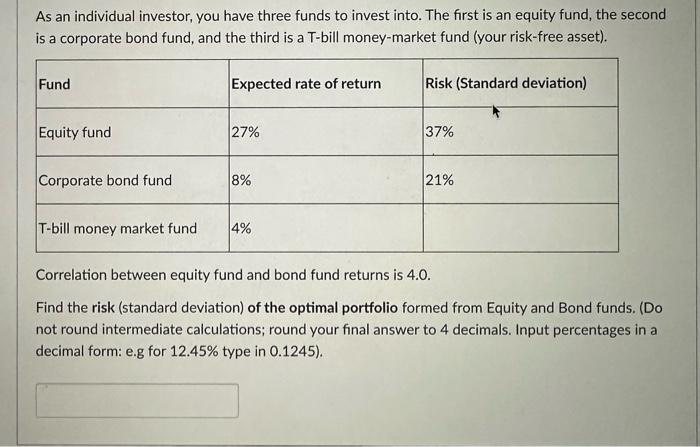

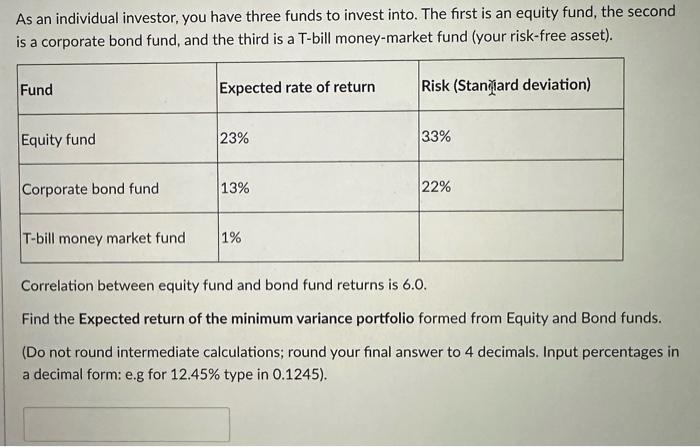

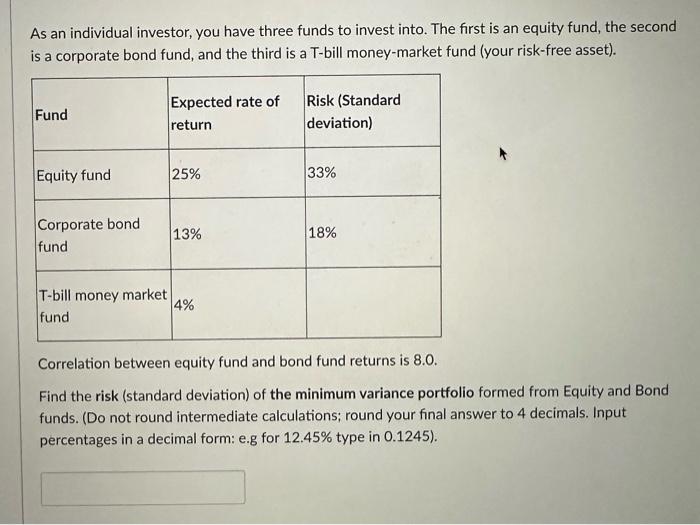

As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 4.0 . Find the risk (standard deviation) of the optimal portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 6.0. Find the Expected return of the minimum variance portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 8.0 . Find the risk (standard deviation) of the minimum variance portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 4.0 . Find the risk (standard deviation) of the optimal portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 6.0. Find the Expected return of the minimum variance portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 ). As an individual investor, you have three funds to invest into. The first is an equity fund, the second is a corporate bond fund, and the third is a T-bill money-market fund (your risk-free asset). Correlation between equity fund and bond fund returns is 8.0 . Find the risk (standard deviation) of the minimum variance portfolio formed from Equity and Bond funds. (Do not round intermediate calculations; round your final answer to 4 decimals. Input percentages in a decimal form: e.g for 12.45% type in 0.1245 )