Answered step by step

Verified Expert Solution

Question

1 Approved Answer

As an incentive to attract savings deposits, most financial institutions today offer daily and even continuous compounding. This means that savings, or passbook, accounts, as

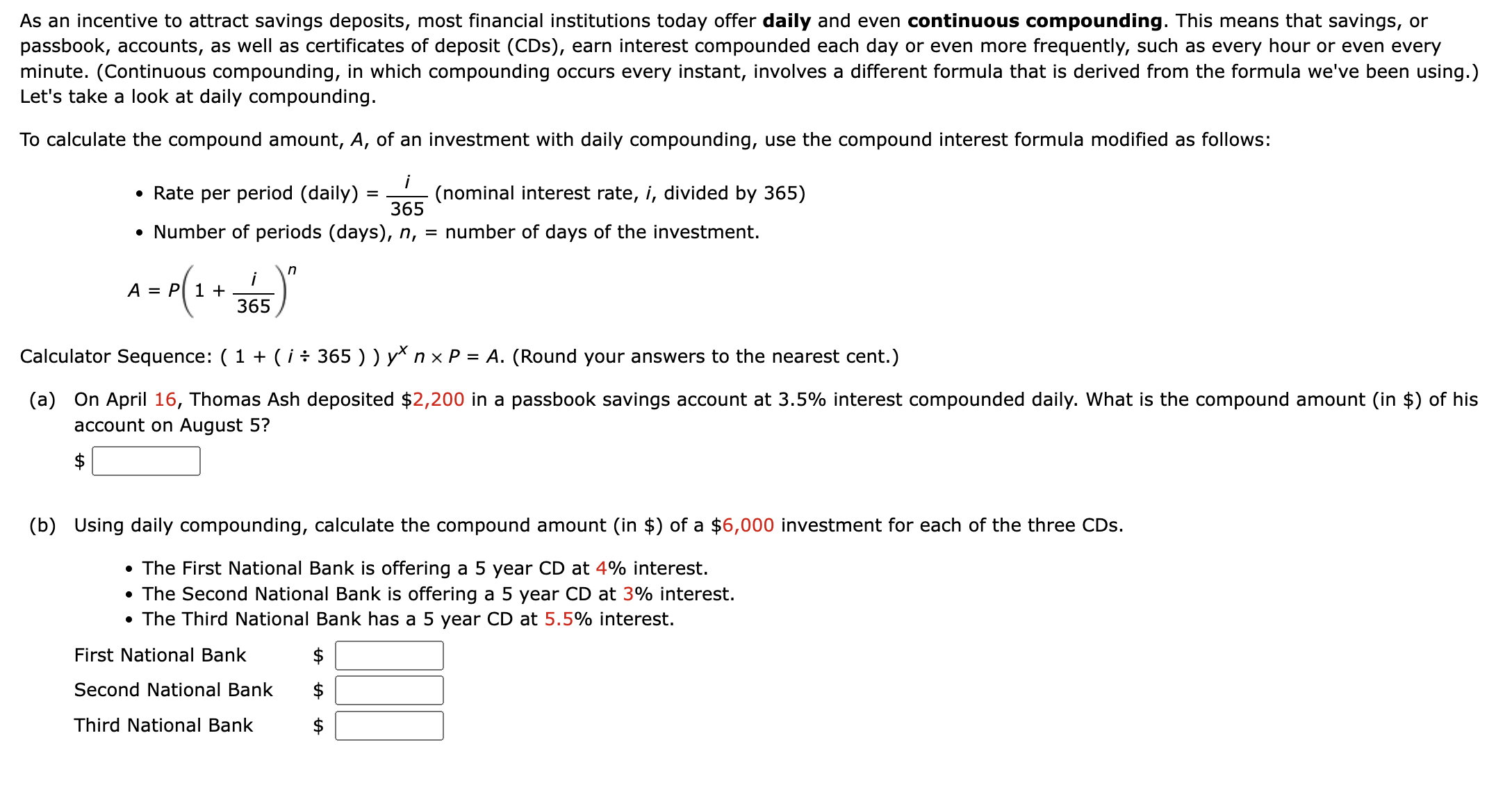

As an incentive to attract savings deposits, most financial institutions today offer daily and even continuous compounding. This means that savings, or passbook, accounts, as well as certificates of deposit (CDs), earn interest compounded each day or even more frequently, such as every hour or even every minute. (Continuous compounding, in which compounding occurs every instant, involves a different formula that is derived from the formula we've been using.) Let's take a look at daily compounding. To calculate the compound amount, A, of an investment with daily compounding, use the compound interest formula modified as follows: - Rate per period (daily) =365i (nominal interest rate, i, divided by 365) - Number of periods (days), n,= number of days of the investment. A=P(1+365i)n Calculator Sequence: (1+(i365))yXnP=A. (Round your answers to the nearest cent.) (a) On April 16, Thomas Ash deposited \$2,200 in a passbook savings account at 3.5\% interest compounded daily. What is the compound amount (in $ ) of his account on August 5? $ (b) Using daily compounding, calculate the compound amount (in $ ) of a $6,000 investment for each of the three CDs. - The First National Bank is offering a 5 year CD at 4% interest. - The Second National Bank is offering a 5 year CD at 3% interest. - The Third National Bank has a 5 year CD at 5.5% interest. First National Bank \$ Second National Bank \$ Third National Bank \$

As an incentive to attract savings deposits, most financial institutions today offer daily and even continuous compounding. This means that savings, or passbook, accounts, as well as certificates of deposit (CDs), earn interest compounded each day or even more frequently, such as every hour or even every minute. (Continuous compounding, in which compounding occurs every instant, involves a different formula that is derived from the formula we've been using.) Let's take a look at daily compounding. To calculate the compound amount, A, of an investment with daily compounding, use the compound interest formula modified as follows: - Rate per period (daily) =365i (nominal interest rate, i, divided by 365) - Number of periods (days), n,= number of days of the investment. A=P(1+365i)n Calculator Sequence: (1+(i365))yXnP=A. (Round your answers to the nearest cent.) (a) On April 16, Thomas Ash deposited \$2,200 in a passbook savings account at 3.5\% interest compounded daily. What is the compound amount (in $ ) of his account on August 5? $ (b) Using daily compounding, calculate the compound amount (in $ ) of a $6,000 investment for each of the three CDs. - The First National Bank is offering a 5 year CD at 4% interest. - The Second National Bank is offering a 5 year CD at 3% interest. - The Third National Bank has a 5 year CD at 5.5% interest. First National Bank \$ Second National Bank \$ Third National Bank \$ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started