Question

There are just three assets with rate of return r 1 , r 2 , and r 3 , respectively. The covariance matrix and the

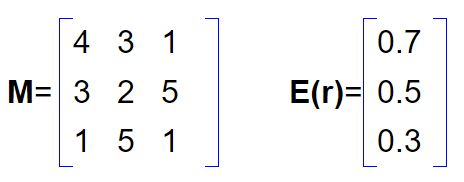

There are just three assets with rate of return r1, r2, and r3, respectively. The covariance matrix and the expected rates of return are as follows:

Consider the portfolio of the three assets. (a) Suppose that the weight vector of portfolio A is WA = (0.5, 0.2, 0.3), find its expected rate of return and standard deviation of the rate of return.

(b) Find the weight vector of the minimum-variance portfolio B.

(c) Let rA and rB denote the random rate of return of portfolio A and portfolio B, respectively. Find the covariance between rA and rB, and then determine if rA and rB are correlated or not. (Positively correlated, Negatively correlated and Uncorrelated.)

(d) Can we find a portfolio whose rate of return is uncorrelated with that of portfolio A? If yes, find the portfolio. If no, explain why.

4 3 1 M= 3 2 5 0.7 E(r)= 0.5 0.3 15 1 4 3 1 M= 3 2 5 0.7 E(r)= 0.5 0.3 15 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started