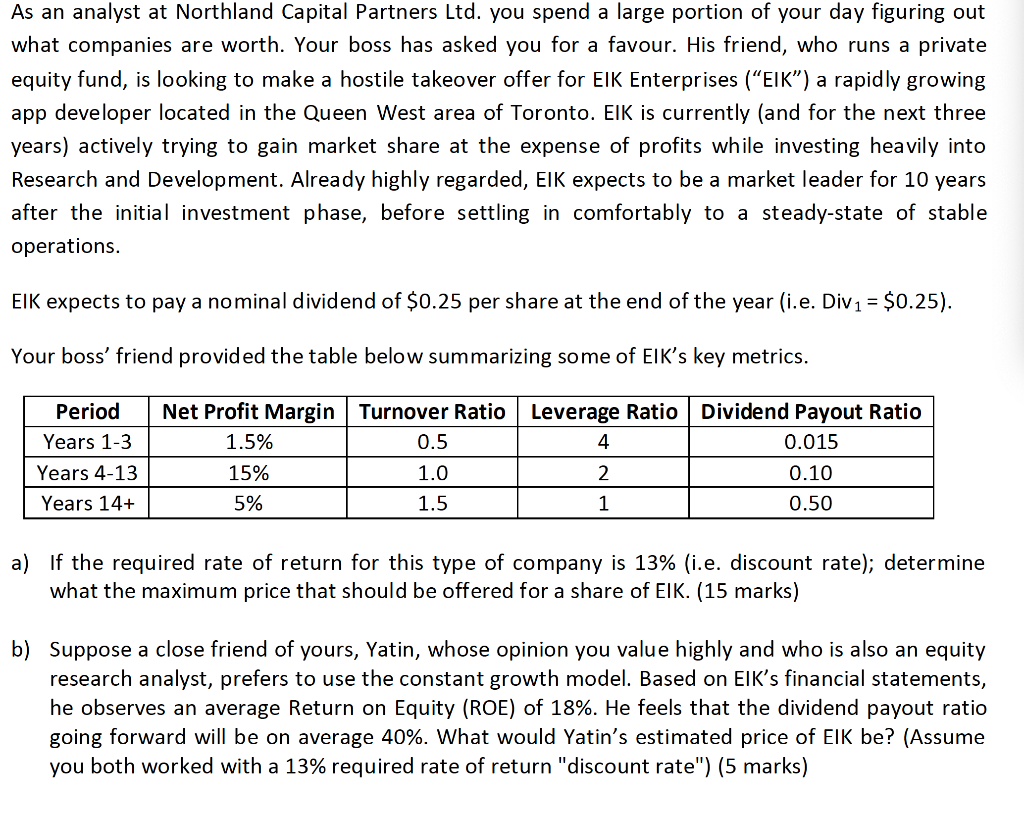

As an analyst at Northland Capital Partners Ltd. you spend a large portion of your day figuring out what companies are worth. Your boss has asked you for a favour. His friend, who runs a private equity fund, is looking to make a hostile takeover offer for EIK Enterprises (EIK) a rapidly growing app developer located in the Queen West area of Toronto. EIK is currently (and for the next three years) actively trying to gain market share at the expense of profits while investing heavily into Research and Development. Already highly regarded, EIK expects to be a market leader for 10 years after the initial investment phase, before settling in comfortably to a steady-state of stable operations. EIK expects to pay a nominal dividend of $0.25 per share at the end of the year (i.e. Div 1 = $0.25). Your boss' friend provided the table below summarizing some of Elk's key metrics. Period Years 1-3 Years 4-13 Years 14+ Net Profit Margin Turnover Ratio 1.5% 0.5 15% 1.0 5% 1.5 Leverage Ratio Dividend Payout Ratio 4 0.015 2 0.10 0.50 1 a) If the required rate of return for this type of company is 13% (i.e. discount rate); determine what the maximum price that should be offered for a share of EIK. (15 marks) b) Suppose a close friend of yours, Yatin, whose opinion you value highly and who is also an equity research analyst, prefers to use the constant growth model. Based on Elk's financial statements, he observes an average Return on Equity (ROE) of 18%. He feels that the dividend payout ratio going forward will be on average 40%. What would Yatin's estimated price of Elk be? (Assume you both worked with a 13% required rate of return "discount rate") (5 marks) As an analyst at Northland Capital Partners Ltd. you spend a large portion of your day figuring out what companies are worth. Your boss has asked you for a favour. His friend, who runs a private equity fund, is looking to make a hostile takeover offer for EIK Enterprises (EIK) a rapidly growing app developer located in the Queen West area of Toronto. EIK is currently (and for the next three years) actively trying to gain market share at the expense of profits while investing heavily into Research and Development. Already highly regarded, EIK expects to be a market leader for 10 years after the initial investment phase, before settling in comfortably to a steady-state of stable operations. EIK expects to pay a nominal dividend of $0.25 per share at the end of the year (i.e. Div 1 = $0.25). Your boss' friend provided the table below summarizing some of Elk's key metrics. Period Years 1-3 Years 4-13 Years 14+ Net Profit Margin Turnover Ratio 1.5% 0.5 15% 1.0 5% 1.5 Leverage Ratio Dividend Payout Ratio 4 0.015 2 0.10 0.50 1 a) If the required rate of return for this type of company is 13% (i.e. discount rate); determine what the maximum price that should be offered for a share of EIK. (15 marks) b) Suppose a close friend of yours, Yatin, whose opinion you value highly and who is also an equity research analyst, prefers to use the constant growth model. Based on Elk's financial statements, he observes an average Return on Equity (ROE) of 18%. He feels that the dividend payout ratio going forward will be on average 40%. What would Yatin's estimated price of Elk be? (Assume you both worked with a 13% required rate of return "discount rate")