Question

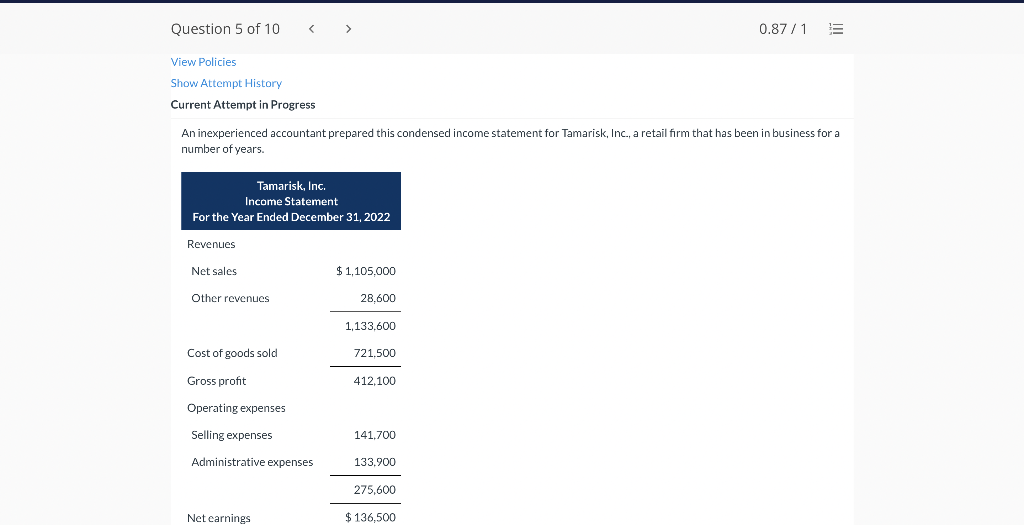

As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented

As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement.

| 1. | Net sales, as presented, consist of sales $ 1,184,300, less freight-out on merchandise sold $ 42,900, and sales returns and allowances $ 36,400. | |

| 2. | Other revenues, as presented, consist of sales discounts $ 23,400 and rent revenue $ 5,200. | |

| 3. | Selling expenses, as presented, consist of salespersons salaries $ 104,000; depreciation on equipment $ 13,000; advertising $ 16,900; and sales commissions $ 7,800. The commissions represent commissions paid. At December 31, $ 3,900 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. | |

| 4. | Administrative expenses, as presented, consist of office salaries $ 61,100; dividends $ 23,400; utilities $ 15,600; interest expense $ 2,600; and rent expense $ 31,200, which includes prepayments totaling $ 7,800 for the first quarter of 2018. |

Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses. Round answers to 0 decimal places, e.g. 5,125.)

| Tamarisk, Inc. Income Statement choose the accounting period December 31, 2022For the Year Ended December 31, 2022For the Month Ended December 31, 2022 | ||||

|---|---|---|---|---|

| select an opening name for section one DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | ||||

| enter an income statement item | $ enter a dollar amount | |||

| select between addition and deduction AddLess: | ||||

| enter an income statement item | $ enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| enter a subtotal of the two previous amounts | ||||

| select a closing name for section one DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | enter a total amount for section one | |||

| enter an income statement item | enter a dollar amount | |||

| select a summarizing line for the first part DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | enter a total amount for the first part | |||

| select an opening name for section two DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | ||||

| enter an income statement item | enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| enter an income statement item | enter a dollar amount | |||

| select a closing name for section two DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | enter a total amount for section two | |||

| select a summarizing line for the second part DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | enter a total amount for the second part | |||

| select an opening name for section three DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | ||||

| enter an income statement item | enter a dollar amount | |||

| select an opening name for section four DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | ||||

| enter an income statement item | enter a dollar amount | |||

| select a summarizing line for the third part DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | enter a total amount for all three parts | |||

| enter an income statement item | enter a dollar amount | |||

| select a closing name for this statement DividendsNet Income / (Loss)Retained Earnings, January 1Retained Earnings, December 31SalesTotal RevenuesNet SalesGross ProfitOperating ExpensesTotal Operating ExpensesIncome From OperationsOther Revenues and GainsOther Expenses and LossesIncome Before Income Taxes | $ enter a total net income or loss amount | |||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started